Can I transfer land from one property to anothe? What is a deed to transfer property? How to transfer property? File the quitclaim deed with the county in which the property is located. When the deed is filed with the county, it becomes part of the public recor and anyone can research the records and find that the property has been transferred from one name to another.

There is usually a small fee involved with filing a quitclaim deed with a county.

Most buyers give attention to only getting the registered sale deed as a proof of rightful ownership of the property and updating the name in the official records like property tax documents is often overlooked by many new property buyers. This involves clarifying tenancy between the property owners. Be clear about what the Seller will pay for, and what the Buyer will pay for. The seller pays for the Capital Gains. The process starts with a trip to the correct Bureau of Internal Revenue Regional District Office (BIR RDO ). The person signing the instrument is called the grantor.

By executing a grant dee the grantor guarantees. A deed is a legal document which describes the property being sold and must be signed by the sellers. To begin the transfer of real estate, the seller should find a blank deed form and get the legal description of property.

In some cases, there may also be Stamp Duty Land Tax to pay. Adding a family member to the deed as a joint owner for no consideration is considered a gift of of the property’s fair market value for tax purposes. Inheriting a property is not enough, legal transfer of its title in your name is a must for any loan mortgage, rent agreement or sale. All these aspects require fulfillment of various legal. Once the beneficiaries and their shares, rights and liabilities are decide the property has to be transferred in their names.

For this you need to apply for property transfer at the sub. This process helps the property owner to transfer the title ownership after the property is either purchased or in case of inherited property. It could be physical or incorporeal or a person’s belongings or jointly owned by a group of people in a legal manner. Given this, a property is something that being accounted for the person owning such property. If the property still has a home loan attached to it you will need to have the details of this on.

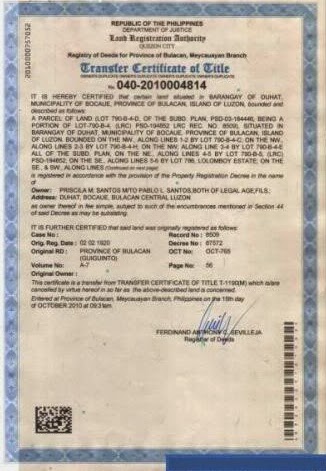

Get a copy of the property title. You can contact your local state office that looks after land titles for a copy of. Fill out a property title transfer form. A property title provides the names of all legal owners of a certain piece of real estate.

There are two types of property title that can be transferred in the state of Illinois. The first is real property , and refers to real estate properties such as lan houses, condominiums or commercial properties. Title to real estate is transferred from owner- to-owner, through the document called the deed.

It is simply a transfer of property from a legal entity (the trust) to a person and the transfer should be considered in that context.

The transfer of property is when the ownership of a property is moved from one person to another person. This happens when a property is sold or when the owner of the property dies and leaves the property to another person. Another way of deed transfer is through a quitclaim deed. Registration in the name of the seller by the person transferring property is crucial for the transfer of clear title in favour of the new owner.

One of the simplest ways to add your wife to the home title is by using an interspousal deed. Known as a grant deed in California, a warranty deed conveys and warrants that there are. Transfer With a Warranty Deed.

The notary will then stamp the transfer deed to make it valid. There are however things to consider such as does the transfer of property to your wife attract stamp duty (which if there is an existing mortgage then there could be, but not second home SLDT) or is there any Capital Gains Tax to pay? Yes, a conveyance of an ownership interest in a legal entity (such as a corporation, a partnership, etc.) which owns property is a transfer of ownership of that property provided that the ownership interest conveyed is more than percent of the total ownership interest.

The documents needed are:-1. Death certificate of your parents. The charges you paid in the registrar office is towards the stamp duties meant for registration of the property in your name. The CGHB charges are meant for the board for the purpose of transfer of name from leasehold to freehold.

It is really required to transfer the name in CGHB record.