What are the four basic financial statements of accounting? What is a simple financial statement? Financial statements include the balance sheet.

Company management and independent auditors are responsible for ensuring that quarterly and annual financial statements accurately reflect the financial condition of a. First when cash is receive you debit cash and credit rent revenue. Than you debit Prepaid rent (an asset account). Credit the cash account.

When the rent is due: debit rent expense. Accounting rules require that financial assets such as equity investments in other firms be classified as either Available For Sale (AFS) or Held For Trading (HFT). The difference between these two classifications is the method of. FINANCIAL STATEMENT STALENESS DATES. Ameriprise may send updated tax statements when we receive revised information from the investment issuer, or when your account has other information changes.

Tax reporting updates due to income reclassification can occur any time throughout the year. We will only send new or updated tax statement (s) for accounts affected by changes. See full list on ameriprise. If you can read a nutrition label or a baseball box score, you can learn to read basic financial statements. If you can follow a recipe or apply for a loan, you can learn basic accounting.

The basics aren’t difficult and they aren’t rocket science. Just as a CPR class teaches you how to perform the basics of cardiac pulmonary resuscitation, this brochure will explain how to read the basic part. We all remember Cuba Gooding Jr. Jerry Maguire, “Show me the money! Well, that’s what financial statements do.

They show you the money. There are four main financial statements. Balance sheets show what a company owns and what it owes at a fixed point in tim. A balance sheet provides detailed information about a company’s assets, liabilities and shareholders’ equity.

Assets are things that a company owns that have value. Assets include physical property, such as plants, trucks, equipment and inventory. It also includes things that can’t be touched but nevertheless exist and have value, such as trademarks and patents. The literal “bottom line” of the statement usually shows the company’s net earnings or losses.

An income statement also shows the costs and expenses associated with earning that revenue. Income statements also report earnings per share (or “EPS”). Cash flow statements report a company’s inflows and outflows of cash. While an income statement can tell you whether a company made a profit, a cash flow statement can tell you whether the company generated cash. A cash flow statement shows changes over time rather than absolute dollar amounts at a point in time.

This calculation tells you ho. It uses and reorders the information from a company’s balance sheet and. He finished seventh, but if he had won, it would have been a victory for financial literacy proponents everywhere.

It’s so important to read the footnotes. The footnotes to financial statements are packed with information. Here are some of the highlights: 1. Significant accounting policies and practices – Companies are required to disclose the accounting policies that are most important to the portrayal of the company’s finan.

MDA is management’s opportunity to provide investors with its view of the financial performance and condition of the company. It’s management’s opportunity to tell investors what the financial statements show and do not show, as well as important trends and risks that have sh. But what do these terms mean and why don’t they show up on financial statements?

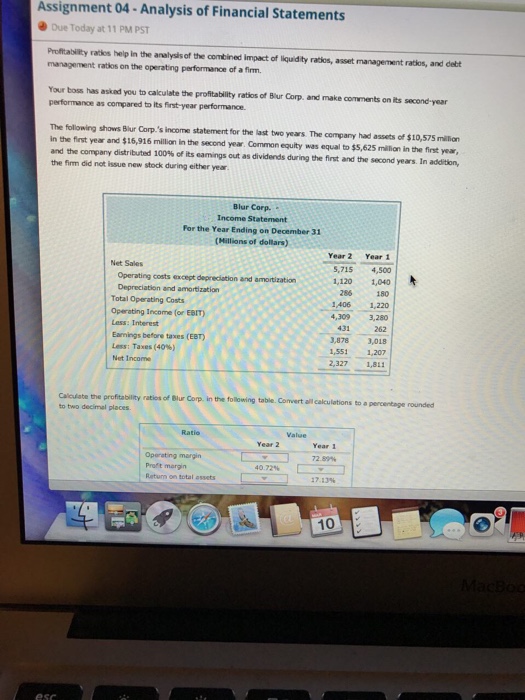

Listed below are just some of the many ratios that investors calculate from information on financial statements and then use to evaluate a company. As a general rule, desirable ratios vary by industry. Although this brochure discusses each financial statement separately, keep in mind that they are all related. The changes in assets and liabilities that you see on the balance sheet are also reflected in the revenues and expenses that you see on the income statement, which result in the company’s gains or losses. Cash flows provide more information about cash assets listed on a balance sheet and are relate but not equivalent, to net income shown on the income statement.

You will note that the first financial period is therefore longer than months. Current liabilities are generally due within a year of the balance sheet date and are listed at the top of the right-hand column and then totale followed by a list of long-term liabilities, those obligations that will not become due for more than a year. The financial statement that reflects a company’s profitability is the income statement. The statement of retained earnings – also called statement of owners equity shows the change in retained earnings between the beginning and end of a period (e.g. a month or a year). The Blueprint goes through different financial statements.

Plus, when it’s time to file your income taxes, you’ll know your financials are 1 comprehensive and correct, ready to be handed off to your accountant. Please see the table below to see when your company is required to file its annual returns, based on the financial year end. March 3 June 3 September 3 and December 31.

Quarterly reports are typically filed. All Major Categories Covered.