What is real estate transfer tax? Is there a federal estate tax in utah? For the rest of the country, the average homeowner who purchases a $ 150home will pay approximately $ 7in closing costs. Included in these closing costs for people in most states is a real estate transfer tax.

The real estate transfer tax can go by many other names. Real estate transfer taxes are taxes imposed on the transfer of title of real property. A majority of states and the District of Columbia provide for this tax but states do not.

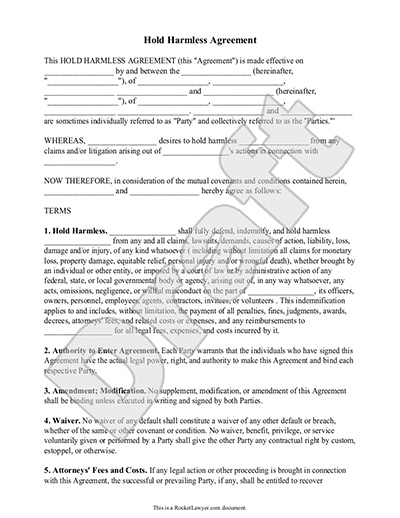

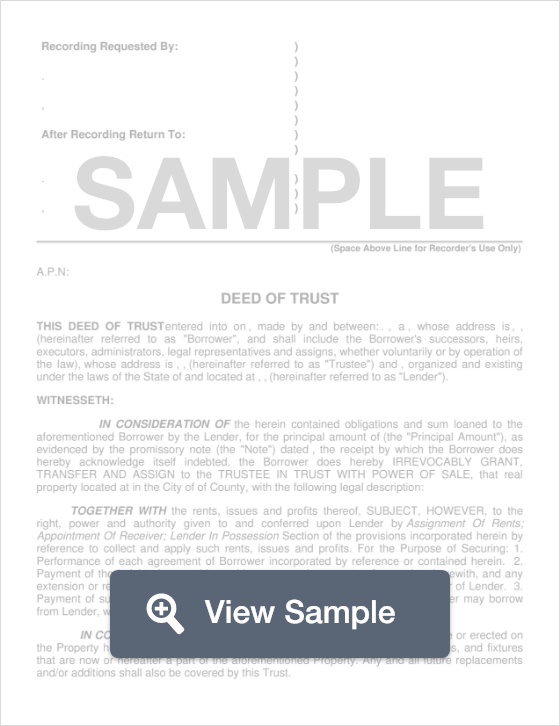

The state statutes may or may not stipulate who (buyer or seller) is. If your estate is large enough, the federal government may tax your estate after you die. To transfer real property by devise, the will must first be declared valid by an order of informal probate by the registrar (75-3-102). Normal Cost of Deals. Deed transfer taxes are part of the normal cost of real estate deals in most states.

Some states also impose a mortgage tax , paid by the buyer through the closing costs. This tax may vary by locality within the state. Whether it’s out of the goodness of your heart or a part of an estate planning strategy, these transactions happen for a number of reasons.

While property transfers can be useful to accomplish a particular goal, not all taxpayers consider the tax consequences. Download our Mobile App available for both iOS and Android. Learn More about our mobile apps today.

For real property, your property tax is calculated by multiplying the taxable value of your property by that year’s tax rate for each taxing entity in your tax area. A fee simple title is presumed to be intended to pass by a conveyance of real estate , unless it appears from the conveyance that a lesser estate was intended. Thus, if the market value of your home is $1000 the taxable value is just $5000.

Your local tax rates apply to that taxable value. Payments accepted by check, cash, e-check, debit card ($fee for any amount), or credit card ( of payment amount fee with a minimum of $5). E-Check is a secure, electronic transfer from your personal or business bank account WITHOUT a fee. The 2nd notice I just received looks pretty official – but wording is still a little ambiguous.

File electronically using Taxpayer Access Point at tap. Utah Property Tax Rates. To get a rough idea of how much estate tax will be due in an estate , one would add up all of the property that will be subject to estate tax , as described below. Flat real estate transfer fee: $2.

Flat fee Arkansas State transfer tax : $3. Local optional transfer tax $0. Cities within a county that implements a transfer tax can have a tax rate that is half of the. It requires an acknowledgement of the grantor’s.

Overview of Real Estate Transfer Taxes To give perspective and context to emerging controlling-interest transfer taxes , it is helpful to com-pare their fundamental elements with those of tradi-tional, deed-triggered real estate transfer taxes. However, if the seller is a VAT-registered person, the sale of his ordinary asset shall be subject to VAT even if the sales made are within the prescribed threshold. For most real estate transactions, the tax is based on the sale price of the property or the fair market value. At the time of publication, transfer tax rates were around $2. The tax rate varies, based on the county.

There are no documentary, mortgage, or transfer taxes. Montanans may pay their property taxes annually by November 30th or semi-annually by November 30th and May 31st. NEBRASKA Title companies, lenders, real estate agents, and attorneys all conduct closings. Conveyance is by warranty deed.

Mortgages and deeds of trust are the security instruments.