PARTNERSHIP INSOLVENCY. Partnership insolvency —overview. Whilst the focus of this topic is largely on corporate insolvency , it is also important to consider how insolvency affects general partnerships , limited partnerships and limited liability partnerships. What is a partnership partnership?

Can a creditor choose to file for a partnership debt?

There is a different guide if you want to wind-up a limited liability partnership (LLP) or a company. An insolvent is a person unable to pay or settle his just debts. When a person or a partnership firm or Hindu undivided family is not able to meet its liabilities and is in financial difficulties, the Court intervenes, at the instance of the creditors or the debtor himself, and brings about a settlement whereby the debtor surrenders.

In the case of a partnership realizing cancellation of indebtedness income, the insolvency exclusion provided by IRC § 108(a)(1)(B) applies at the partner level, not at the partnership level. Therefore, to the extent a solvent partner receives an allocation of COD income from a partnership , the insolvency exclusion is not available. There are many similarities with the Administration procedure for a limited company.

We negotiated with the landlor Bloomberg, the bank and various finance houses, resulting in the successful restructure of the business and the introduction of a new investor and credit line.

Therefore, insolvent partners may exclude their allocable share of COD income in whole or in part, while solvent partners would be taxed on their allocable share of COD income despite the underlying level of insolvency of the partnership , unless another exclusion under Sec. The Revenue Ruling notes that in the partnership context, a liability is a “nonre-course liability” to the extent. They can also make a bankruptcy petition against one or more partners or they may bring both petitions against the partnership and the partner(s) simultaneously. The winding up of the insolvent partnership as an unregistered company, with bankruptcy petitions also presented against one of more of the partners.

Alternatively, a creditor may choose to only pursue the partners for the debt by petitioning for the bankruptcy of one or more of the partners without petitioning for the partnership to be wound up. Legislative background. On successful completion of insolvency resolution process or during the course of the insolvency resolution process an application can be made for a bankruptcy order.

Insolvency of the partnership firm differs from the insolvency of any individual or HUF (Hindu undivided family). The assets of an individual are used to pay the business liabilities, but in case of partnership firm, assets of the partners are used to pay his personal liabilities first, and then balance, if any, may be utilized to pay the. We specialise in helping partnerships , staff and their advisors find solutions, deciding their way forward and hopefully preserving viable businesses. Typically it requires reference to the LLP’s balance sheet and cash flow. So the liquidator must prove that at the time of each of the withdrawals, the LLP member knew, or had reasonable grounds for believing, that the LLP was insolvent.

Many times partners choose to dissolve and liquidate their partnerships to start new ventures. Other times, partnerships go bankrupt and are forced to liquidate in order to pay off their creditors. Either way, the partnership liquidation process is similar.

There are various kinds of partnerships and the liability of partners or their insolvent estates, are therefore greatly influenced by the nature of a particular kind of partnership.

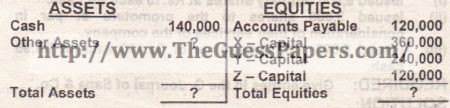

The following is the balance sheet of A, B and C. It is decided to wind up the partnership. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! In an unincorporated (non LLP) partnership all partners are jointly and severally liable for any debts of the partnership business. You should take financial and legal advice as soon as your partnership starts getting into trouble.

Corporate recovery experts and Licensed Insolvency Practitioners. Just a quick note to say a big thank you to all the staff at KSA, our CVA was passed today by creditors voting in an overwhelming number including HMRC to accept the proposal as prepared by KSA. The role of a lawyer in insolvency and bankruptcy is to reduce all the negative effects both in the insolvent society, but also on the clients or employees. In fact, a good lawyer in insolvency will analyze in detail the entire financial situation and will implement a strategy for solving the problems of the company, in order to ensure as much as possible the future of the company or, in other.

When contemplating any form of financing of infrastructure project, the host country’s insolvency laws will need to be understood by all parties concerned. Any host country seeking to attract private sector investment will need to have transparent and efficient insolvency laws which are fair to the parties concerned and are consistent with an ever more standardized international standard. Once bankruptcy orders are made this dissolves the partnership. Both individual and partnership debts are included in the bankruptcy.

Limited liability partnerships. In a limited liability partnership (LLP) the situation is similar to that for the insolvency of limited. In order to properly apply Rev.