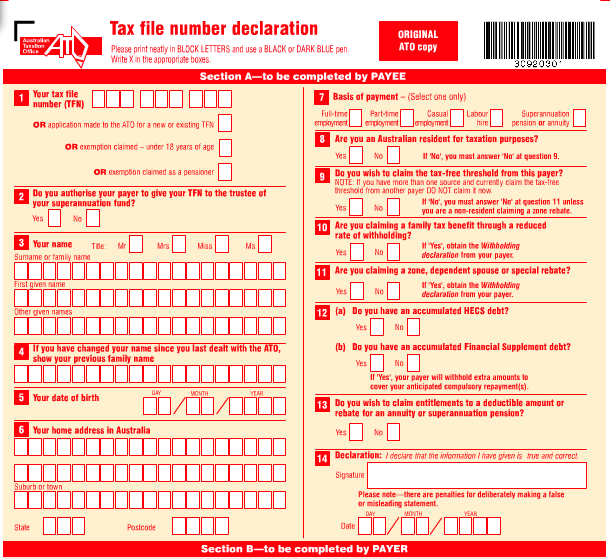

What is TFN declaration? How to get a fillable TFN? This is not a TFN application form. To apply for a TFN, go to ato. ATO have developed a fillable TFN declaration form which is available on ATO’s website.

Just download it from ato. This feature is available on Reckon One Payroll Medium module. In Reckon One Payroll, you can submit your employees Tax File Number ( TFN ) Declaration using Reckon GovConnect. The Tax fi le number declaration is not an application form for a tax fi le number (TFN ). Tax file number ( TFN ) declaration filing in Xero accounting. The record allows for a TFN declaration for an existing employee recor or for the data to be collected prior to the creation of a NetSuite Employee record.

You can simply download it from ato. For employees that you have already added to Payroller: Go to People. Select the relevant employee. Click on the blue pencil button to edit. From here, go to the Tax section.

Tick the TFN declaration box. STP is designed in a way that the software could caputre and then submit the information to replace a TFN dec as part of payday (payevent) reporting. Every time a new employee starts employment, the employer is required to have them complete a Tax File Number Declaration form and send it to the Tax Office. It is this Tax File Number Declaration Form that provides the information to add the employee to Wages Manager and determine the Tax Withholding Scale that applies.

If the employee has not provided a TFN declaration within days of the start of the withholding obligation, the payer is required to notify the ATO by completing as much of the TFN declaration as possible with the information they have. But if you don’t provide your TFN within days of starting work, then your employer is obliged to tax you at the TOP marginal rate. Do not use this form if you are a beneficiary wanting to provide your tax file number to the trustee of a closely held trust. You must provide all information requested on this form. Providing the wrong information may lead to incorrect amounts of tax being withheld from payments made to you.

Purpose: Steps to follow to ensure STP automatically submits TFN Declarations to the ATO. You need to retain a copy of the form for your records. The information can be lodged online if have the required software. If so should I go back and select the declaration for existing employees who I have already sent a paper form as well? This creates a form filled PDF TFN Declarations which you sent to employee, employee completes and sends back to Employer.

Program extracts the data from the PDF and compiles the lodgement file (plain text file like the EMPDUPE file) which employer uploads via Business Portal. Firstly, you are not required to provide your employer with a tax file number declaration form. You may claim an exemption from quoting your TFN.

You have successfully completed this document. TFN Declaration Form (James Cook University of North Queensland) This document is locked as it has been sent for signing. Other parties need to complete fields in the document. A TFN declaration applies to payments made after the declaration is provided to you. Completing the Tax File Declaration as part of your employee self setup is an essential step so that your employer can determine how much tax to withhold from your wages.

This declaration helps us calculate how much tax to deduct from your pension payments. The amount of tax deducted may be reduced if you are entitled to the tax-free threshold.