Blanket exemption certificate. The seller may rely on the blanket certificate until it is revoked in writing. The Office of Foreign Missions (OFM) enforces the exemption of eligible foreign missions and their members from payment of any taxes when purchasing, leasing, registering or titling a vehicle.

The owner may establish prima facie entitlement to exemption or exclusion of the classified motor vehicle by filing an application for exempt status with the assessor within days of the date taxes on the vehicle are due. When an approved application is on file, the assessor must omit from the tax records the classified motor vehicles described in the application. What IRS Form is required for taxes on selling car? What is form j in the sales tax exemption?

How to apply for a vehicle exemption? Application for Property Tax Exemption. Texas Comptroller of Public Accounts. To qualify for the exemption , the vehicle must be registered solely in the name of the veteran, or jointly with a spouse.

This application is for use in claiming a property tax exemption for one motor vehicle used for both the production of income and personal non-income producing activities pursuant to Tax Code Section 11. Form DTF-8defines the terms non-resident and resident. To claim an exemption from registration late fees. Trust Affidavit for Exemptions (VP 242) To enable the use of a Veterans or other exemption when the vehicle is titled to a trust.

Exemptions from the motor vehicle sales and use tax are: Transfer by contest, drawing or raffle ( Form MVU-21) Transfer of a fire engine or ambulance ( Form MVU-22) Motor vehicle, trailer or other vehicle transferred to an insurer ( Form MVU-23) Gifts ( Form MVU-24) – As long as the donor paid any. Individuals who are requesting a Property Tax exemption must complete PT-401-I. EXEMPTION SECTIONS: Required documentation is listed for each exemption.

If the vehicle is registered or purchased out of state, you must pay vehicle taxes up front. Any motor vehicle owned by the commonwealth or any political subdivision or United States government. The portion of the retail price attributable to equipment or adaptive devices placed on new motor vehicles to facilitate or accommodate handicapped persons is exempt from motor vehicle usage tax. Documentation of amount paid for such equipment or adaptive devices must be submitted with this certification.

To be a valid exemption , you must be registered for New Jersey sales tax. Vehicle Property Tax Exemption Government. One motor vehicle owned and used for personal transportation by the qualified veteran.

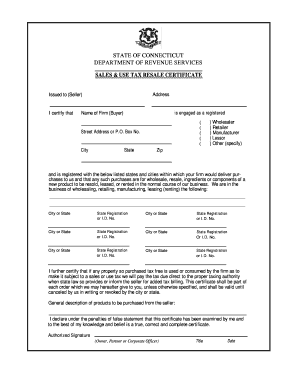

The purchaser pays the appropriate amount of Florida sales and use tax. Unit Exemption Certificate. This exemption certificate is used to claim exemption or exception on a single purchase. This certificate is used to make a continuing claim of exemption or exception on.

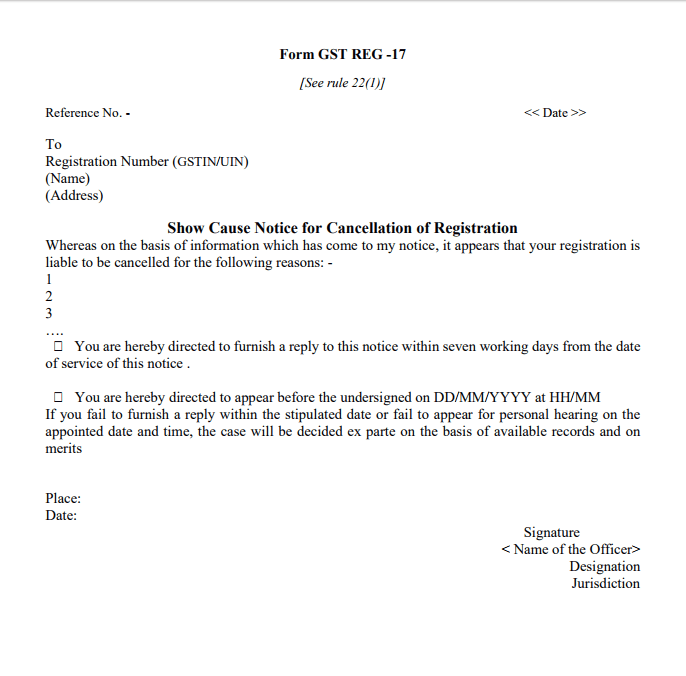

A, 1- which also lists the required. Select exemption reason of military. The customer must complete and sign this form to claim the. Methods allowing tax exemption.

An affidavit must be used when this method is used. The Wisconsin Department of Revenue (DOR) reviews all tax exemptions. You may be penalized for fraudulent entries. WisDOT collects sales tax due.

