Independent Contractor Vs. Here is a 10-question test to help determine the classification of a worker as either an employee or independent contractor. See full list on irs. Facts that provide evidence of the degree of control and independence fall into three categories: 1. Behavioral: Does the company control or have the right to control what the worker does and how the worker does his or her job? Financial: Are the business aspects of the worker’s job controlled by the payer?

Type of Relationship: Are there written contracts or employee type benefits (i.e. pension plan, insurance, vacation pay, etc.)? Will the relationship continue and is the work performed a key aspect of the business? Some factors may indicate that the worker is an employee, while other factors indicate that the worker is an independent contractor. There is no “magic” or set number of factors that “makes” the worker an employee or an independent cont. The form may be filed by either the business or the worker.

The IRS will review the facts and circumstances and officially determine the worker’s status. Be aware that it can take at least six months to get a determination, but a business that continually hires the same types of workers to perform particular services may want to consider filing the Form SS-8(PDF). Once a determination is made (whether by the business or by the IRS), the next step is filing the appropriate forms and paying the associated taxes.

Forms and associated taxes for independent contractors 2. There are specific employment tax guidelines that must be followed for certain industries. If you classify an employee as an independent contractor and you have no reasonable basis for doing so, you may be held liable for employment taxes for that worker (the relief provisions, discussed below, will not apply). If you have a reasonable basis for not treating a worker as an employee , you may be relieved from having to pay employment taxes for that worker. To get this relief, you must file all required federal information returns on a basis consistent with your treatment of the worker.

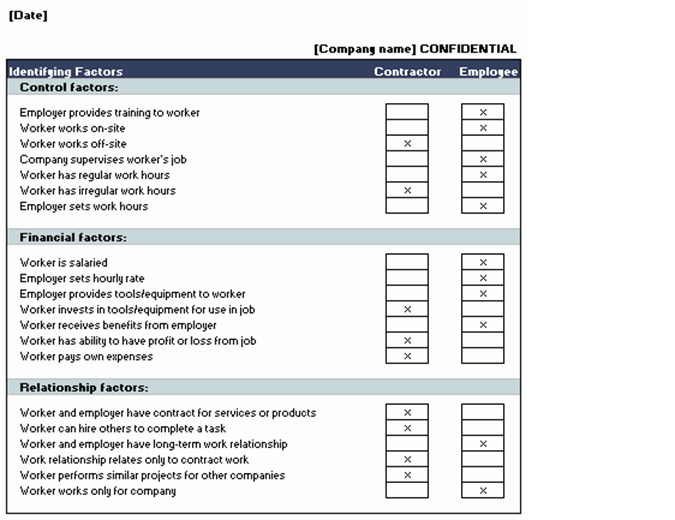

Employee or independent contractor checklist. Do you need an employee or independent contractor ? Use this accessible checklist template to find out, or to determine whether current workers are properly classified. The employee is not responsible for covering these expenses for your business. As an independent business owner, an independent contractor pays his or her own expenses. Under the common law, you must examine the relationship between the worker and the business.

What makes you an employee vs. How is an independent contractor different from an employee? Can you be both an employee and an independent contractor?

Do independent contractors need workers compensation insurance? An employee is generally guaranteed a regular wage amount for an hourly , weekly , or other period of time even when supplemented by a commission. However, independent contractors are most often paid for the job by a flat fee. For the employee, the company withholds income tax , Social Security , and Medicare from wages paid. For the independent contractor, the company does not withhold taxes.

To determine whether a person is an employee or an independent contractor , the company weighs factors to identify the degree of control it has in the relationship with the person. Employment and labor laws also do not apply to independent contractors. It is crucial for employers to understand the distinction between the two aforementioned types of workers, considering the serious penalties that. Businesses specify these categories in the IRS Form SS-8. However, there are very important legal differences between the two, going way beyond job title.

The major difference between an employee and an independent contractor is the level of control that the employer has over the. The nature and degree of control by the principal. The amount of initiative, judgment, or foresight in open market competition with others required for the success of the claimed independent contractor. A person is not an independent contractor.

You can view this publication in:.