Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! No Installation Needed. Convert PDF to Editable Online. What is a trust agreement?

Beneficiaries have a fixed interest in all the property that is the subject of the trust. It sets out how the unit trust is managed. They are similar to a Shareholders Agreement. As the trustee is often a company, the owners will also require a “shareholders agreement” to also address the corporate aspects of their structure.

The other two types are mutual funds and closed-end funds. A trust is a legal agreement by three parties that allows you as the “ trustor” to transfer your property and assets to your beneficiaries. Formal agreement through which a trustor vests the ownership rights (title) to one or more assets to one or more trustees for conservation and protection on behalf of one or more beneficiaries of the trust.

The trust instrument is also called a simple Trust Agreement because it does not contain provisions to reduce or eliminate estate taxes. A charitable remainder unitrust (known as a CRUT) is an irrevocable trust created under the authority of Internal Revenue Code § 6(Code). This simple Trust Agreement contains the type of provisions often found in a revocable living trust for a married person with young adult children and a modest estate.

Unit Holders Agreement. A trust agreement is a document that spells out the rules that you want followed for property held in trust for your beneficiaries. Common objectives for trusts are to reduce the estate tax liability, to protect property in your estate, and to avoid probate. This is a trust for which the interest of each beneficiary can be described at any time by referring to units of the trust.

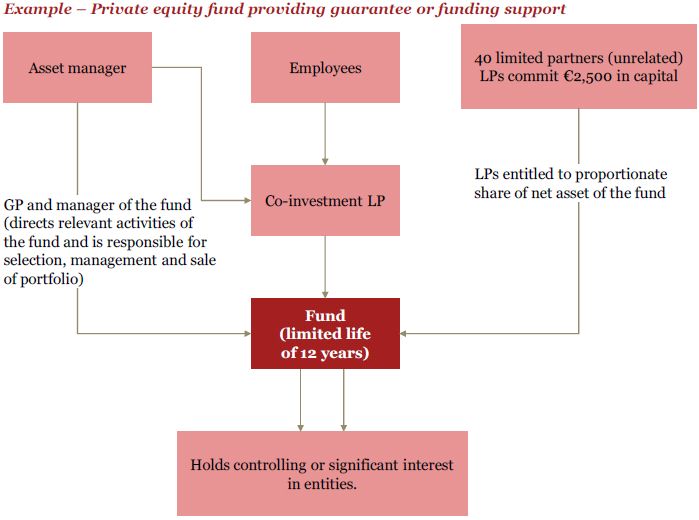

A right of property, real or personal, held by one person, the trustee, for the benefit of another, the beneficiary, from which a fixed percentage of the net fair market value of the assets, valued annually, is paid each year to the beneficiary. A unitrust, also known as a charitable remainder trust , is a legal device defined by federal tax laws that is frequently used by wealthy individuals who wish to make a substantial contribution to a school or charitable organization. If you invest in a unit trust or fun your money is pooled with money from other investors and invested in a portfolio of assets according to the fund’s stated investment objective and investment approach. Section 26(a)(1) provides that a UIT’s trust indenture or agreement must designate a trustee that is a bank having a specified minimum amount of capital (not less than $50000). The following unit trust agreement is an example of an agreement drafted to meet the minimal requirements of the Charitable Bingo Enabling Act and the Administrative rules of the Charitable Bingo Operations Division (CBOD).

This person is known as the settlor. The settlor begins a trust with the intent of holding property and assets for the benefit of someone else. The settlor can place any asset into the trust including real estate, vehicles, investments, savings accounts, and even antique items and art. Think of a trust as a special place in which ordinary property from your estate goes in an as the result of some type of transformation that occurs, takes on a sort of new identity and often is bestowed with super powers: immunity from.

Depending on the type of trust that you and your lawyers create, the account will likely be set up with a trustee designation. If you are the trustee, this will include your name. Those investing in the trust own units whose price is called the net asset value. In this investment agreement the term ‘unit trust portfolio’ refers to the Nedgroup Investments unit trust portfolios administered by us.

A unit trust is a form of collective investment constituted under a trust deed. Each unit represents the same amount of assets in the unit trust portfolio. For example, a CRUT with a value of $000and a payout would pay $100to the income beneficiary in that year. When a grantor transfers assets to an irrevocable trust , she relinquishes all future rights to access, use, or control those assets.

This includes purchasing units in a unit trust. The distribution per unit and rate paid by the trust may be higher or lower than the amount shown above due to certain factors that may include, but are not limited to, a change in the dividends or distributions paid by issuers, actual expenses incurre or the sale of securities in the portfolio. A trust acquisition also occurs when your trust interest increases.

Put simply, it sets out how that trust will be managed — setting out the rights and responsibilities of each owner. This is in the sense that they are not subject to any discretions on the part of a trustee, and are unitize in the sense that those rights are divided amongst the beneficiaries based on how many units have been issued to them. This type of agreement confirms the terms and conditions of the relationship between unitholders and covers matters that are not adequately or appropriately addressed in the unit trust deed especially to minimise any future uncertainty, dispute or friction should there be a difference of opinion between the parties in respect to how the unit trust should be operated or how a unitholder can transfer their units, etc. Unlike discretionary trusts, unit trusts allocate the shares in the property for beneficiaries in the trust agreement , rather than discretion by the trustee.

Each beneficiary is allocated a unit in the trust property beforehand. In your Trust Dee the shares in the investment property are now determined by what was set out in the agreement. If the investment performance for that year was and the value of the trust on the valuation date was $200the income beneficiary would receive $110in that year.

Operating Agreement – – ARTICLE IV CAPITAL CONTRIBUTIONS 4. UNIT INTERESTS IN THE COMPANY. Such a trust would keep the assets separate from a spouse’s assets but may be subject to creditors, depending upon the state and whether the creditors fit within the ascertainable standard outlined in the trust.