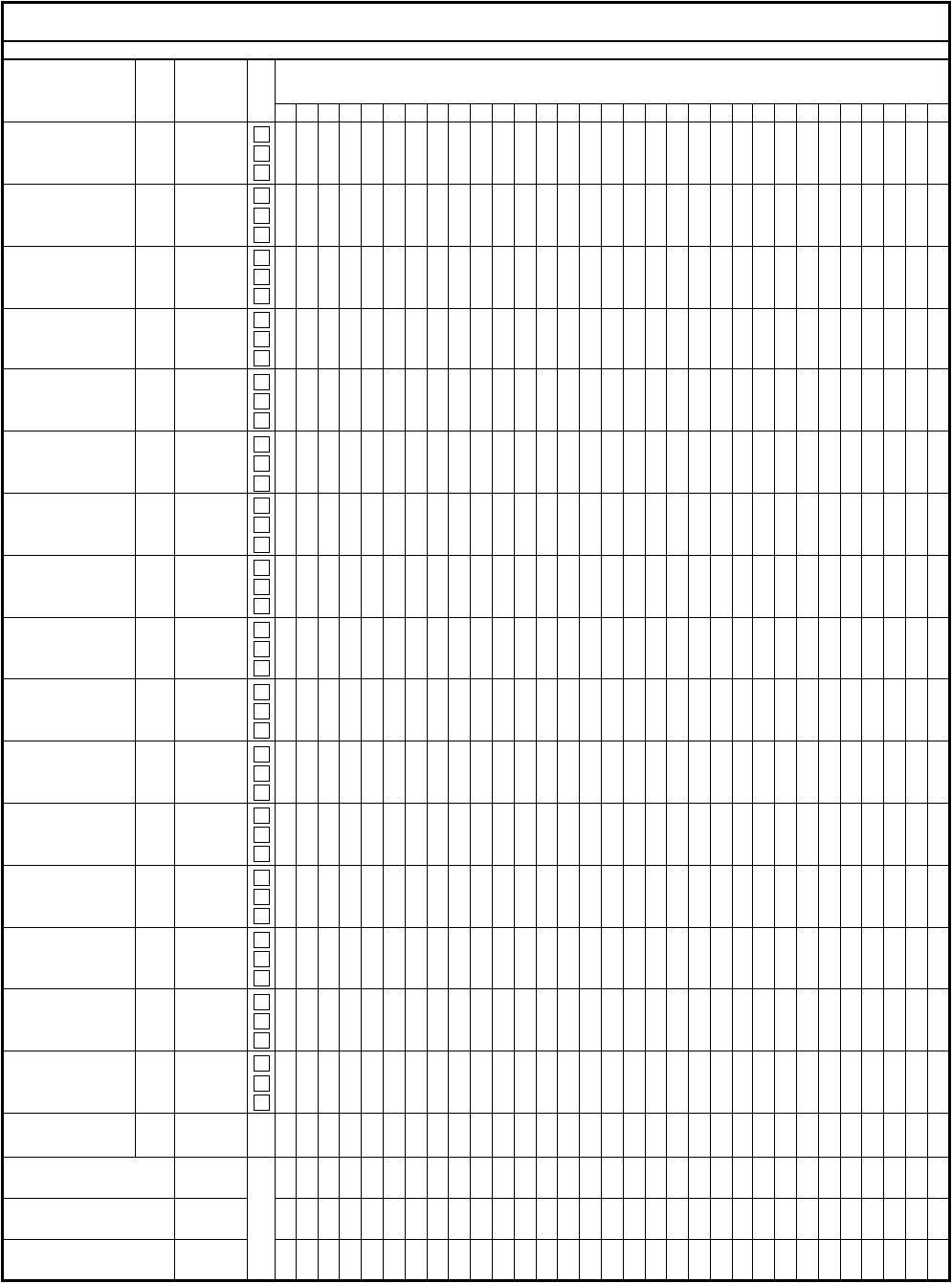

Disclosure of this information is required. Failure to keep this information in your books and records could result in disallowing a deduction that was claimed. Each motor vehicle must be listed separately to qualify for tax exempt status. A partial exemption of a motor vehicle may not be granted. If a motor vehicle is used for other than incidental nonexempt use, no exemption may be granted.

We would multiply the $0x. Contractor Registration and Tax Forms. Sales and Use Tax Returns. Taxpayer Seminar Form. Electrical Generation Tax.

The exemption ID number must be entered in Section B of the Form 13. An individual or business that has been issued a common or contract carrier certificate of exemption may only use it to purchase those items described above prior to the expiration date on the certificate. The certificate of exemption expires every years.

An exemption from payment of sales tax may apply when a member of the US military, who is a permanent Florida resident, stationed outside of Florida, purchases a motor vehicle or vessel outside of Florida and titles and registers the vehicle or vessel in Florida.