Is it necessary to register as a sole proprietorship? Should I start a sole proprietorship or a LLC? What are the difficulties of starting a sole proprietorship? What can you claim as a sole proprietorship?

It’s important to note that by default, a single-owner business is automatically considered a sole proprietorship by the IRS. There may also be additional steps needed depending on the state. The most common is the business name registration.

A sole proprietor is someone who owns an unincorporated business by himself or herself. However, if you are the sole member of a domestic limited liability company (LLC), you are not a sole proprietor if you elect to treat the LLC as a corporation. See full list on irs. It is an unincorporated business owned and run by one individual with no distinction between the business and you, the owner.

You are entitled to all profits and are responsible for all your business’s debts, losses and liabilities. SOLE PROPRIETORSHIP FIRM REGISTRATION FORM. Most businesses need to register with the provinces and territories where they plan to do business. In some cases, sole proprietorships operating under the name of the business owner do not need to register. Note: This list of links is provided for your convenience.

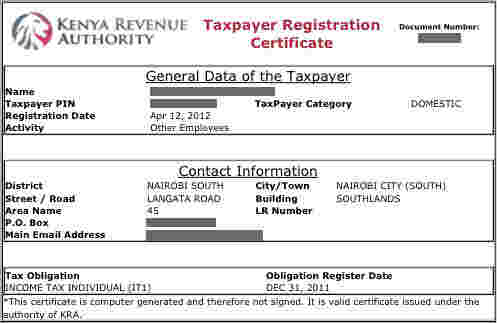

It may not be a comprehensive list of the registration requirements in all provinces and territories. Your business may need a federal business number and related tax accounts. If you register your business in one of the following provinces, you will automatically receive your federal business number as part of your provincial registration: 1. Saskatchewan If your business is in another province or territory and you need a business number , you need to register for a business number with us. Find out if you need a federal business numberR.

Business may be registered using personal name or using a trade name. Starting Sole -Proprietorships or Partnerships Getting a name, paying the registration fees, appointing an authorised representative and other steps involved in registering your new business with ACRA. And Via Obtaining A Udyog Aadhaar Under The Ministry Of MSME. Because there is no division between the owner and the business, the owner will generally be responsible, in civil and criminal law, for actions conducted in the course of the business.

