What is an Unit Trust Company? How does unit trust affect investments? Are unit investment trusts securities? In Asia, for example , a unit trust is essentially the same as a mutual fund. In Canada, a unit trust is an unincorporated.

At the end of each quarter, Bob receives a dividend payment reflecting the dividends and interest earned by the securities underlying the unit trust.

For example , one UIT might consist of a basket of blue-chip stocks that have raised dividend payouts every year for at least years and have a certain minimum market capitalization size. Another might be made up of biotechnology stocks headquartered within the United States. In this guide, the term “fund” will also refer to a unit trust.

There are 50units already in issue. The NAV does not represent the price you will pay for a unit in a unit trust. This means that the NAV is £2. A unit trust is a form of collective investment constituted under a trust deed.

Those investing in the trust own units whose price is called the net asset value. A Unit Trust spreads your money across many investments, reducing the chances of you suddenly losing large amounts of money should the markets change.

The value used is not a minimum, maximum or suggested amount. That is, a UIT buys a relatively fixed portfolio of securities (for example , five, ten, or twenty specific stocks or bonds), and holds them with little or no change for the life of the UIT. Example of a Charitable Remainder Unitrust. The price of unit trusts can go up and down, driven by the price of investments held by the fund.

If the assets fall in value, the unit price will also reduce. Offer price per unit = NAV of $1. With $00 you buy: 952. Buy price per unit = NAV of $1. In a unit trust all units have the same rights to income and capital distribution and voting rights in a meeting.

Be aware of the format of the exam questions. Understand how to do the necessary calculations. Be able to answer the past years’ sample questions. A Unitrust, also called a Charitable Remainder Unitrust or CRUT, requires that a fixed percentage (minimum ) of the annual value of trust assets be paid to the income beneficiary. For example , a CRUT with a value of $000and a payout would pay $100to the income beneficiary in that year.

Because the investment portfolio of a UIT generally is fixe investors know more or less what they are investing in for the duration of their investment. Unitholders’, who are the beneficiaries in a unit trust , own a set number of units in a similar fashion to shareholders in a company. Unit Trusts are typically classified by geography, sector and type of assets held.

For example , if a fund name reads Yellow Pebble Asia Energy Equity Fun this means that the fund is managed by a fund house called Yellow Pebble which invests in equity stocks of companies in the energy sector that are listed in Asia. The unit trust in this document package is a fixed unit trust.

Please see the product pages on our website for information on the trusts created by these deeds. Process: Establishing the Unit Trust – Fixed To effectively establish the Sample Fixed Unit Trust , you need to arrange for the following formalities to be completed. In a UT the unitholders have a fixed right to the income or capital of the trust and will receive the same in the proportion of units they hold compared to the total units on issue (on a similar basis to a company and its shareholders). The portfolio is divided up into “units”, which are then bought by investors. For Internal Circulation and Training Purposes Only.

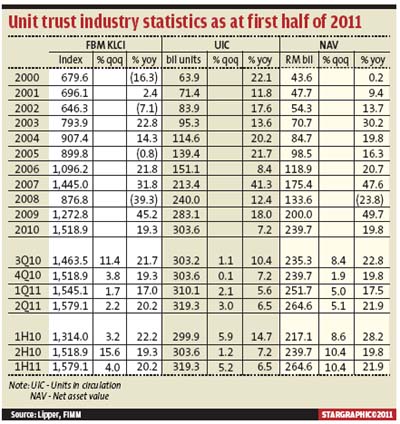

Source: FiMM Study Guide –Dealing in Unit Trusts. Unit trust funds are professionally managed by fund managers. NAV per unit = Fund NAV Units in circulation NAV per unit = RM24mil 12mil = RM2.

Research on the performance of investment trusts versus unit trusts (see here, for example ) regularly shows that investment trusts regularly do better in the vast majority of sectors when you look at longer periods of ten years or more. It is invested by money managers in a variety of securities such as stocks, bonds, fixed incomes and etc. The term “ unit trust ” is often used in the British Commonwealth while “mutual fund” is more widely used in the United States.