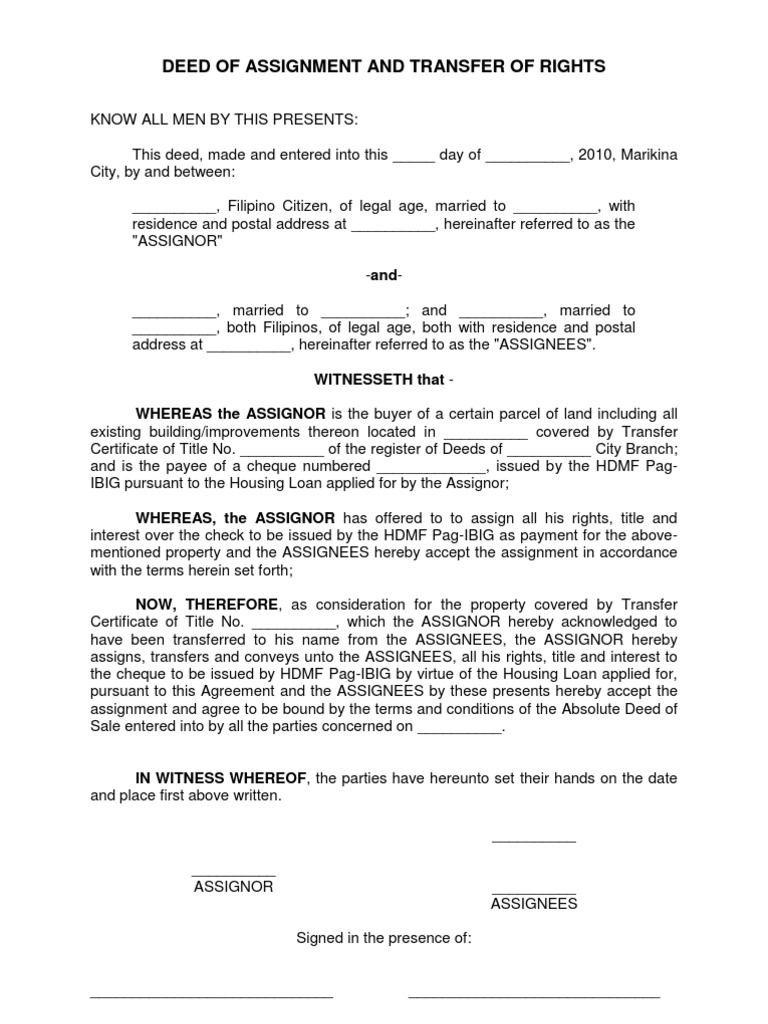

Property deed transfer – Search through the best Property on Mitula. A property deed is a formal, legal document that transfers one person or entity’s rights of ownership to another individual or entity. What does transfer deed mean?

See full list on how. Deed Forms are required to be written documents and might also be called the “vehicle of the property interest transfer. After transferring the deed out of the trust , the deed is no longer owned by the trust.

Show the name of the trust as grantor of the dee but ensure that the new deed shows the grantee is an individual. If you are the owner of any real property (lan buildings, vehicles), you will likely already have a title, which is a document of your official ownership. If you have questions, check with an estate attorney. Along with that title, you will also have a deed , which is the document that allows you to transfer the property to a new owner.

