What does third party insurance really mean? What exactly does third party insurance cover? A third party insurance claim is a claim made by someone other than the policyholder or the insurance provider.

In this case, the insurer may be regarded as the second party. A liability claim is the most common form of third party insurance claim.

When would that happen? Here are a few examples: 1. You were a passenger in a car when it was involved in an accident, and you were injured. You were the driver judged NOT at fault for an auto accident in a state without no-fault insurance.

See full list on dmv. If your injuries are extensive or fault is in question, consider talking to a personal injury lawyer. Submit your bills and proof of expenses to the insurance company as they direct.

In that situation, your insurance company may employ subrogation to recover the money it has paid out.

Making a third-party car accident claim can be as simple as writing a letter. This is called “giving notice” and is often overlooked. Proper, prompt notice can mean the difference between recovery and walking away empty-hande. There are some characteristics of a third-party car accident claim that are universal.

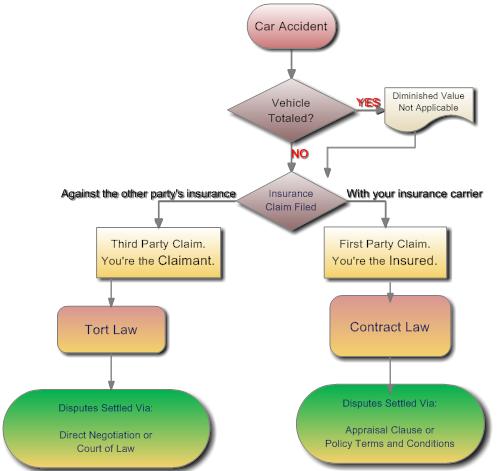

First and foremost, a third-party claim does not involve a contractual obligation between the injured party and the insurance company. This sounds more complicated than it really is. Simply put, a third-party claim is the legal name for making a claim on another’s auto insurance policy. Exactly how and when such claims can be made vary based upon the presence (or lack thereof) of no-fault laws, but the over. Third-party claims are much more prevalent in “fault” states than in “no-fault” states.

While no-fault generally require an injured party to first recover from their own insurance company, fault states have no such requirement. A third-party claim of this type can be very simple or. Generally, no-fault states have mandatory minimum insurance requirements, meaning that every driver carries a statutorily dictated minimum amount of insurance.

If the insurance company is unable or unwilling to settle with the injured third party, the third party can bring the liability claim to the tort system. What Is a First-Party Insurance Claim? A first-party insurance claim is between the policyholder (the first party) and the insurance company (the second party).

These are contractual claims that are. Making a claim with your own insurer is a first- party claim ).

Plus, you can track your claims process online or through our mobile app. Once you file, a claims representative begins the process as soon as possible. We’ll Review It State Farm will review the details of your claim , determine if the incident is covere and assess the loss or damage. Call us about your case at 602. The other person’s insurer will process the claim, but don’t count on a quick payment.

As noted previously, the first party is the named insured (policyholder), the second party is their insurance company (policy issuer) and the third party are those who have been damaged as a. Third-party insurance protects policyholders from claims by other people (“third parties”). It differs from “first-party” insurance such as health insurance or a California “Med Pay” policy, which covers losses sustained directly by the policyholder. Typically, you file a third – party claim when you are involved in an accident in a no-fault state and the accident is not your fault. Filing a car insurance claim , and getting it resolve is easy with Esurance. Get the lowdown on how auto claims work — plus the many ways we strive to make the auto insurance claims process as fast as possible for you, from start to finish.

Or learn more about how to file a claim. The following claims cannot be reported via My Account: For flood claims , fill out a flood loss claim report online. Why people love Third Party Claims. How to file other claims.

We take the confusion and intimidation factor out of making a claim. We can have a rental car quickly delivered to your door. We’ll aim to get your accident-related expenses paid by the insurer.