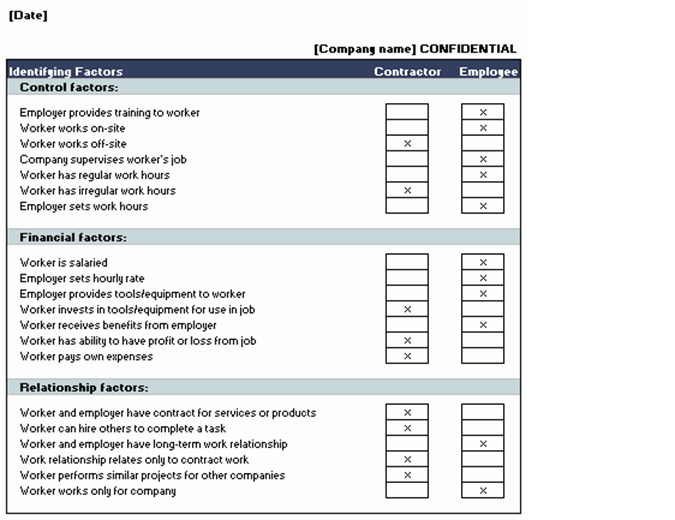

When determining if someone should be considered an employee or independent contractor , there are two tests that can be done. However, regardless of which test is use employee worker status is essentially based on who controls the worker’s activities. IRS Form SS-can also help in making these determinations. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

Contractors don’t receive benefits packages or pensions. Who is an employee vs.

Are they employees or independent contractors? Can I classify a worker as an independent contractor? Is your worker an employee or a contractor? The ABC test application may vary by state.

An employer must answer yes to all three parts of the test to qualify a worker as a contractor. The IRS automatically categorizes workers as employees unless proven otherwise. For the employee , the company withholds income tax, Social Security, and Medicare from wages paid.

For the independent contractor , the company does not withhold taxes.