What type of checking accounts are offered at Wells Fargo? How do you get free checks from Wells Fargo? Certificate of Good Standing. Statement of Organization.

Open your new Wells Fargo business checking account and. Overdraft protection is available from your Wells Fargo. Owners, partners, and key executives need to be present at account opening. CDs, and credit), OR.

First $0in cash deposits processed per fee period at no charge. Text and mobile banking. Access to our National. The information in this disclosure may not be entirely accessible to screen readers.

Minimum opening deposit: $25. See the common fees for this account (PDF). You can avoid the $monthly service fee with one of the following each fee period: $5average balance, OR.

When depositing into a Wells Fargo business deposit account. Please refer to the Merchant Services Terms and Conditions and Operating Rules or Program Guide for additional information. Clover devices require a Clover software plan for an additional fee. Beginning of popup Notice. Please contact your own legal, tax, or financial advisors regarding your specific business needs before taking any action based upon this information.

Pacific Time, Saturday a. Time in business: At least two years (varies by product) Credit score: 640. This survey also included an oversample of diverse segments — ensuring a minimum of 3interviews each among African American, Asian, and Hispanic small business owners. Within days of account opening (the “qualification period”), receive a total of $0or more in qualifying direct deposits to the new checking account during the qualification period. Fund the new business checking account with a minimum opening deposit of $25. Bank”) to obtain verifications and reports from time to time, such as credit bureau reports and.

Business Account Applicant. The primary account owner is – years old. On the primary account owner’s 25th birthday, the account is automatically subject to the monthly service fee unless you meet one of the other options to avoid the monthly service fee. The recipient of the business checking cash bonus offer in the past months.

Offer cannot be: Paid without a valid U. Taxpayer Identification Number (W-9). Combined with any other business deposit offer. Reproduce purchase sol transferre or traded. Fees and required balances also tend to be higher for business bank accounts , while interest rates are lower. For many small businesses, a critical step is opening a business checking and savings account.

Think of these accounts as essential tools to help your small business grow and thrive. A Fast Flex loan can get you instant approval, but you need a Wells Fargo checking account with deposits over $50open at least year. There is a $minimum per investment, per account. Fund name $ Amount Fund name $ Amount.

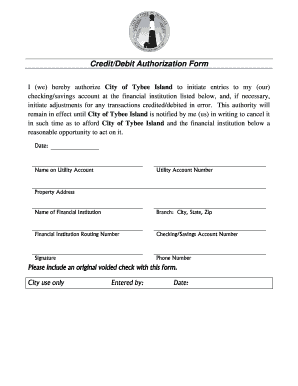

I Once a month on the day of the month or Twice a month on the and days of the month. This privilege will be effective upon receipt of valid bank information. A Wells Fargo Multicurrency Account. MCA) offers you greater convenience with your foreign currency transactions.

You can deposit foreign receivables without having to convert them to U. These accounts all have monthly fees, but you can avoid them with a minimum balance requirement in most cases. Because Wells Fargo is so big, it offers virtually any service your business might need.