What is travel reimbursement? How to submit a travel expense claim? The purpose of this Program is to provide reimbursement of travel and subsistence expenses and other incidental non-medical expenses that the Secretary of the U. Department of Health and Human Services (HHS) may authorize by regulation to living organ donors and up to two relatives or other individuals accompanying the living donor in the United States.

If the Servicer provides access to the Review Materials at one of its properties, the Issuer will reimburse the Asset Representations Reviewer for its reasonable travel expenses incurred in connection with the Review on receipt of a detailed invoice. Find out what expenses we reimburse. Gather your receipts and track your mileage. Be sure to keep your receipts for all.

Grantee will be reimbursed for travel and subsistence expenses in the same manner and in no greater amount thanprovided in the current Commissioner’s Plan” promulgated by the Commissioner of Minnesota Management and Budget (MMB). Many employers will reimburse an employee who uses their personal vehicle for business at a standard mileage rate. Become familiar with your company’s policy because expenses, as varied as dry cleaning and gym membership, can be covered for employees on extended trips in addition to the expected travel costs, housing, and meals.

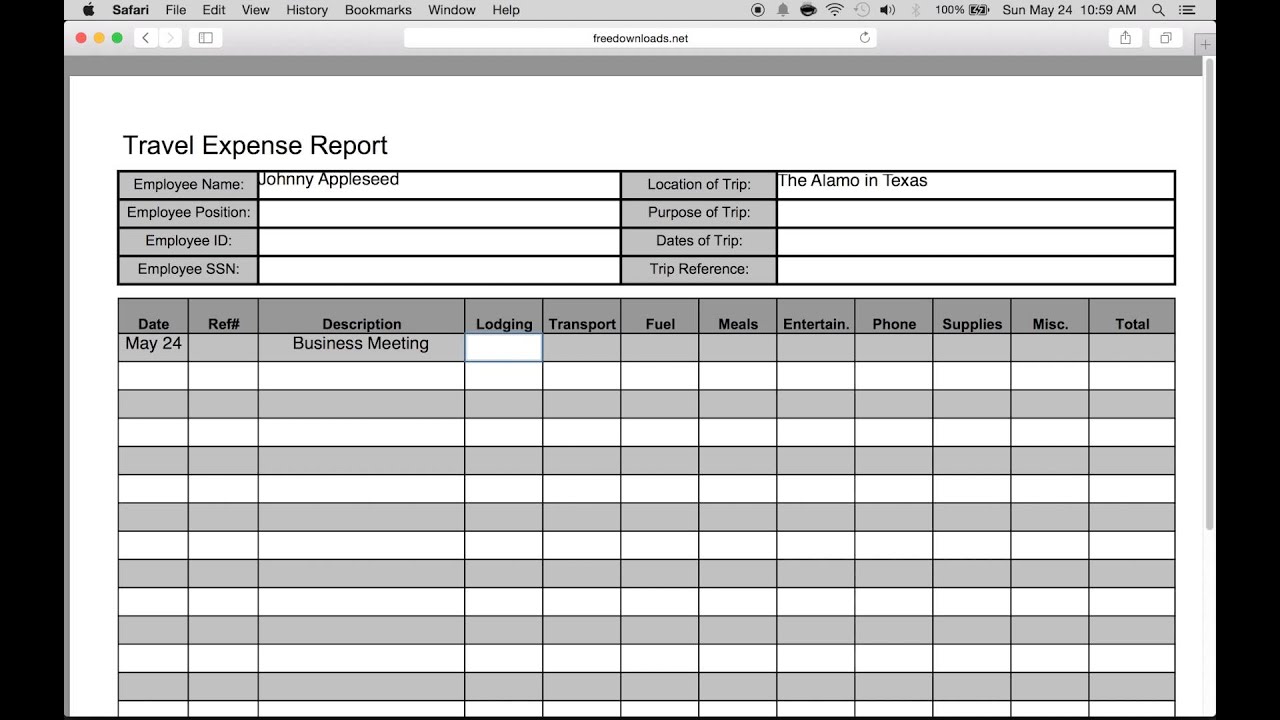

ACCOUNTING FOR TRAVEL AND RELATED EXPENSES. All travel expenses reimbursed from university-administered funds must be. See the attached screenshot below.

Accommodations while attending meetings,. Non-Qualifying Expenses. Lost personal property. Travel for business purposes. Fines incurred while operating a. If you are not reimburse then your travel expenses may constitute expenses which you can deduct on your own taxes.

With this travel expense reimbursement form, you get blank sections where you. Use this medical travel expense reimbursement form to ask. However, you must incur a minimum of four consecutive nights lodging on official travel to qualify for this reimbursement. If you wish to get reimbursed for the amount you spent during a travel , your company will need you to pass on documents and receipts. Some companies will give you a reimbursement rate following the travel budget forms they have prepared beforehand.

For IRS purposes, travel expenses are considered ordinary and necessary expenses incurred while traveling away. Meals and Entertainment. Most employers pay or reimburse their employees’ expenses when traveling for business. According to the IRS regulations, the Contractor must report this expense as income.

MISCELLANEOUS EXPENSES. All you need is a simple spreadsheet for this type of form, so our Employee Expense Reimbursement Form below is just the thing. I have also added a new printable PTA Reimbursement form. Business expense reimbursements include.

Payment processing is easy with SureExpense’s customizable, web-based software. However, whether those payments are business expenses or taxable income depends on the visa category of the visitor and the services performed. There may also be restrictions on what activities an international visitor may engage in while in the USA. Employees’ travel reimbursement requests turned in days or more after completion of travel will be paid through Chrome River and taxed as income through Payroll per IRS guidelines. Avoid out-of-pocket expenses ! See items and services that are not allowed for reimbursement at Disallowed Expenses.

They are taxable because employer reimbursements are paid through payroll. The notice also includes a reminder regarding employers. If a customer agrees to reimburse you for these expenses , then you can record the reimbursed expenses as revenue.

They know that an employee should be reimbursed for the expenses he has claimed against the amount he has expensed out to fulfill the business related duty.