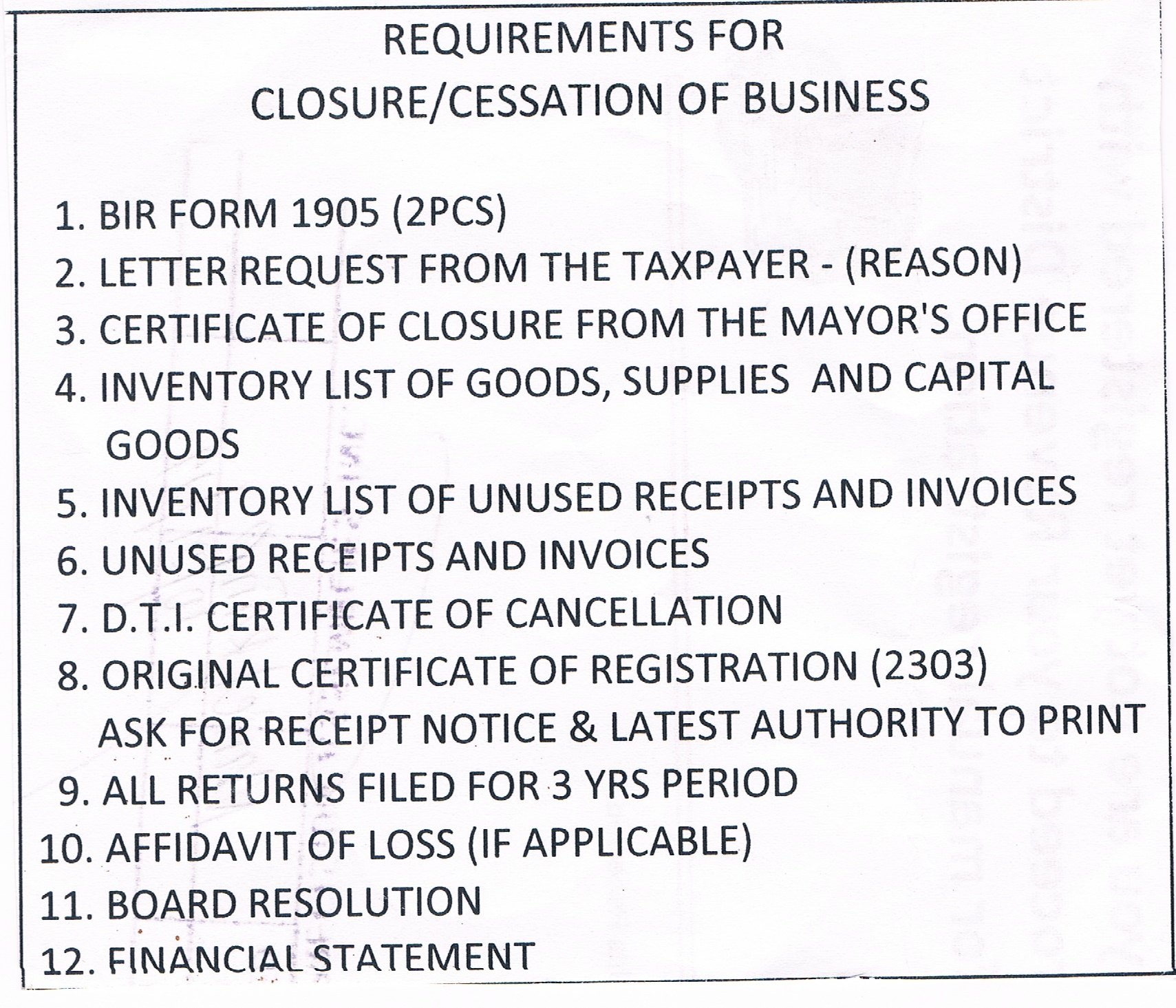

If you are the sole owner of a business, you become a sole proprietor simply by conducting business. Even though there aren’t complicated start-up requirements for establishing a sole proprietorship, there may be local registration, business license, or permit laws you need to comply with to make your business legitimate. Obtain the relevant application form from the respective Divisional Secretariat Office.

The following two documents. Handing over the certified report of the Grama Niladharee and the duly completed application form along with the. Registration process No, it is not necessary to register as a sole proprietor. After considering the above documents,.

PROPRIETORSHIP REGISTER is a Private company primarily doing consultancy and professional services for proprietor business owners in India to get different types of proprietorship certificate based on their business by procuring certain consultation fees from the customer. Business and professional corporations are for-profit corporations. A nonprofit corporation is formed for any lawful purpose except for financial profit. A professional corporation is a for-profit corporation formed for the purpose of providing one or more specific types of.

Under sole proprietorship’s, the compliance’s are minimal and easy to fulfill. Sole proprietors may particularly want to do this step. The process requires filling out a form with your personal information, including your name, date of birth, home address and proposed business address.

Sole Proprietorship concern is an entity that can be started by an individual who is a citizen of India holding a valid PAN. It is a business ownership structure for individuals who want to work, manage, control and direct the organization independently. The owner of a sole proprietorship business typically signs contracts in his or her own name, because the sole proprietorship business has no separate identity under the law. It requires no formal paperwork, making it one of the most common forms of business in the State of Florida. Many businesses fall under this umbrella without ever consciously setting out to establish itself as one.

Washington State sole proprietorship registration is not required for a business to legally exist. It is a requirement for a sole proprietor to register before the business can legally operate in the state. Washington law requires that most businesses register with the Washington Secretary of State. Aadhar number is now a necessity for applying for any registration in India.

Also, income tax return can. You can’t file your income tax return until you get a PAN. So if you don’t have a PAN number, apply for. Non-Wisconsin LLC or corporation.

You already hold one or more other permits with the Department of Revenue.