Fill Out Your Form In Minutes With Our Template Builder. Sample Loan Agreements – Start Now. Download To Word And PDF Instantly. Create A Comprehensive Agreement. Customize Your Template Instantly.

The borrower promises to pay back the loan in line with a repayment schedule (regular payments or a lump sum). As a lender, this document is very useful as it legally enforces the borrower to repay the loan. An unsecured promissory note is a simple agreement form that accompanies a loan.

The purpose of this document is to outline how the borrower (the person receiving money from a bank or another lender) promises to pay back the money. Loan Agreement Forms Family Loan is an Unsecured Loan It’s of utter essence however to note that family loan agreements are totally unsecured since the person borrowing the money is a family member or a close friend. This is to say that there are no assets taken as collateral incase the family member fails to pay back the money. An agreement between a lender, who may be an individual or a corporate body, and a borrower, who is a individual person (or a company). The loan is unsecured with no guarantor.

Likely to be used for family loan arrangement or loan to director by his own company. Provisions to protect the lender. A Personal Loan is a form of unsecured loan that you can use for personal purposes, like funding a home renovation project or paying for medical bills and emergencies.

This type of loan is not usually for commercial or business use. Unlike other types of loans , a Personal Loan is unsecured , which means that it normally does not require an asset as collateral when you apply for one, but you would need Personal Loan Agreement Forms to set the terms and conditions of the loan you will take and. How do you write a loan agreement? What is a secured loan agreement?

Alternatives to this unsecured loan agreement. Net Lawman offers three documents in this set. Each is available in two versions: one for a company borrower and the other set for a human individual or partnership borrower.

All can be for any purpose. Learn more about unsecured loan agreement , which is a document covering the terms of an agreement for you to borrow money from somebody else. Browse our various legal documents across different industries, and explore the business legal advice offered through the LawBite website and app. This document is used to record the terms between the parties, including the method and amount of repayment of loan and also the penalty in case of default of such payment. A loan agreement is a legal document and a written promise to repay the money that is described by the Agreement between the lender and the borrower.

Maryland corporation (the “Lender”). A bank loan agreement is a contract between a borrower and a lender that outlines the terms and conditions of a loan. Banks and independent lenders alike can use this Bank Loan Agreement Template to quickly draft up loan agreements for new clients. The form provides that the borrower promises to pay the lender in monthly installments.

Write A Comprehensive Loan Agreement In No Time. The agreement also provides that there will not be a pre-payment penalty on the note. Notice of Default in Payment Due on Promissory Note – This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The borrower is given the full sum of the loan on the first (1st) on the day of commencement and must pay back the lender along with any interest stated. Access to this document and the LeapLaw web site is provided with the understanding that neither LeapLaw Inc.

Other names for this document : Secured Promissory Note Form , Loan Security Agreement. The word secured means that the loan is backed by an asset put up as collateral. If the loan cannot be repaid the collateral is forfeited to the creditor.

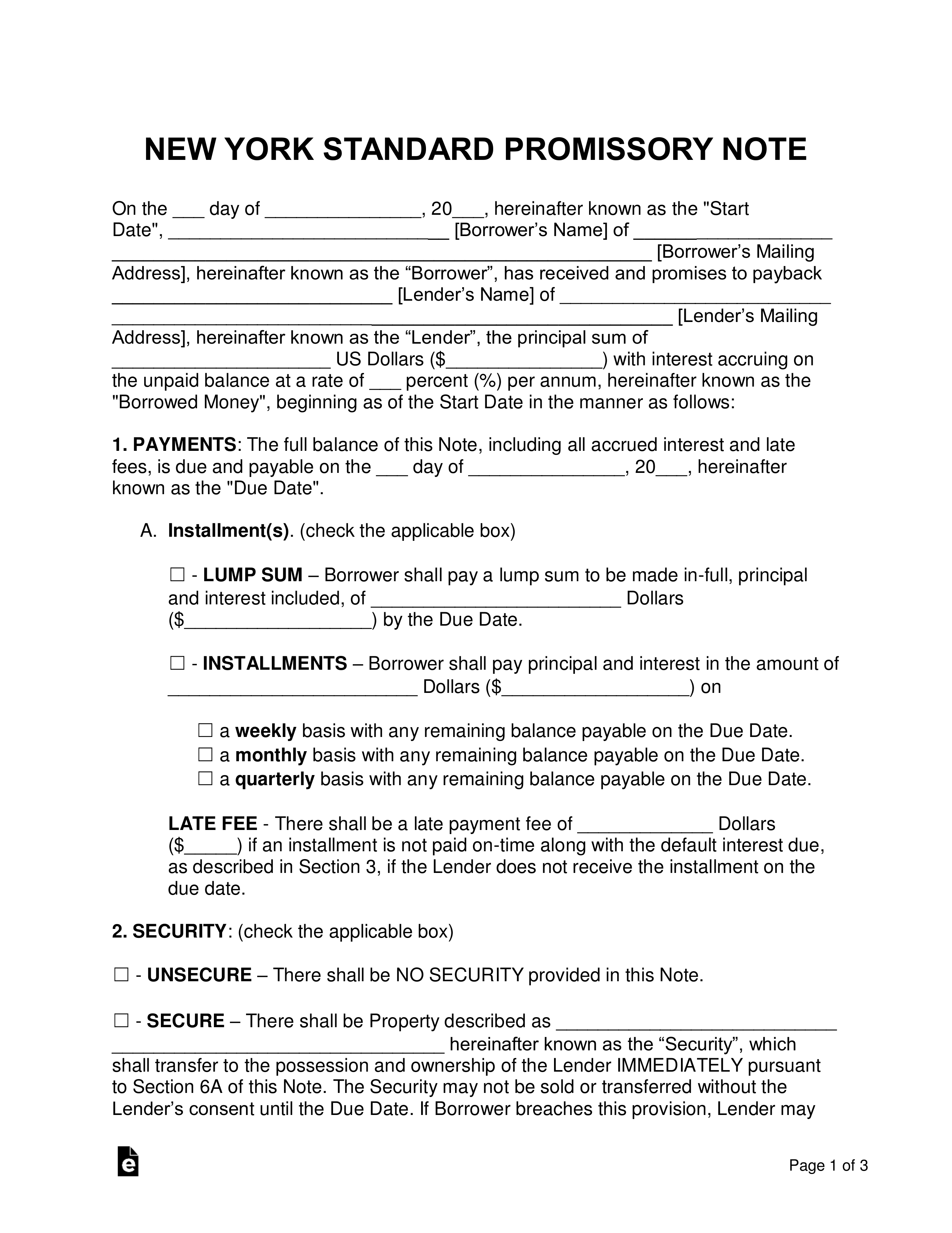

LOAN AGREEMENT AND PROMISSORY NOTE.