Can executor of estate transfer assets? How to transfer your issuer sponsored shares? Can beneficiary transfer stock to brokerage account? What determines if stock is transferred to estate? If you have inherited shares or are managing shares for a deceased estate , Deceased Estate Assistant guides you through the process of transfer , sale or finalising the estate.

An investor can hold listed Australian shares under a CHESS (Broker) Sponsored or Issuer. Transferring or Selling Shares. If the remaining shareholders decline to take up the offer, the shares can be transferred to a third party. The first step in transferring stock to an heir is to locate the bank holding the account. This may be a traditional bank, an.

Communicate with the bank. Generally, those companies can provide assistance and the necessary forms to get the stock transferred. If the stocks are transferred to the estate, then dividend income and gain or loss on the sale of the stocks is income or loss of the estate for income tax purposes (An estate with income files an income tax return). When you inherit an asset you must keep special records.

You also need to know its market value at the date they die and any related costs incurred by the legal personal representative. The total of this is the amount the asset is taken to have cost you. If the legal personal representative has had the asset value ask for a copy of the valuation report. They should be able to give you these details. See full list on ato.

Normally a capital gain or loss is disregarded when a CGT asset passes from the deceased to a beneficiary or legal personal representative. However, a capital gain or loss is not disregarded if a post-CGT asset passes from the deceased to a tax-advantaged entity or foreign resident. In these cases, a CGT event is taken to have happened to the asset just before the person died.

The CGT event will result in a: 1. These capital gains and losses should be taken into account in the deceased person’s ‘date of death return’. This is the tax return for the period from the start of the income year to the date of the person’s death. Any capital gain or loss from a testamentary gift of property can be disregarded if the gift is made to a deductible gift recipient and the gift would have been income tax.

If you inherit an Australian residential property from a deceased person who was a foreign resident for six years or less at the time of their death, the main residence exemption that the deceased accrued for the dwelling is available to you as the beneficiary. The main residence exemption means you may not pay CGT on any capital gain made after you sell or dispose of the inherited property depending on the use of the property by both you and the deceased. Similarly, the normal CGT rules apply if a legal personal representative sells an asset from a deceased estate. If the asset is a dwelling, special rules apply, such as the main residence exemption may apply in part or full.

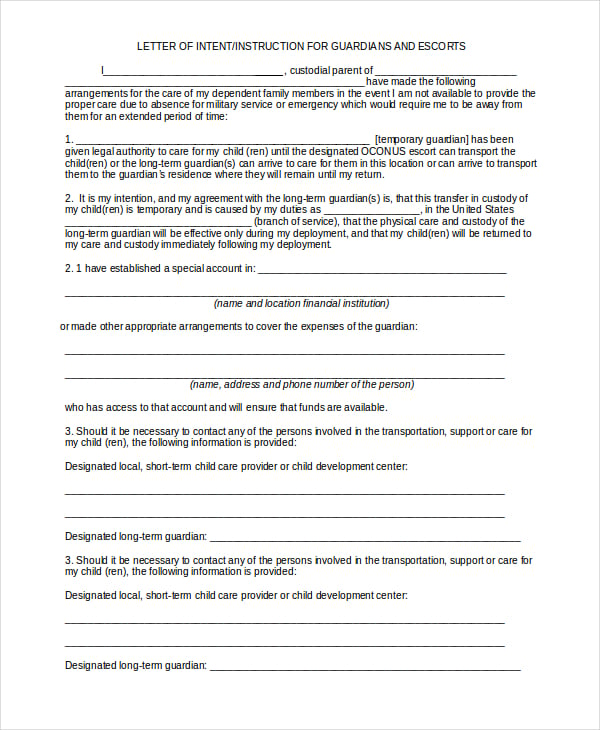

Winding up a deceased estate 2. Cost base of asset 3. Choosing a calculation method 4. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! This person will fill out stock transfer paperwork, send it to appropriate parties and make sure the transfer is completed in a timely manner. Credit: As I’ve noted before, death can bring out the worst in families. To transfer stocks, the executor also needs a copy of the will or a. That sai I see no problem where beneficiaries of a deceased estate request a direct transfer of shares , providing all.

Each state has its own laws about the order of inheritance in cases where there is no will or other estate planning document. In some states, the spouse shares the estate with the children of the deceased. Property that was held by the deceased with another party or parties as joint tenants does not form part of the estate. The appointed Executor of a Deceased Estate is the only person who is lawfully authorised by the Master of the High Court to handle the assets of the Deceased. The Executor is required to effect transfer of the Immovable Property in terms of the Last Will and Testament of the Deceased.

Death is not a CGT event that will create a tax liability on the shares transferring to your name. However, when you subsequently sell the shares , the sale will trigger a CGT event at that time. To manage the details of the shareholding, you need to notify the AMP Share Registry that the shareholding is now an estate.

You can contact the share registry as outlined below. OUR SMALL ESTATE SERVICE TRANSFERRING OR SELLING THE SHARES DONATING THE SHARES TO CHARITY REPLACING LOST SHARE CERTIFICATES GLOSSARY We know it can be a difficult time when someone close to you dies – especially if you’ve never had to deal with things like shares before.