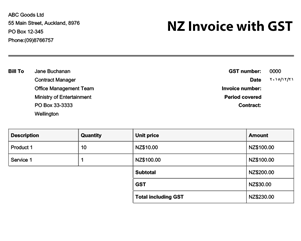

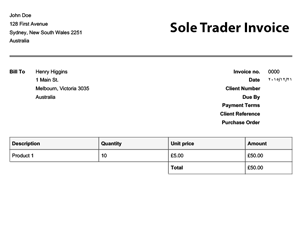

You’ll need to tell Inland Revenue you’ve become a sole trader and you’ll need to register for GST if you earn over $60a year. They’re entitled to keep all profits after tax, and they’re legally liable for any debts and losses incurred by their business. What is the need of sole trader business? Why to work as a sole trader?

Does government help for sole traders? Government help for sole traders — business.

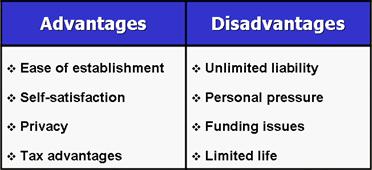

Mahi ā-kiri Self-employed Self-employed people carry out business activity on their own. Self-employment includes contracting, working as a sole trader and small business owners. Running your business as a sole trader has several advantages. The main advantage is simplicity.

As a sole trader , you register for GST if your earnings are over $60per year. To learn more about becoming a sole trader , including claiming expenses, ACC payments, record keeping and intellectual property, visit business. Operating your business as a sole trader avoids the costs and formalities involved in establishing and operating a separate legal entity.

Are you self-employe a sole trader , a partnership or trust?