What are the features of a sole trader? What is a function of the sole trader? Ownership of a business is the first characteristics of sole proprietorship and in this type of business enterprise, there is an individual who manages and controls his business. That sole trader has both the authority and responsibility(i.e., ownership) of his business so that he manages the assets and liabilities of his business and as well as increases the growth of business also.

Because of the ownership, if he gets a profit from the business then the whole profits are received by the sole proprietor. Similarly, if there is a loss in business, then that loss has to bear it. See full list on subjectquery. Management is the second Characteristics of sole proprietorship and it means an owner of the sole trader business is also known as manager and controller of his business. Through proper management, he manages all things, resources (human and material resources), business activities and he also takes better decisions for managing the challenges and opportunities for the purpose of creating the better environment.

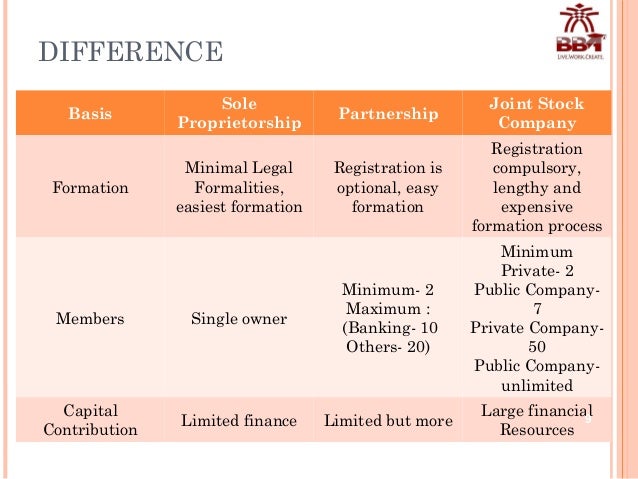

In simple words, management is such a process that we can assemble, manage, control all the business and other related things. Source of capital is the third characteristics of sole proprietorship and it indicates the way of acquisition of funds i. Where will the capital come from? The answer is, sole proprietor capital is come from his personal savings, from friends and families, and from financial institutions.

The capital volume is very limited in the sole proprietorshipbusiness because it’s business size is very small and there is no factor of continuity also. Stability is the fourth characteristics of sole proprietorship and it means the stability and continuity of the firm is totally depend upon efficiency, capacity, and life cycle of a sole proprietor. The growth and success of the sole proprietorship business also depend upon the stability because it develops the improvement capacity of any business and also protects from the unnecessary materials. In the sole proprietorship business, stability is also the main feature or characteristic of sole proprietorbecause it helps to define the majority, strength, fastness, and continuity of the business enterprise. Single man control is the fifth characteristics of sole proprietorshipand it means an individual owner of a sole business controls all things individually.

He controls all efforts and resources related to the business solely. In this sole business, an individual takes itself from all the decisions and implement it by enhancing his business. Liability is the sixth characteristics of sole proprietorship and it means the liability of a sole trader is always unlimited. It means that, at the time of loss, if an individual fails to pay his debts, then his personal property sold to pay the liabilities of his creditors.

If we consider, it is also said that unlimited liability is also a huge disadvantage for any sole proprietor. No sharing is the seventh characteristics of sole proprietorshipand it means whatever profits earned from the individual trader business, its totally belongs to the sole owner of the business. In this case, the sole proprietor follows the procedure of no profit or no loss. However, in the partnership business, profit sharing function is a must. Employment opportunity is the eighth characteristics of sole proprietorship and it means is to provide the facility of employment opportunities to our community and society.

Through employment facilities, the sole proprietor helps to fulfill the unemployment criteria and also increases the engagement of the business (like enhancing the growth, productivity, labor facility, sales, community and so on). This feature point is very helpful to make solo business efficient and effective. Minimum legal formalities are the ninth characteristics of sole proprietorship and it means that in the sole proprietorship business, the legal document is necessary for the business but in a minimum way. The sole trader business is the easiest business structure because there is a very low capital invested in it and has minimum formalities also.

So, that’s the reason, the legal formalities is also an important characteristic of sole proprietorship. Recommended Article:- 1. Also known as a sole proprietorship, a sole trader is a form of business that is owned and operated by a single person. A sole trader does not experience many legal formalities, assumes all the risks with unlimited liability and is solely responsible for business decisions. Decision Making Power- Decision making is the sixth features of a sole trader and it means that an individual owner of the sole proprietor business can take all the legal decisions about the business because he is the owner and manager of his business.

Single person is the owner in this type a of business. That person is responsible for all the things relating to the business. He himself bears all the risk and organize the whole business. On the closure of business he is personally liable for all gains and losses. The liability of a sole trader is unlimited.

If you start working for yourself on a self-employed basis as a sole trader, you must register with HM Revenue and Customs(HMRC), which can be done online. While it’s not possible to register in advance, you must inform HMRC promptly after you start trading. Other things you’ll need to consider when starting the business include: 1. Setting up a bank account – it’s invariably best to keep a bank account for the business that’s separate to your personal accounts 3. Depending on the type of business, finding suitable premises from which to operate. If you choose to operate from home, depending on the circumstances you may need to consider whether your rental agreement permits it, any alterations that may be necessary. As a sole trader, the income from your business is counted alongside your personal income.

You’ll also need to pay to HMRC: 1. Class national insurance contributions (NICs) – at a fixed rate of £3. Any tax you owe must be paid by January following the end of the tax year to which it relates. You may also need to make twice yearly ‘payments on account’, which are effectively advance payments for the current tax year. If you employ people as part of your sole trader business, you must collect the right amount of income tax and national insurance contributions from their pay and re.

But, unlike most other types of business entity, there’s no need to maintain accounts in a specific form or structure. As part of this, you’ll need to keep good records of your sales and expenses incurred. These will then be invaluable when you come to complete your annual self assessment tax return.

Unlike a limited company, there’s no need to file a confirmation statementor indeed to make any filings with Companies House. But you’ll still need to fulfil requirements that apply to all types of business, like ensuring you have the right insurance in place and keeping on top of Health and Safety requirements. A Sole proprietorship, also called sole trader or simply a proprietorship, is a type of business entity that is owned and run by one individual and in which there is no legal distinction between the owner and the business.

Accordingly, he bears all the risk associated with the enterprise. Hence, the business ends up at his will or on his demise. A sole trader is the simplest form of business structure and is relatively easy and inexpensive to set up. That single individual has to supply capital owned or borrowed to the business. This video explains what a sole trader is and the advantages and disadvantages associated with this type of business.

Post any questions you may have below. Sole Proprietorship Firms: Characteristics , Merits, Limitations! Key characteristics of being a sole trader. If the entrepreneur individually unable to take up the business because of shortcomings attached to sole proprietor form of business, he may go for partnership form of business nose characteristics or essential features are as follows: Association of two or more persons: Partnership is formed by the association of two or more persons. If you’re a sole trader, you run your own business as an individual and are self-employed.

You can keep all your business’s profits after you’ve paid tax on them. You’re personally responsible for.