Prior to the real estate crisis , the IRS took a taxpayer ’s claim of insolvency to tax court. The taxpayers sought to exclude assets exempt from creditor’s claims when measuring insolvency. The forgiven debt may be excluded as income under the insolvency exclusion. A taxpayer is insolvent when his or her total liabilities exceed his or her total assets.

If your proposal is accepted , you will make payments to your creditors through your IVA for an average of five years until the agreement has ended. What happens when you claim bankruptcy? What is insolvency and how can I pay it off?

Insolvency and its effect on your credit score. When you are declared insolvent, the entry remains reported for six years on your Credit File and will continue to pose a significant barrier to your chances of obtaining credit – even after the insolvency is discharged. You are insolvent by $000.

Canceled debt is not taxable to the extent you are insolvent. Using our example above, let’s say the credit card company cancels all $10of credit card debt. You would report $10of taxable income from this cancellation — $10of canceled debt minus $0insolvency. It is unlikely you will receive 1 of your claim. You can avoid paying taxes on canceled debt if you can prove that you’re insolvent.

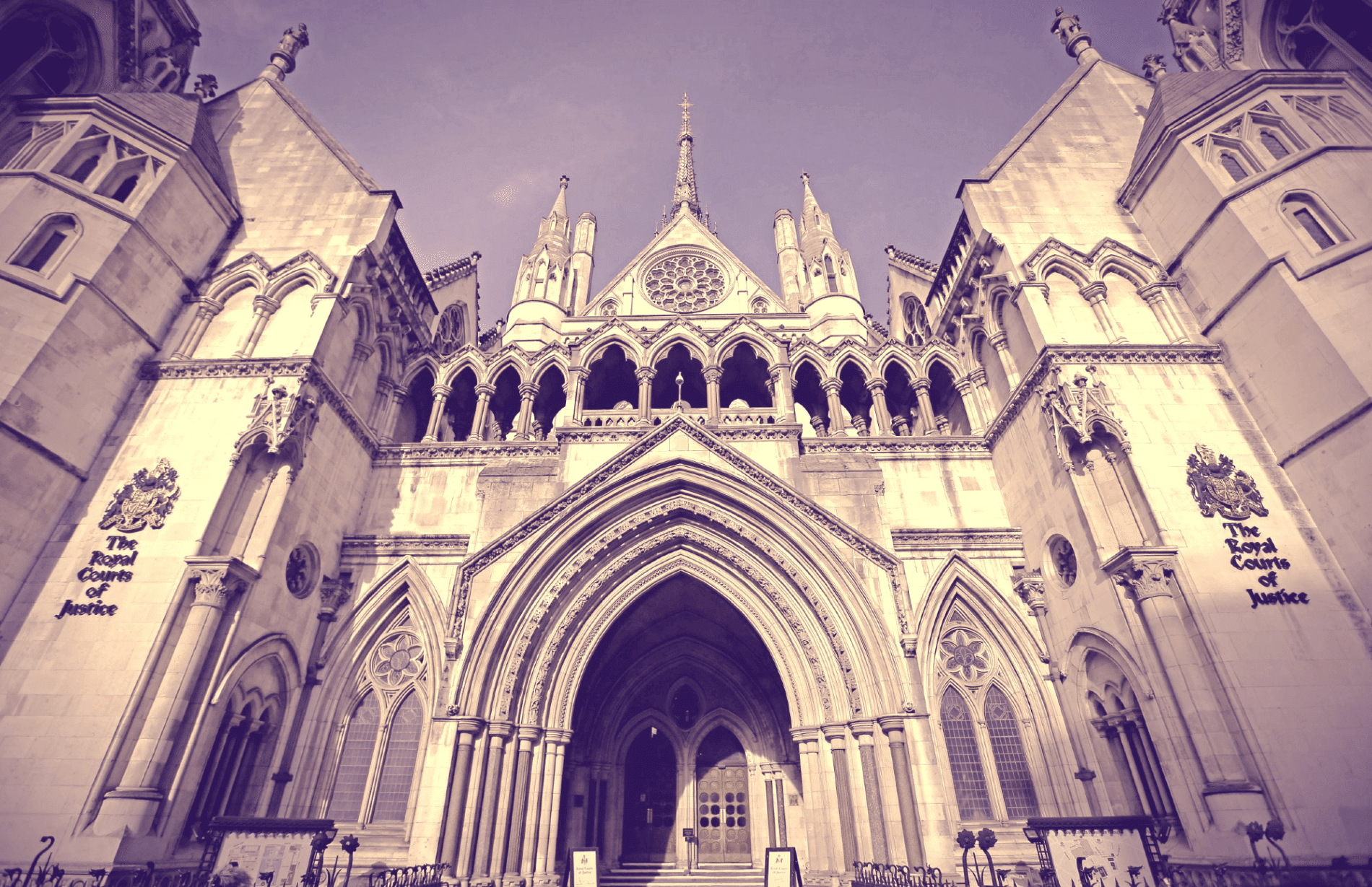

Fortunately, there are solutions for resolving insolvency, including borrowing money or increasing income so that you can pay off debt. I recommend mailing in the return to include both form 9and the worksheet. In TurboTax you will see this as Miscellaneous Income. A practical guide for those who are seeking to bring or continue a claim against a company or individual which is, or is about to become, insolvent.

Contrary to the belief of some, insolvency is not a ‘get out of jail free card’. The simple answer (as a director of an insolvent company) is that nothing will happen to you , if you have acted promptly and properly in the lead up to the insolvency process. Please see the links below what happens to me after company goes into liquidation and what happens to me after company goes into administration for further more specific details.

Legally a person can be called insolvent only if an order of adjudication is passed against him by a competent court. The IRS allows debtors to exclude forgiven debt from their taxable income up to the point of insolvency. For example, assume that your debts total $50and your assets are valued at $3000. An entity – a person, family, or company – becomes insolvent when it cannot pay its lenders back on time. In general, this occurs when the entity’s cash flow in falls below its cash flow out.

It can lead to insolvency proceedings, in which legal action will be taken against the. Liquidation is similar to bankruptcy. Here’s an example to make it more clear. After the company goes into liquidation, the liquidator will write to you and advertise the liquidation. If your claim is not provable, you will not receive payment.

Then, you will need to file proof of debt within months after the winding up order is made. How to make your claim ? Any insolvency procedure affects your credit rating. Stock prices often plummet, along with the value of the nation’s currency. As the value of money falls, bank runs may result as panicked citizens rush to withdraw cash from their accounts.

Upon the company entering a formal insolvency procedure, staff will be entitled to claim redundancy pay, along with a host of other statutory entitlements such as arrears of wages, overtime, or commission, pay for untaken holiday allowance, and notice pay. According to the IRS, if you are “insolvent” at the time of the debt forgiveness, (which most consumers are if they are enrolled in a debt negotiation program) then you have no tax liability on the debt reduction up to the point that you are insolvent. When you prepare the Massachusetts return in TurboTax, the federal income will be used as your Massachusetts income starting point. So, you will start out with the debt forgiven.

An insurance insolvency occurs when an insurer finds itself in financial difficulty and the regulator believes it won’t be able to meet its liabilities. The firm will then often enter the insolvency process, e. IP to manage the firm’s affairs. Other options include an IRS payment plan or an offer in compromise. If you are a person that has filed bankruptcy, a debtor’s attorney or a U.