A third – party car insurance is a type of four-wheeler insurance that offers financial protection to the owner of insured car in case of injuries or damages to another person or their property. For third – party auto insurance claims, the person you injure or whose property you damage will make a claim directly to your insurance company, and your insurer will deal with making a settlement. If someone makes a third – party insurance claim against you, your insurance company will settle the claim, up to.

Once you’ve decided on the plan , the next step is to compare third party motor insurance online. Online comparison helps you get the best deals that meet your requirements. You can compare the plans on the parameters like benefits, features, coverage, claim settlement process , premium etc. If you’re on the hunt for a third party deal for your car , our guide offers some essential tips for comparing policies and choosing the right policy for you. What does third party car insurance cover?

Third party car insurance is the legal minimum level of insurance you need to take to the roads in the UK. What is third party auto insurance? Third party property car insurance , which generally only covers your liability for the damage your car causes to other people’s property, including their vehicles.

By using our third party car insurance comparison service , you can do just this with little effort and lots of reward. Just let us know what kind of policy you’re after, and we’ll bring you up a list of the best car insurance quotes on the market that meet your requirements. In contrast, you can compare and choose your Third Party Property Damage insurance provider no matter where you are in Australia.

You can use our free car insurance comparison service to compare Third Party Property Damage policies, as well as higher levels of car insurance , in minutes from a range of providers. We do not, our self, provide a comparison service for compulsory third party (CTP) insurance. A Third – party liability policy will leave you vulnerable to risks involving damages to your own car. What’s third party , fire and theft (TPFT) insurance ? It’s car insurance that covers you if you injure someone with your car or cause damage to other people’s vehicles or property.

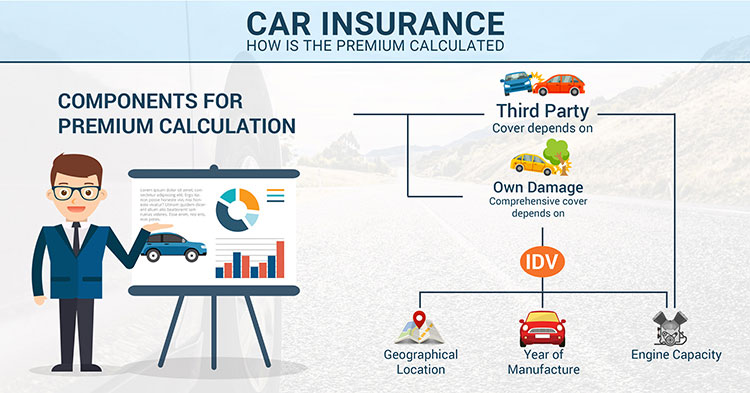

It’ll also pay out if your car ’s stolen or damaged by fire, but you won’t be covered for the loss or damage to your own car in any other circumstances. The main difference between third – party and comprehensive insurance is the kind of coverage it offers. While a Third – Party insurance only covers you against third – party damages and losses, a comprehensive car insurance will cover for your own damages as well. Choosing the right kind of insurance for your vehicle is crucial in India. It is a mid-level policy and is more expensive than third party insurance.

Learn more about Third Party Fire and Theft insurance and to frequently asked questions. Comprehensive insurance offers the broadest range of car insurance cover. It doesn’t cover damage to your car or your property. Watch this video to compare third party car insurance with other car insurance options. A third party car insurance is the most basic car insurance policy with the minimum level of coverage, thus making it the cheapest car insurance Malaysia has to offer.

Simply, this is an insurance policy that indemnifies other people for the loss and damage to their vehicle, property and self due to an accident that is inflicted by you. In comparison with third party liability car insurance , a comprehensive four wheeler insurance policy offers extensive coverage, more benefits and covers the damages caused to the insured car in case of an accident, collision, theft, etc. MoneySuperMarket’s car insurance comparison tool lets you compare third-party only policies, and you can also see how the costs differ in comparison to third-party, fire and theft and fully comprehensive quotes.

Third party only (TPO) car insurance is the most basic car insurance you can lawfully buy in the UK. It covers you for accidentally causing injury to others, damage to third party property and liability while towing. Running a quote with MoneySuperMarket lets you compare policies from over 1car insurance brands, helping you find the right cover to suit your needs – and it’s easy to switch if you find a better deal.

Dave Merrick, head of car insurance. No extra points collected on any third party car insurance policies. Car insurance can be expensive, so it’s important to shop around.

No flybuys extra points will be collected for the month in which your policy terminates. Standard flybuys Terms and Conditions apply. Tunes cards, tobacco and tobacco.