What is contract of indemnity? How does indemnification work? These include insurance indemnity contracts, construction contracts, agency contracts, etc. Implied indemnity This is an obligation to indemnify that arises, not from a written agreement, but more from circumstances or the conduct of parties involved. Type I, Type II , Type III , Which Indemnity Clause Is Your Contract Type?

Metal Deck Specialists. As the name suggests, this is the broadest form of protection for the indemnitee. It requires that the. This is an agreement that the indemnitor will indemnify the indemnitee but does not expressly. These special insurance policies indemnify or.

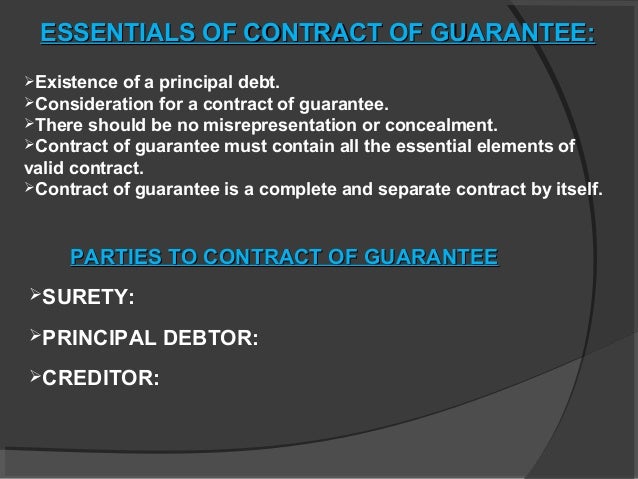

Indemnity is a contractual obligation of one party to compensate the loss incurred to the other party due to the acts of the indemnitor or any other party. The duty to indemnify is usually, but not always, coextensive with the contractual duty to hold harmless or save harmless. In contrast, a guarantee is an obligation of one party assuring the other party that guarantor will perform the promise of the third party if it defaults. In these clauses, one party will indemnify the other party for all loss or liability related to. Indemnity bonds are surety bonds used by governments, businesses and individuals to establish assurance that an agreement will be fulfilled as stated.

Reflexive or Reverse Indemnities. Conventional indemnity plan – An indemnity that allows the participant the choice of any provider without effect on reimbursement. In this context, there are several types : Broad form indemnity agreements, also called no-fault agreements, have been common in construction contracts where all loss is placed on the sub-contractors. Many states have declared this type of indemnity agreement to be illegal.

