Both types are elaborated below. There are types of promissory notes , secured and unsecured. This is a type of promissory note that is backed by a valuable property or a security such as a house, car etc.

These notes differ according to where you want to use them. All of these serve the same purpose. Find out the types of promissory notes below.

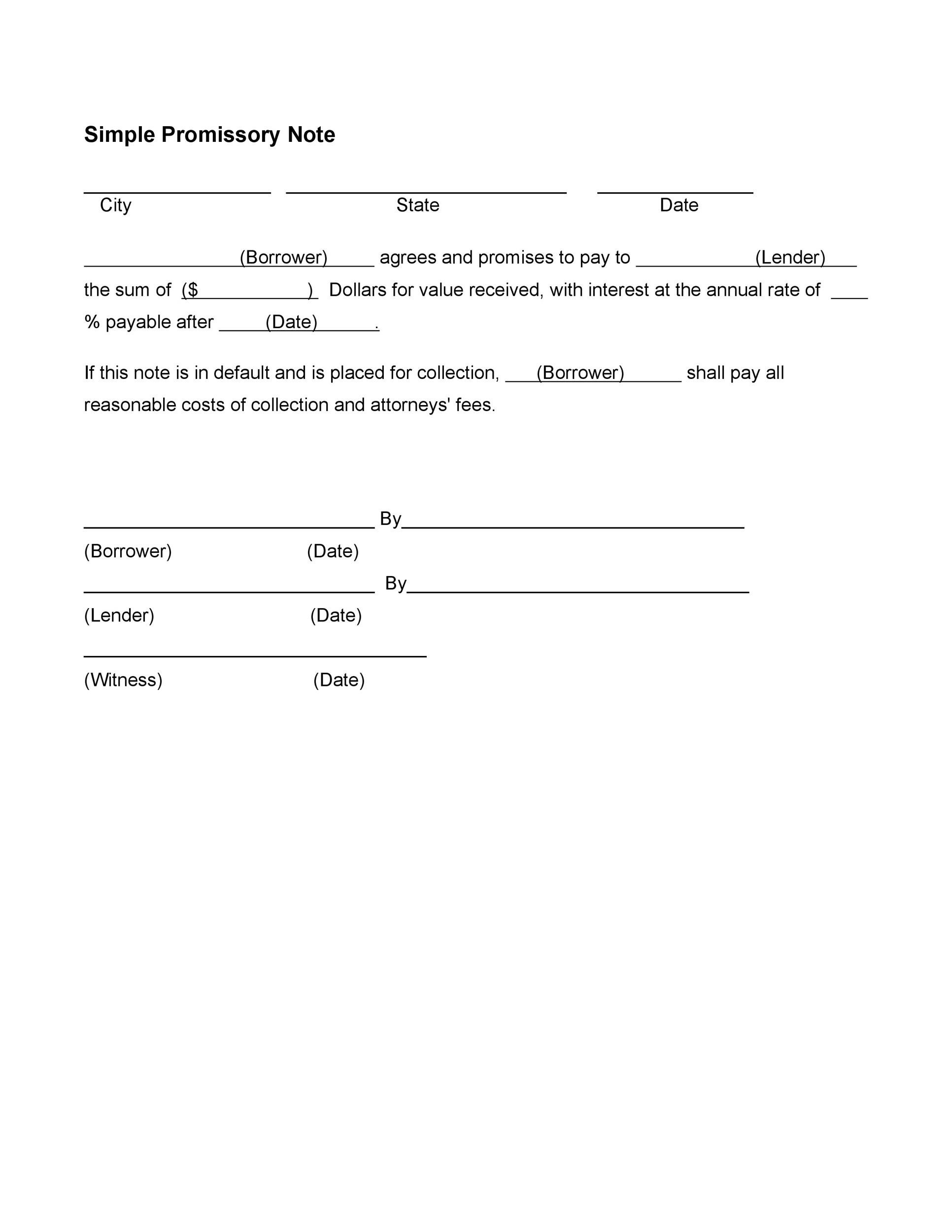

Do take note that each of these types are legally binding contracts. You may also like medical note examples. This type of promissory note is the one that you might use in order to record your personal loan from another person or party, usually.

