How do you transfer trust real estate to a beneficiary? Can the successor trustee transfer property to? Is trustor same as trustee in california? What is a revocable transfer in California?

A trustee has the power to transfer property out of the trust. If the property is going to be kept by the family, a new deed transferring ownership to the beneficiaries named in the trust is necessary. Real property outside of California. Property held in trust , including a living trust. Real or personal property that the person who died owned with someone else (joint tenancy).

That’s the document that transfers title to the property from you, the trustee, to the new owner. Transfers may be result of a sale, gift, or inheritance. A transfer via a trust also qualifies for this exclusion. For property tax purposes, we look through the trust to the present beneficial owner.

When the present beneficial ownership passes from a parent to a chil this is a change in ownership that is eligible for the parent-child exclusion. Assets with beneficiary designations or those held in a trust. Similarly, property owned by the decedent for which one or more people were named as beneficiaries can be retitled by following the steps and procedures of the institution holding the account or asset. The grantor must execute a revocable transfer on death (TOD) deed prior to death.

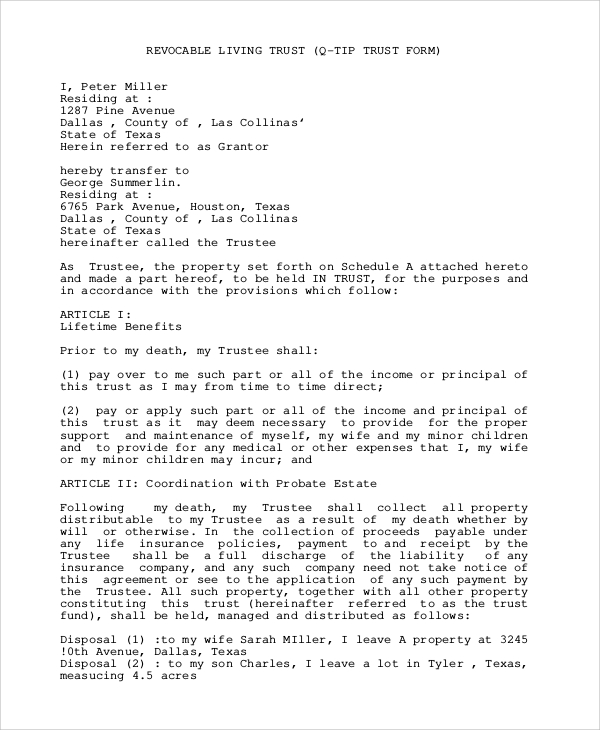

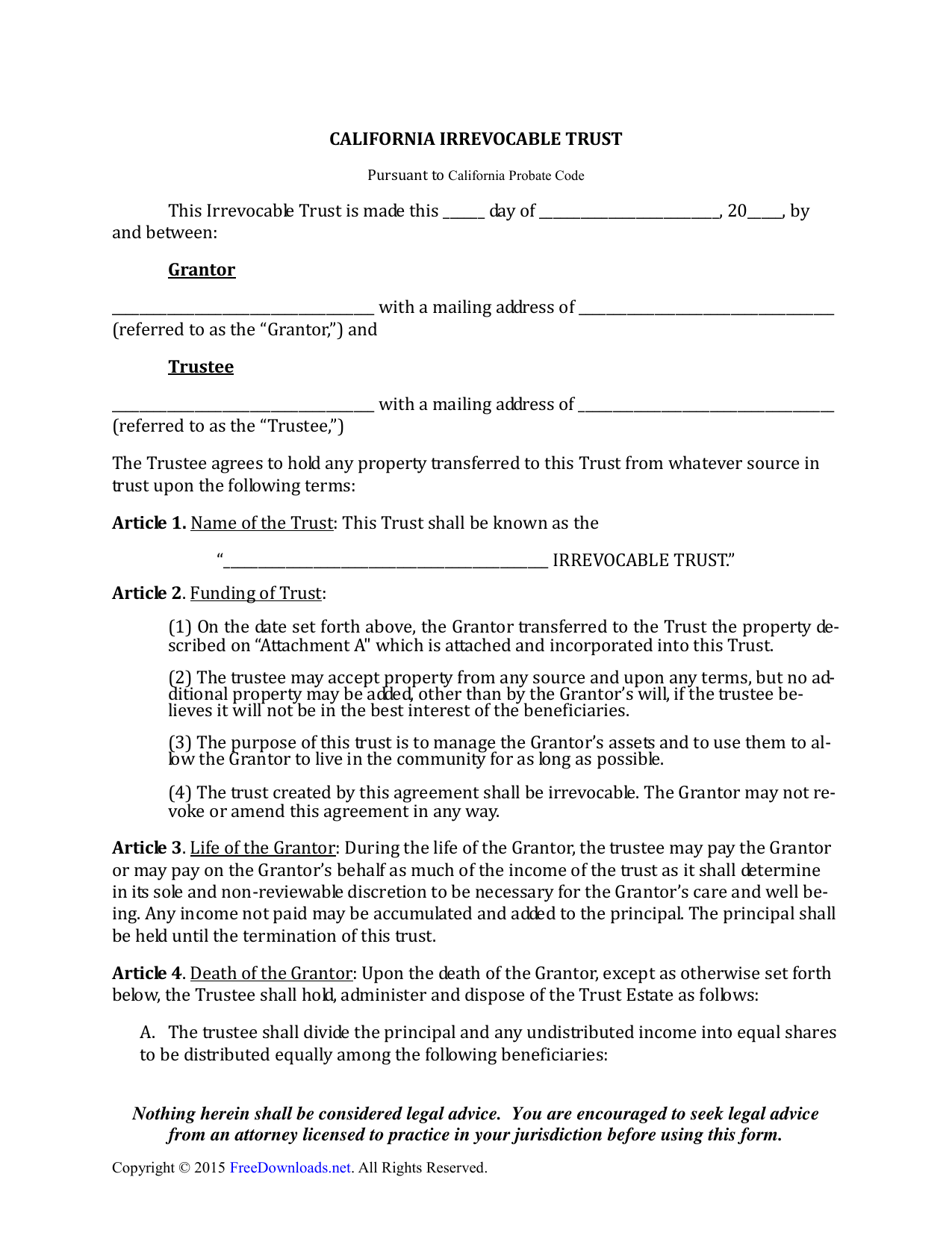

Establishment of a trust commits the property or assets of an indivdual(s) to a trustee for use or safekeeping. Definitions: Beneficiary —The one for whose benefit a trust is created. Co-trustees—Two or more persons who are intrusted with property for the benefit of one or more persons. Settlor—The term “settlor” is frequently used instead of “trustor.

