How are treasury bills make money? Other articles from investopedia. Treasury Department with a maturity of one year or less.

T- bills are sold through the U. For example, if you buy a $0bill at a price per $1of $99. Before you buy a bill , you have to decide whether to make a competitive or non-competitive bid.

Non-competitive bidding is the simplest way to purchase a treasury bill and is what most people do who are not experts in security trading. Market quotations are obtained at approximately 3:30. US treasury constant maturity rate index for year, year, and year T bills , bonds and notes for consumers. Funds collected through such tools are typically used to meet short term requirements of the government, hence, to reduce the overall fiscal deficit of a country.

ET by Sunny Oh Stocks book fresh round of records, Dow ends 1. Issue Date Tender Security Type Discount Rate. These investments are often considered quite safe because they are backed by the United States government. The US government guarantees treasury bills , making them a particularly safe investment.

View the latest bond prices, bond market news and bond rates. These bills are by nature, the most liquid money market securities and are backed by the guarantee of the Federal Government of a nation. They are sold at a discount and redeemed at par.

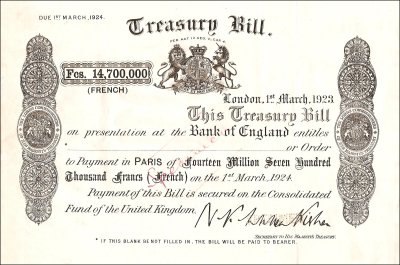

A treasury bill is only typed instrument which is found in both capital and money market. These instruments constitute a useful cash management tool primarily to cover temporary shortfalls in government’s weekly cash flows an secondly, to. In other words, they are IOUs with a maturity date of less than one year offered to the financial markets by the US government in an effort to fund its activities. They’re a safe product, easy to understand and available at a relatively affordable price. That’s why they’re highly coveted by investors.

Issued by the Government and is 1 risk free. Bills are typically issued with month, month and year maturities. Maturities and volumes are published at 11.

This raises short term capital for the government to fund a variety of needs. Bonds of longer maturity are called dated securities. Interests are paid on maturity. View and download daily, weekly or monthly data to help your investment decisions. The deadline for submission of tenders to the Reserves and Domestic Market Management Department of the Central Bank is 12:noon on the auction date.

At a discount means the instrument is sold to an investor, at below the face value. A $10face value day (month) t bill is currently being sold at auction.

So they possess high liquidity compared to other market players in the short tenure. High marketability: As they are issued by government and possess good liquidity in the market, treasury bills have the high marketability. It is therefore neither a bill of exchange nor a promissory note, but represents a charge on the revenues and assets of the Republic of South Africa.

TREASURY BILLS By AP Faure. MEMBERS OF THE GENERAL PUBLIC WHO MAY WISH TO INVEST SHOULD APPLY THROUGH ANY COMMERCIAL BANK OR DISCOUNT HOUSE IN THE COUNTRY BEFORE THE SUBMISSION DATE. Bond market data, news, and the latest trading info on US treasuries and government bond markets from around the world.

But banks haven’t been eager to pass on those higher rates to depositors, as noted above. Mnuchin is responsible for the U.