These items are then sold or repossessed if the borrower fails to make a payment or has a default. Examples of such loans are mortgages and auto loans wherein. How does a mortgage differ from a promissory note?

What are the advantages and disadvantages of promissory notes? Are Bank issued promissory notes legal? Is an IOU considered a legal promissory note? Department of Education. Depending upon the kind of promissory loan, notes are of different types.

Few are mentioned below. Though people avoid legal writings when seeking a loan from close contact, the promissory note shows belief and trust in the interest. While both have similar elements that are necessary for a promissory note, it has one main difference. The main difference between secured promissory notes and unsecured promissory notes is the collateral. Other types include a promissory note , a document stating a promise to pay a specific amount to a particular person on a fixed date mandated by the payee.

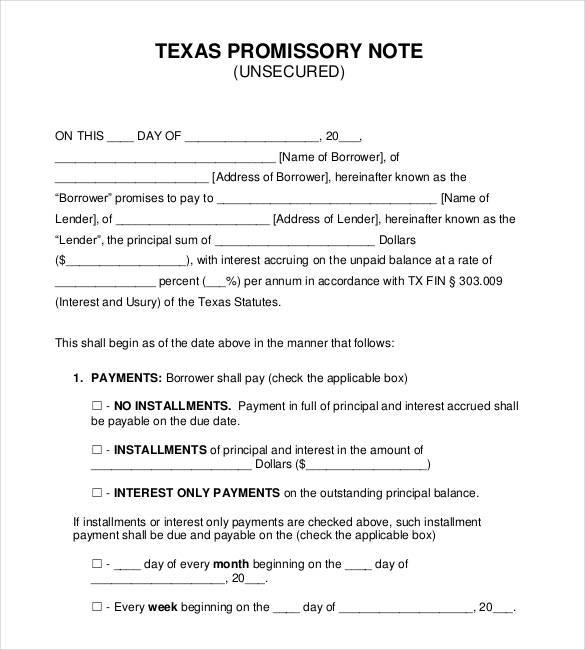

Other various types of thank you notes in PDF , in which our site gladly offers. A Texas promissory note is a contract between a borrower and a lender. The lender agrees to provide a loan.

The borrower promises to repay it according to the terms of the agreement. There may be a co-signer who agrees to satisfy the loan if the borrower does not. A secured promissory note involves collateral.

A promissory note must include the lender and borrower’s name and address, amount of money being borrowe payment schedule, and the signature of both parties to finalize the promissory note. One can write a promissory note for different kinds of loans, such as personal loans , student loans, and vehicle loans. Every promissory note always comprises of three important parties. These include the maker, the payee as well as the holder.

Even endorsers and endorsees can be parties in certain cases. The maker: This is basically the person who makes or executes a promissory note and pays the amount therein. Promissory notes are enforceable legal documents.

Many people sign their initial secured promissory notes or dedication notes as a part of the method of obtaining a student loan. Non-public lenders generally need students to sign dedication notes for every separate loan that they do away with. For a more detailed loan, an in-depth Loan Agreement can be used. How to modify the template. This promissory note form can be used in most situations.

For certain legal forms, some states require specific wording and conditions to be included in the document. It is your responsibility to ensure that this promissory note form complies with state and local requirements. Here are types of promissory notes that can be held in a PENSCO self-directed IRA: 1. In the event of default, the lender is entitled to the underlying collateral. Though every good promissory note contains certain elements, there are several types of promissory note.

That sai promissory notes are generally defined as securities unless they mature in months or less. The US Supreme Court has created a rebuttable presumption that any note maturing in more than months is a security unless it resembles a note that is not commonly classified as a security.