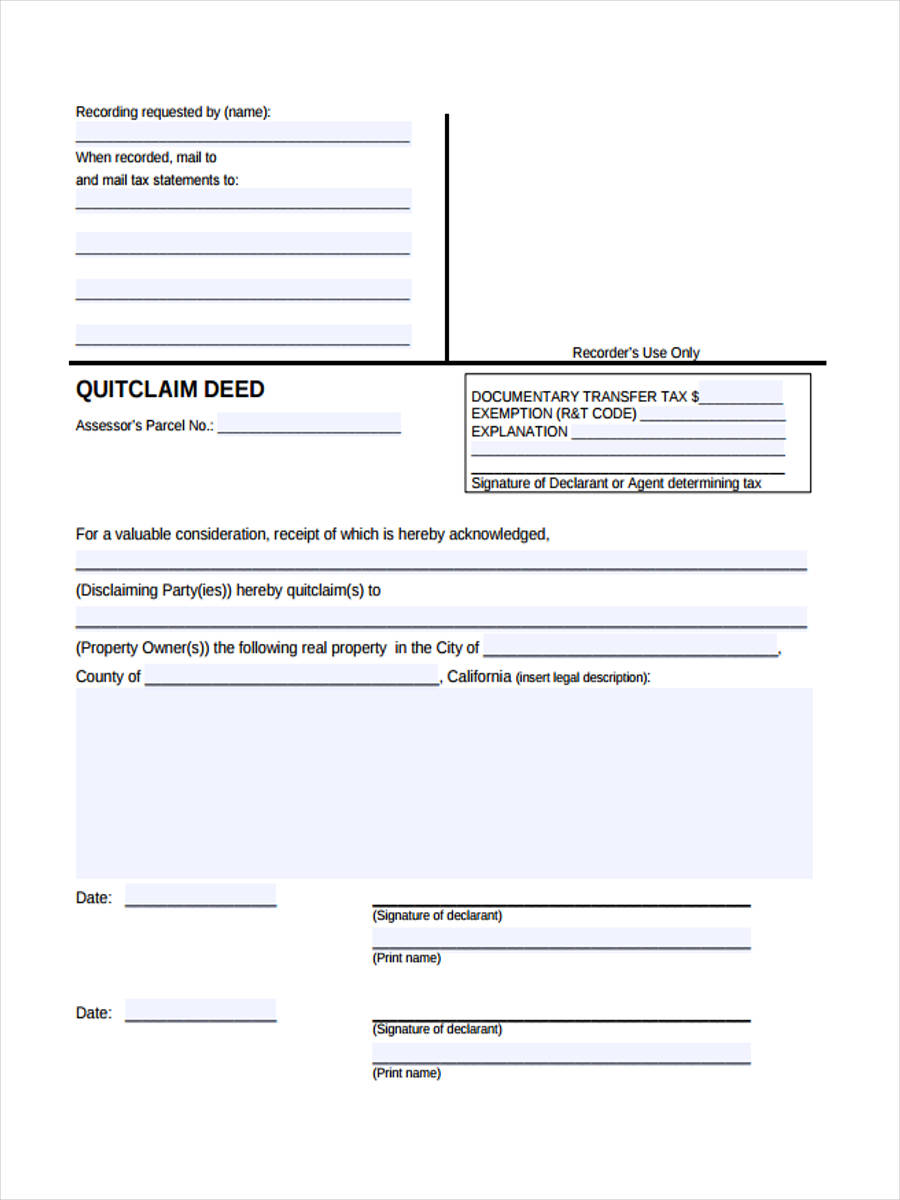

If you are the full owner, you will usually have both a deed and a title, but these are two very distinct legal concepts. Locate your current deed. Check to see whose names are on the deed and whether the deed is a warranty or quitclaim.

Check with your title insurance company and lender. Decide on the type of deed. Transfer the title of the property and add it to your living trust. There are a few kinds of deeds.

Each can transfer property. But they differ in the amount. Get the current deed. To transfer the property, you need the legal description of the property. Find the property’s tax ID.

