How can I become IRS agent? How long does it take to become an Enrolled Agent? How do I become an income tax preparer? How to become an Enrolled Agent? Visit Prometric’s Special Enrollment Examination (SEE) web pageto schedule your test appointments , review the SEE.

Apply for enrollmentand pay enrollment fee electronically using Pay.

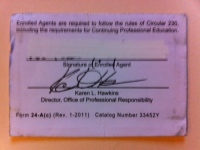

In addition to the credentials outlined in this section, many tax preparers also become CPAs or enrolled agents. Become an enrolled agent , the highest credential the IRS awards, and find out how to maintain your status. An enrolled agent is a person who has earned the privilege of representing taxpayers before the Internal Revenue Service by either passing a three-part comprehensive IRS test covering individual and business tax returns, or through. Are a ‘fit and proper person ’. You haven’t been convicted of. It is simply a case of attaining the relevant experience and suitable qualifications.

Tax Accounting Course. The application fee is $687 and not subject to GST.

You must pay the application fee in full when you apply for registration. Payment details, including your reference number are provided in the online application form. The application fee is subject to a consumer price index adjustment on July each year. We will advise you after the decision is made to either grant or reject your application for registration. See full list on tpb.

We aim to process complete applications within days of receiving them. If your application is granted: 1. Australian Taxation Office (ATO) that you are now registered with us. You can then contact the ATO to arrange access to their online services, such as Online services for agents.

ATO of our decision to reject your application. For more information refer to: 1. Qualifications and experience for tax agents 3. Change of tax agent details or circumstances 5. Professional indemnity insurance for tax agents 6. Be of good character and integrity. Items 2to 2require a primary academic qualification in accountancy, law or a relevant discipline other than accountancy. As a general guide, if you have a qualification: 1.

Otherwise, you must have completed a separate unit covering this component. Board approved unit) 2. To learn more about the amount and types of relevant experience individual applicants must demonstrate when they apply to register visit Relevant experience for tax agents. A condition placed on your registration will limit the scope of services you can provide. This allows people with relevant experience in particular areas of taxation law to be eligible for registration (provided all other registration criteria are met). Registered tax agents must undertake continuing professional education (CPE) that meets our requirements to be eligible to renew their registration.

For a summary of CPE requirements for registered tax agents please visit Continuing professional education for tax agents. What do you need to become a tax preparer? Becoming a tax preparer is a straightforward process involving a few basic requirements. In some cases, this know-how comes in the form of certification.

These include: Know-how. An enrolled agent is a registered tax return preparer required to pass a suitability check, take an extensive test covering individual and business taxes as well as representation issues, and undergo hours of additional education every three years. The fastest potential pathway to becoming a registered tax agent is with a diploma or higher award in accountancy, plus board approved courses. A Diploma of Accounting generally takes around a year, although some students may complete faster, and others may take up to two years. This licence is issued once you: Pay a prescribed fee.

Get a recommendation for registration by the tax agents committee. In New Mexico, a Registered Agent can also serve as a general point of contact for receiving business and tax notices, payment reminders, and other documents. You are identified fit and proper person to prepare tax returns, notices of objection.

Recent improvements for tax agents. A tax agent must have a myIR account. The clients of a tax agent can be individuals or entities.