Most people who come to Australia for a working holiday or to visit are foreign residents for tax purposes. See full list on ato. If you plan to work in Australia you need a tax file number (TFN).

Your TFN is your personal reference number in our tax system. You can apply for a TFN online once you have your work visa.

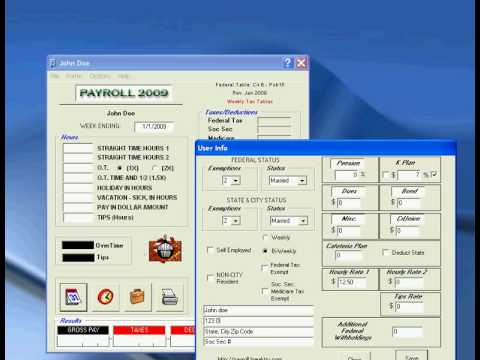

When you start work, you give your employer a TFN declaration. This helps the employer work out how much tax to withhold from your pay. If your employer is registered with us, they will withhold tax from.

Through Single Touch Payroll (STP) you will be able to see your year-to-date tax and super information in myGov. Working holiday makers do not register. It will show the amount you earne tax withheld and superannuation that has been paid.

You will see the information by logging in to myGov and accessing ATO online services. Your employer is no longer obligated to give you an end-of-year payment summary but if they do the payment summary will be available in myGov along with your income statement.

The information on your income stat. The Australian income year ends on 30 June each year. You do not need to lodge an income tax return or a non-lodgment advice if both of the following apply: 1. You are required to lodge an income tax return if either of the following applies: 1. Employers are required to make super contributions on behalf of their eligible employees to fund retirement. If you worked and earned super as a working holiday maker, your super will be taxed at when it is paid to you.

Departing Australia superannuation payment (DASP) 2. Returning to your home country 3. The simple calculation for a full-time worker The easiest way to work out the number of days annual allowance you should take your number of days worked a week and multiply this number by 5. The national unemployment rate stands at 10. What is the tax rate for working holiday makers? How to calculate holiday entitlement? How many days of paid holiday do you get? How much tax will be withheld from Gorge pay?

From that date, if you are in the following working holiday maker visa subclass you will be affected by the new rules: 4( working holiday ) 4( work and holiday ) HOW THE NEW RULES WORK. That gives someone working a five-day week the days we’ve already mentioned.

It only takes a few seconds to let you know how much money you’re owed. Holiday let income calculators can help work out your overall ROI however will be limited and generally can only be compared to other similar properties on a given platform. Schedule – Tax table for working holiday makers.

AU$6is the average Backpacker Tax Refund. Claim your Australia working holiday visa backpacker tax back from the Australian government. Use our backpacker tax calculator – your refund is waiting. Holiday calculator to work out statutory holiday leave in days or hours.

Use this tool to calculate holiday entitlement for:. Money and tax Passports, travel and living abroad. But for most people in full-time work there is a minimum requirement from your employer to give you days per year of holiday. We have developed a calculator that allows you easily calculate the amount of holiday time you have left this year.

If you work for yourself, you need to pay the self-employment tax , which is equal to both the employee and employer portions of the FICA taxes (1 total). Luckily, when you file your taxes, there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay. Let say the employee hourly rate is Php 57.

Business Days Calculator counts the number of days between two dates, with the option of excluding weekends and public holidays.