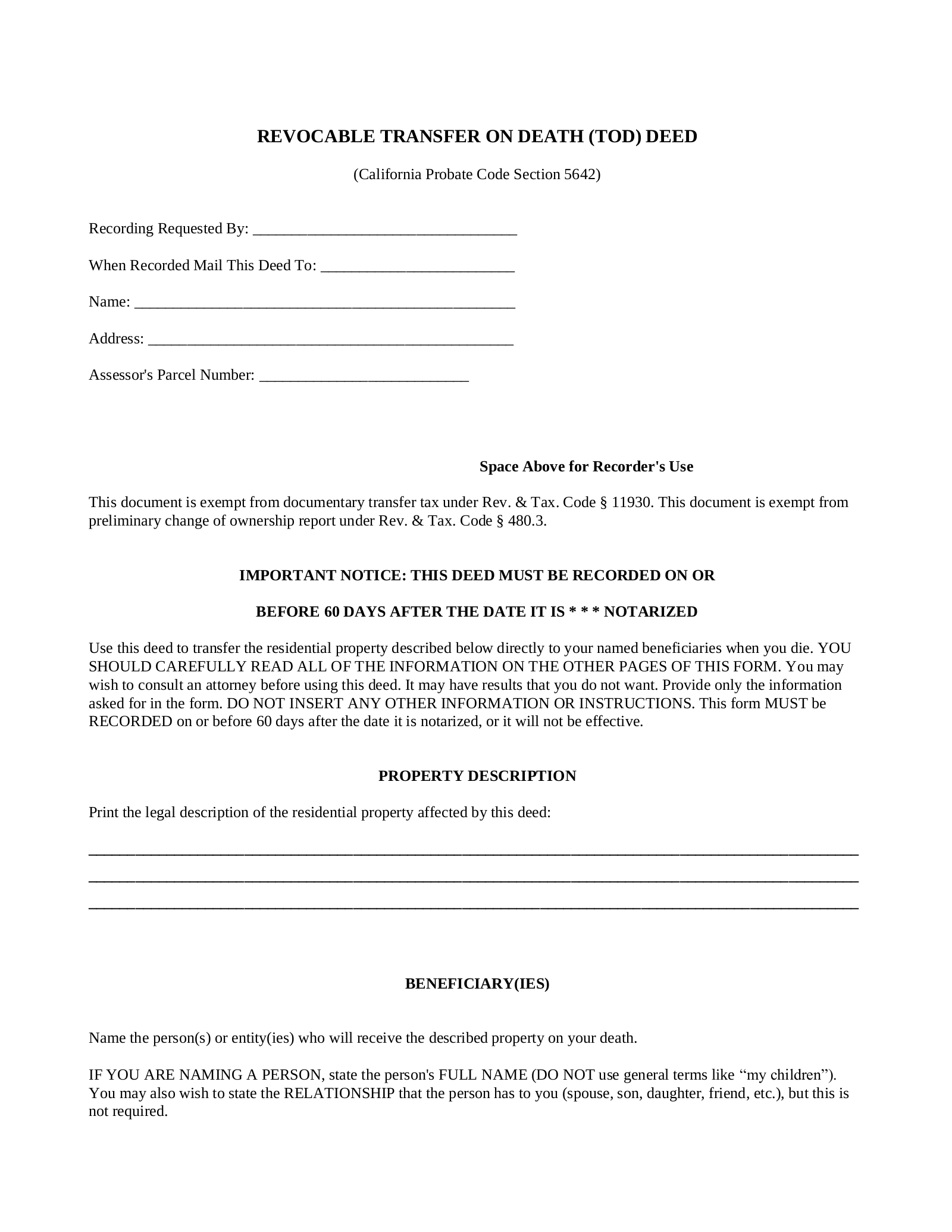

A transfer on death dee sometimes called a “beneficiary deed”, is an instrument that states who should receive a piece of real estate upon the death of the current owner (s). It’s typically a 1- or 2-page document that is recorded in the county where the real estate is located. Download A Free Sample – 1 Free! A deed is the legal document that is used to transfer title (i.e., legal ownership) of real estate from one person to another. The law imposes certain requirements for a deed to be valid and.

This process is not limited to an individual as the term can also apply to transfer ownership of one business to another owner. Benefits of Transfer -on-Death Deeds For avoiding probate, a TOD deed is an inexpensive alternative to a living trust. People have long used living trusts to.

A TOD deed allows the property owner to keep control of their property. A deed form is a document that is used to transfer the ownership of real property from one (1) party to another, grantor to grantee. If the owner wants to change or revoke the deed.

This is typically filled-in at the conclusion of a sale, referred to as the ‘closing’, and filed with the County Registry of Deeds. All Major Categories Covered. The deed must be delivered to the grantee. Let’s say that you are about to sell your house. Real Estate Transfer Forms – Made Easy!

All deeds must be in writing to satisfy the statute of frauds, which is a statute in each state. Methods of Deed Transfer Quitclaim Deed : This is the most common way to transfer a property to a family member. With a quitclaim deed , there is a. Death Deed Transfer : This allows the transfer of a property to an appointed relative once the owner passes. When someone passes away without a will or other estate planning in place, the laws of the state govern who stands to inherit their property.

Some property, such as household goods, can be acquired simply by taking possession of it. Warranty Deed : They are sometimes. Other property, however, such as the deed to a house, requires the transfer of ownership by filing a new deed. Usually, you will need to perform a deed transfer if you want to either remove someone’s name or change ownership. The grantee to a real estate deed must have the legal capacity to receive property.

A conveyance of real estate should be subscribed by the person transferring the title or interest in said real estate, or subscribed by his legal agent or attorney (47-1-5).