An ‘affidavit death of trustee’ is a declaration, under oath, by the successor trustee. If the successor trustee sells the property, the affidavit death of trustee is all that is required. Transfer-on-Death Deed California’s transfer-on-death dee or beneficiary dee allows an owner of real property to execute a deed that names a beneficiary.

This beneficiary is granted title to the property when the owner dies. Furthermore, the beneficiary will receive title to the property without going through probate. The trustee can execute the transaction, the property at this time should be in the name of the living trust (such as Smith Family Trust ) and needs to be transferred (deeded) to the beneficiaries as individuals. Or they can cash you out and keep the property in trust. An appraisal should be obtained first.

To have the property transferred to you, give the affidavit to the person, company, or bank that has the property now. NOTE: Make sure the case is not already in probate court. If it is, you cannot use the affidavit process unless the personal representative of the estate agrees in writing to let you do so.

The most common means of transferring real property upon death of the owner are three well-known methods: (1) holding property in joint tenancy or as community property with right of survivorship, (2) a living trust , or (3) a will. With irrevocable trusts, the transfer is permanent, meaning that the grantor (the person who creates the trust ) must give up all control and ownership of the property. Because the trust is considered irrevocable, it typically cannot be modified in any way after the trust has been executed.

These deeds are sometimes called beneficiary deeds. You sign and record the deed now, but it doesn’t take effect until your death. If you would prefer the beneficiary to receive the property at an older age than allowed by your state, go back to the interview and choose to set up a child’s trust instead of the UTMA.

California allows you to leave real estate with transfer -on-death deeds. Using a child’s trust you can provide property management up to age 35.