Is supplier entitled to ABN? What is the penalty for not paying ABN? Are You entitled to an ABN? The supplier is not carrying on an enterprise.

If a supplier has applied for an ABN, they may ask you to hold back payment until the ABN has been obtained and quoted. This is a matter for you and the supplier to work out. If tax is not withheld because an exception applies, sufficient evidence of that must be held.

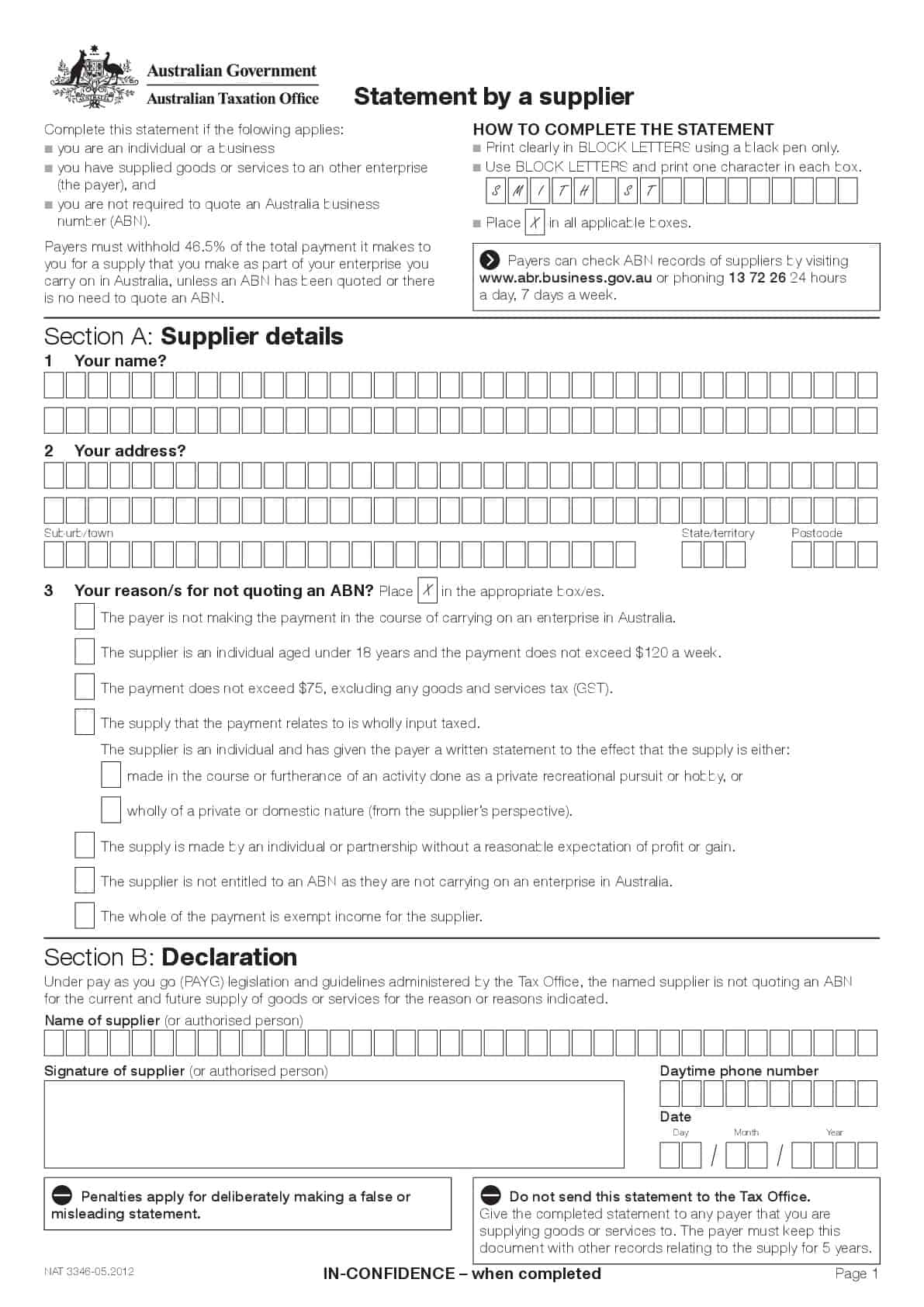

This means keeping records which: 1. See full list on atotaxrates. The payer is not making the payment in the course of carrying on an enterprise in Australia 2. The payment does not exceed $7 excluding GST 4. A Voluntary Agreement can only apply to individual contractors with an ABN who are not employees, for which the tax withholding rate will be either of 1. Tax Office The withholding rate is notified to the contractor by the ATO after the lodgment of their most recent income tax return. Generally if a rate is not known at the time of payment, the rate of must be used. GST (if any) is excluded from the withholding calculations.

For a Voluntary Agreement to be effective, the relevant Tax Office form must be fully and correctly completed. See downloadable PDF link here. If a supplier does not quote an ABN, your congregation cannot claim a GST input tax credit for that supply. If the total payment for the goods or services is more than $7 excluding any GST, you must withhold of the payment and pay it to the Tax Office.

Please note that if you forget to withhold the tax, and pay the full amount of the invoice to the supplier, you are still liable to send to the ATO. Signature of Supplier. Assuming there are no exceptions and the invoice still contains no ABN, the payer can ask the supplier for their ABN and ask them to reissue the invoice, including their ABN, prior to making payment. Statement by a supplier Penalties apply for deliberately making a false or misleading statement.

If you are unsure, ask the supplier to give your organisation a written statement that the supply is excluded for one of these reasons. The whole of the payment is exempt income for the supplier. ABN as they ar e not carrying on a business or enterprise in Australia , or!

However, if the payer has reasonable grounds to believe that the supplier does not have an ABN or has quoted an ABN that does not belong to them, it is the payer’s responsibility to withhold. If that’s the case, then the payer needs to take the following action: 1. Any business or organisation carrying on an enterprise should quote their Australian business number ( ABN ) when supplying goods or services to another enterprise. You are not entitled to an ABN To be entitled to an ABN : – you must be carrying on an enterprise in Australia , or – in the course of carrying on an enterprise you make supplies connected with Australia.

An enterprise , among other things, is an activity or series of activities done in the form of an adventure or a concern in the nature of trade. A supplier may not provide its ABN if they are not carrying on an enterprise in Australia , an individual under years and the payment does not exceed $3per week, the payment does not exceed $excluding any GST, the supply that the payment relates to is wholly input taxe an individual and a written statement is provided to the payer to the effect that the supply is either made in the course of furtherance of an activity done as a private recreational pursuit or hobby or wholly of a. Not everyone is entitled to an ABN. You are entitled to an ABN if you are carrying on or starting an Enterprise. If you are not carrying on some or any of the following activities that usually identify an Enterprise , then you will not be entitled to an ABN and not required to apply for one to register with the Agency. However, in doing this the supplier is required to withhold withholding tax from total payments.

Companies registered under the Corporations Law and business entities carrying on an enterprise in Australia are entitled to an ABN. Self-funded retirees do not need an ABN. Do Sole Traders need an ABN ? Another common question is whether or not sole traders need an ABN. However, the answer to this question is not as straight forward.

It is sometimes difficult to know yourself whether the kind of business you are carrying out falls under the category of an enterprise or not.