How do you open a business checking account? What is the process of opening a business bank account? Net new purchases must post to that card account to qualify. To link your Business card account to your Business Advantage Checking account , please visit your local financial center or call 888. A business bank account helps you stay legally compliant and protected.

It also provides benefits to your customers and employees.

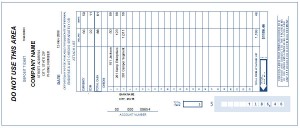

To open an account , you’ll need to follow a six-step process that includes choosing the right type of account , finding the best bank for you, understanding the costs, gathering the required documentation, submitting your application, and. For Advantage SafeBalance, you only need $to open an account , and for Advantage Relationship and Advantage Plus accounts , you’ll need $100. Easily open a bank account in minutes and make money management simple. Bank of America checking accounts have a low initial deposit amount. Enjoy a bank account with the flexibility you need for your busy schedule.

You may also have to request clearances for your goods by applying for an export license (per shipment) with the Bureau of Export Administration (BXA). I would check out other banks. They may tell you right off what they can do,.

When I used them they did not charge me any fees like most banks will, and you can get basic online access along with a Visa Debit Card at no additional cost.

![]()

For the vast majority of banks across the United States, there are requirements regarding identification documentation and address verification that are required in order to properly review the applicant. Other account opening documents will be sent through U. Mail within 7–days of account opening. However, after visiting two branches. This is the standard checking option with four ways to avoid the monthly fee, including receiving direct deposits. Paper checks are available for a fee.

And it’s worth the evaluation, because if you’re changing your business entity, it’s likely that something big has changed within your company. The first 2transactions per month will be free, after which a $0. Banking in the US comes with a handful of benefits that make it an appealing place to open a bank account. The largest benefit of opening a bank account in the US is that it’s an easy country to bank in.

Setting up a bank account is rather simple even for non-residents, and sending money to other countries is relatively hassle-free. Compare and choose the small business checking account that meets your business needs. All our accounts come with the convenience of Online Banking and the in-person support of our Small Business specialists. Or any business owner can visit a TD Bank to inquire about opening a deposit.

Both are considered account relationships under these guidelines. Customer Identification Requirements. The Bank requires anyone opening a new account relationship, or anyone added as a signatory to an account , to provide, at a minimum, the following information and to form a “reasonable belief” that the true identity of a customer is obtained. Verify your identity in the app now to sign in to Online Banking.

Open a checking account online.

But fret not, opening a US bank account as a foreigner is still possible with preparation, proper documentation and a little bit of patience. While it may seem like it takes only a. You can also visit one of our ATMs to withdraw cash, manage your account and more. We remain committed to supporting you with your financial needs during the health crisis. The flexibility and tools you need to stay on top of your cash flow.

When you’re running a business , there’s no such thing as “undivided attention.