How Do I Transfer Property From Trust to Beneficiary? How do you transfer trust real estate to a beneficiary? What is a Beneficiary Transfer? Who has legal authority to transfer property from a trust to a beneficiary?

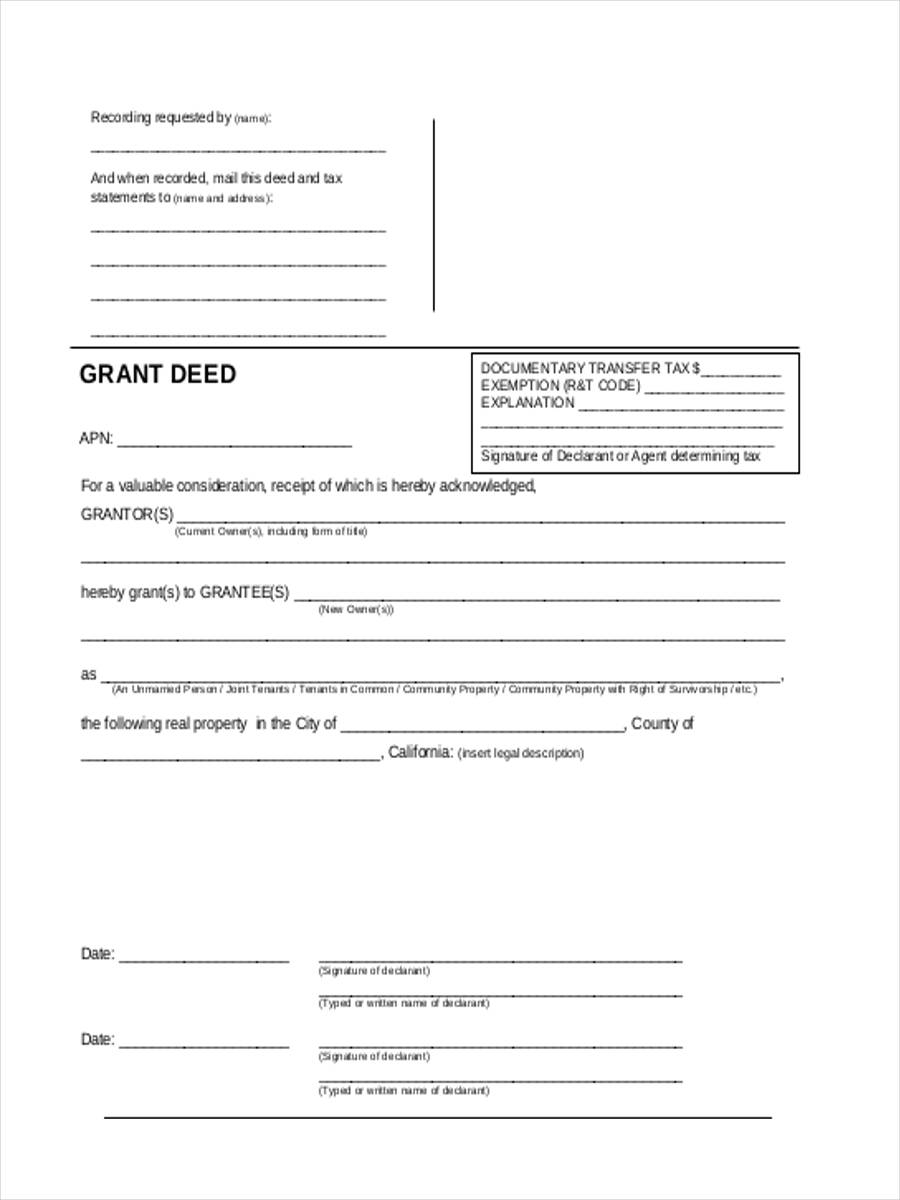

Can I transfer the property title to a trust? The grantor essentially transfers all the ownership of the associated assets into the trust and removes the right of ownership of those assets to the trust itself. If a trust holds real estate, the trustee will need to sign a new dee transferring the property to the new owner – the trust beneficiary. By Mary Randolph , J. When you’re ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you’ll need to prepare, sign, and record a deed. Transfer on Death Deeds are used in Estate Planning to avoid probate and simplify the passing of real estate to your loved ones or Beneficiaries.

It’s also known as a “ Beneficiary Deed” because in essence, you’re naming a Beneficiary who will receive the deed to your property after you pass away. Trust property may include any type of asset. Ownership would not necessarily revert back to you. If you included provisions for a trust protector in your original trust documents, you can call upon this third party to make the change.

Every trust must name at least one trustee. The trustee is the person who manages the trust and the trust property. Some trusts, however, name co-trustees. This means the trustee must obey the trust terms and only transfer property when the trust authorises it. See full list on pocketpence.

Most personal property can be transferred without a document of title. For example, household furnishings, family jewellery, electronics and farm equipment do not require documents of title. Other types of property require documents of title, including real estate, cars, boats, ATVs and certain types of financial accounts.

Cars and other types of personal property typically are transferred by a bill of sale. A transfer from a discretionary trust (the trust ) to a beneficiary absolutely (where the beneficiary is a natural person). For the purposes of s36A: Dscretionary trust and beneficiary are defined in s36A(3). The discretionary trust from which property is being transferred to a beneficiary of that trust is called the principal trust.

Secon expenses related to the transfer -on-death deed are less than the ones related to other methods of transferring property , such as revocable trusts and. Will the trust issue a Form K-to the beneficiary ? If so, how much income will be reported on that K-1? Is the estate or trust required to recognize gain on the distribution?

Documents you need to send. Transfer of trust property by the beneficiary : The beneficiary can (where there is one beneficiary or if there are several beneficiaries and all of them agree) direct the trustee to transfer the trust property to him (if there are several beneficiaries to all of them) or to such other person as the beneficiary (or the beneficiaries may desire). Only the trustee has legal authority to transfer property from a trust to the beneficiary.

The method for transferring property to a beneficiary depends on the type of property. More specifically, the method depends on whether the property requires a document of title. For those people who want to jointly own real estate with other Trust beneficiaries , deeding property out of the Trust is an easy option. When it comes to stocks and bonds, those also can be transferred out of the trust without being sold. A) Trustor-Transferor Beneficiary Trusts.

The transfer of real property by the trustor to a trust in which the trustor-transferor is the sole present beneficiary of the trust. A trust to which a unit trust scheme relates. A superannuation fund under s41A. Relevant time means the time at which the property first became subject to the fixed trust.

When the maker of a revocable trust , also known as the grantor or settlor, dies, the assets become property of the trust. The procedure for transferring real property from an estate to someone other than a designated beneficiary , for example if real property is sold by an executor , however, is not handled by a. How to transfer property to beneficiaries. Real property includes lan houses, units and commercial or industrial properties in NSW. If the trust liquidates an asset before distributing cash-proceeds to the beneficiary , then the trust will recognize the taxable gain or loss, not the beneficiary.

If the trust directly transfers property to the beneficiary (e.g. stocks or mutual funds), then the tax basis will depend on whether the trust is revocable or irrevocable.