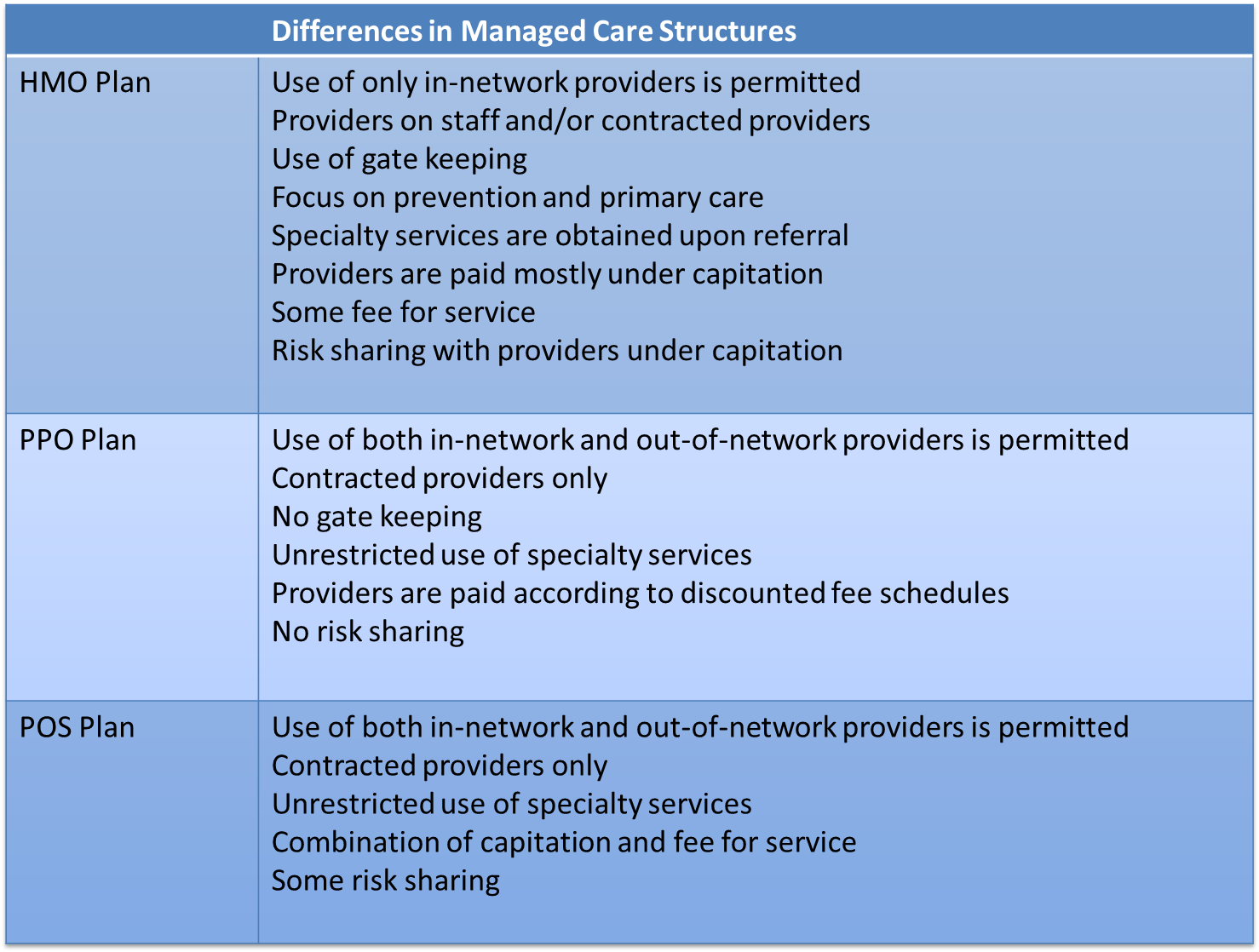

Advantages of Indemnity Health Insurance Plans. The indemnity health policy is different than policies offered by health maintenance organizations (HMOs) and preferred provider organizations (PPOs) because it allows you obtain medical care where you choose providing compensation for a set portion of the costs. A contract of indemnity has two parties. The promisee or the indemnified or indemnity -holder: He is the person whose loss is covered or who are compensated.

Each insurance brand may offer one or more of these four common types of plans: Health maintenance organizations (HMOs) Preferred provider organizations (PPOs) Exclusive provider organizations. Therefore, indemnity clauses are often the focus during contract negotiations. The meaning of indemnity clauses differs depending on individual situations and the contract itself.

Discovery covers are used. Indemnity clauses are tricky yet very useful contractual provisions that allow the parties to manage the risks attached to a contract, by making one party pay for the loss suffered by the other. The scope and effect of an indemnity depends mostly on the intention of the parties and the way it is drafte so make sure you pay great attention to. Although the three forms of indemnity were once regarded as distinct, California courts have held that there are only two basic types of indemnity : express indemnity and equitable indemnity. Though not extinguishe implied contractual indemnity is now viewed simply as “a form of equitable indemnity.

The different types of Indemnity Limits. Employers and Public Liability insurances usually limit their liability in respect of damages and claimant’s costs arising from any one occurrence, with no limit for the period of the policy. This risk transfer device often utilizes one of three types of indemnity clause: broa intermediate, or limited. A copay is a flat fee, such as $1 that you pay when you get care.

Coinsurance is when you pay a percent of the charges for care, for example.