What is an example of an unincorporated business? What does unincorporated business mean? Commerce) a privately owned business , often owned by one person who has unlimited liability as the business is not legally registered as a company. Definition Any business which has not filed articles of incorporation with the local state authorities and is not recognized as an incorporated business by the Internal Revenue Service.

A key difference between a registered business and an unincorporated business is that owners of an incorporated company enjoy liability protection.

Creditors have no power to target your assets to collect a payment because the company is responsible for its own financial affairs. Similarly, if your unincorporated business is involved in a lawsuit, you can be held personally responsible for the costs. Unincorporated businesses are typically sole proprietorships or partnerships. By contrast, an incorporated business takes considerable time to run and is well-suited to larger businesses, including those with a significant number of employees. See full list on upcounsel.

The first step in establishing an incorporated businessis to file articles of incorporation, which requires the payment of a fee. Additional costs you may incur as a registered business owner include: 1. Annual fees to regulatory boards 2.

Legal fees for assistance in maintaining the corporation 3. Ongoing costs for financial reports, accounting, and federal and local tax filings 4. These documents may include financial records and reports on the activities of the business. An unincorporated business owner can usually avoid such expenses. Common costs may include: 1. Occasional legal assistance 2. When filing taxes, owners of an unincorporated business must report any profits or losses on their own tax returns because the business has no independent existence.

However, corporations pay a lower rate of tax than individuals. This means that a registered business owner can be taxed twice. As an owner of an incorporated business , you also have the option of deferring taxes to a later date, or apply for tax deductions. By ensuring you claim deductions for business expenses, you can cut your tax bill substantially. If you own an unincorporated business , you have the option of claiming personal tax credits.

Unlike owners of registered businesses, you can also use any losses incurred by your company to decrease your personal income tax bill. When an owner of a registered business sells the company to an investor, the company continues to exist as before. By contrast, you need to draw up new deeds to sell an unincorporated business to a new owner.

A further advantage for owners of registered companiesis that they can issue stock to raise capital. You should keep in min however, that doing this will lead to a decline in the share of the company you own.

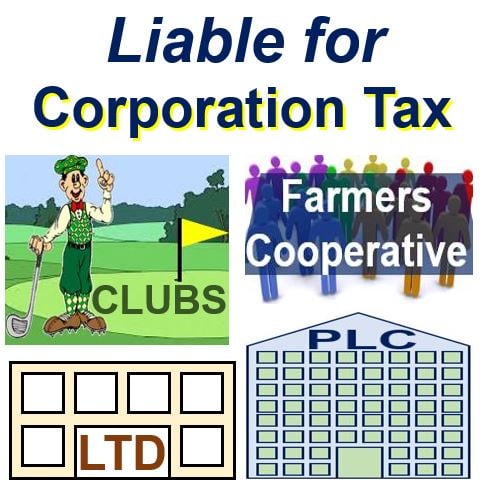

On the plus side, banks and other financial organizations see the ability of registered businesses to issue stock as a positive thing and are usually more likely to lend money to you than to an unincorporated business. This is because they consider the issuing of stock as a way to cover debts or increase cash flow. Additionally, you need to report business activities to shareholders and the government i. These entities can be partnership businesses or association of persons or any other similar entities which consists of more than persons (owners). If you are the owner of a business , you have several structuring options.

Choosing your business structure is the most important decision that you can make when starting your company, and it can affect several important issues: 1. How your business is taxed. Your ability to expand your company in the future. There are two basic business classes: unincorporated and incorporated. Deciding whether to incorporate your business or leave it unincorporated depend.

Incorporation makes your business a completely separate legal entity from yourself. Choosing to incorporate your business will provide a variety of tax and financial benefits. If you decide to incorporate your business, there are different structures you can choose, meaning you can pick an option that meets the current and future needs of your business.

You can incorporate your business using one structure and then transition to another structure as your business expands. For instance, many sm. In addition, incorporation provides more beneficial taxation and makes it easier for you to pass on your business to your children.

Receiving limited liability protection is the main reason people choose to incorporate their business. After incorporation, you will be shielded from the debts of your company, meaning your personal assets cannot be pursued in a lawsuit against your company. While unincorporated companies do not provide the liability protections and beneficial taxation of incorporated business , there are some distinct advantages to leaving your company unincorporated. They do not require the large amount of paperwork that you would need to complete and file to incorporate a business.

In addition, unincorporated companies are much less complex than incorporated businesses and do not need to follow th. Forming a limited liability company is simpler than incorporating and provides the same sort of asset protection. The business can be active or in the process of being liquidated. Unlike an incorporated business , which has an independent legal existence, unincorporated companies are not distinct from their owners. By contrast, a C corporation is subject to double taxation: entities organized as C corporations pay taxes on what the business earns, and then employees who receive payment pay taxes again against what the business pays them.

An incorporated business (also called a corporation) is a type of business that offers many benefits over being a sole proprietor or partnership, including liability protection and additional tax deductions. Forming a corporation also allows you raise capital through sale of shares of your company. Accounts of a sole proprietorship or a DBA are not insured under this account category.