What documents do I need to open a bank account? What is needed to open a Chase account? Chase has a business checking account for your business. Business checking includes mobile and online banking with access to 10ATMs and nearly 0branches.

If you are a sole proprietor , you’ll need to meet these basic requirements.

For a full list of requirements, click here. Employee’s date of birth. Upon meeting a business banker, you will then choose which account is right for you and begin depositing funds into the account.

These bonuses might be $20 $3for $5— it all just depends on the offer and coupon available. To open any type of bank account you typically need a few documents to verify your identification and an initial deposit. Based on the account you are opening, the initial deposit may vary so be sure to check with Chase!

Driver’s license passport, etc.

Click on the offer table above and apply for your account online. Add money using a debit card or a transfer from your Chase account. Start using your new account. First, you will need your EIN number.

Secon you’ll need to bring (or upload) a copy of your Articles of Organization. Can I use my personal bank account for my small business ? Here are some of the most common documents banks ask for when you open a business bank account. Some banks may ask for more.

Ownership agreements. Both parties need a U. Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. Savings accounts and Certificate of Deposit accounts are FDIC insured up to the maximum amount allowed by law.

Follow these six steps to open a business bank account. Decide what type of account you need. The first step is to figure out what type of business bank account you need.

A business checking account is good for daily expenses.

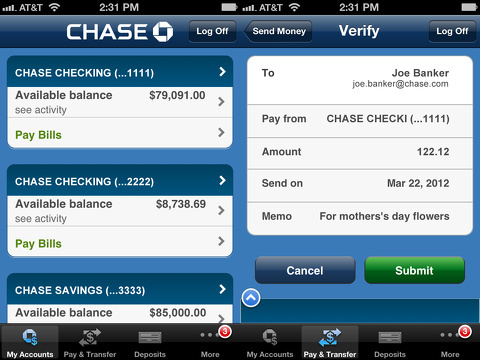

It may come with a debit car checkwriting privileges, merchant services and other perks to help you manage your money. Business banking offers limited personal liability protection by keeping your business funds separate from your personal funds. Enter your ZIP code and indicate whether you’re starting a new application or completing an application you previously saved.

Enter your coupon code if you have one, then indicate whether you’re a new or existing Chase customer. Banks need to prove that a business is legitimate and that the directors of the business are aware of a bank account being opened in their names. Guidelines for opening accounts clarify which officers will be allowed to represent the business in banking transactions.

If your business is operating as a DBA, the bank will need to see additional documents containing your name in association with the business name and your Assumed Name Certificate or Trade Name Certificate. How do you open a business bank account ? Quick answer: non-US citizens can open a US bank account for personal or business purposes. Significant requirements (federal laws, state laws, and bank policies) are listed for identification, to vet the sources and uses of your money, and to assure financial regulators that the bank is dealing with legitimate businesses and business owners.

Access your bank account or open a bank account online. Chase banking We want to make banking easy.