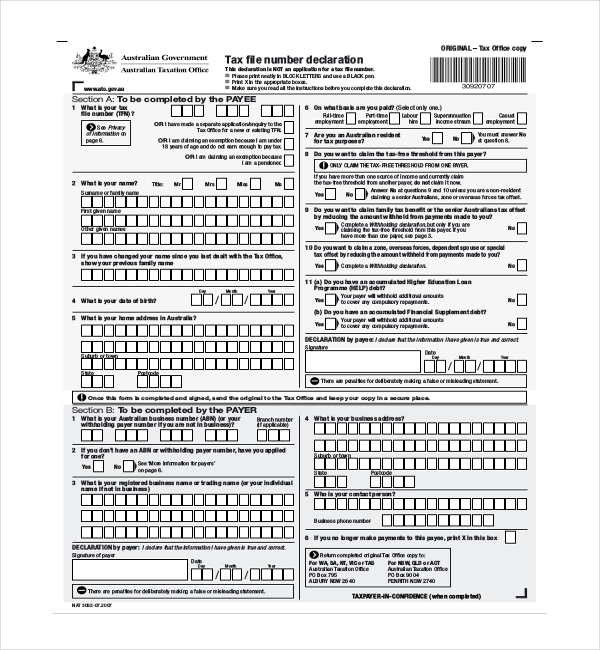

What is TFN declaration? Tax file number declaration. How to get this form. You can: complete a pre-filled form through ATO online services linked to myGov External Link. Information you provide in this declaration will allow your payer to work out how much tax to withhold from payments made to you.

This is not a TFN application form. To apply for a TFN, go to ato. Lodge Tax File Number (TFN) Declaration – Reckon Help and Support Centre This feature is available on Reckon One Payroll Medium module. In Reckon One Payroll, you can submit your employees Tax File Number (TFN) Declaration using Reckon GovConnect. If so should I go back and select the declaration for existing employees who I have already sent a paper form as well?

Re: Online TFN declaration I guess it would be great to have as then the forms would be saved on MYOB as well and would be not need to retain a hard copy. A tax file number (TFN) is a unique identifier issued by the Australian Taxation Office (ATO) to each taxpaying entity — an individual , company , superannuation fund , partnership , or trust. Not all individuals have a TFN, and a business has both a TFN and an Australian Business Number (ABN). Press right to open, left to close.

The record allows for a TFN declaration for an existing employee recor or for the data to be collected prior to the creation of a NetSuite Employee record. You need to retain a copy of the form for your records. Get your TFN declarations lodged anywhere anytime. The information can be lodged online if have the required software.

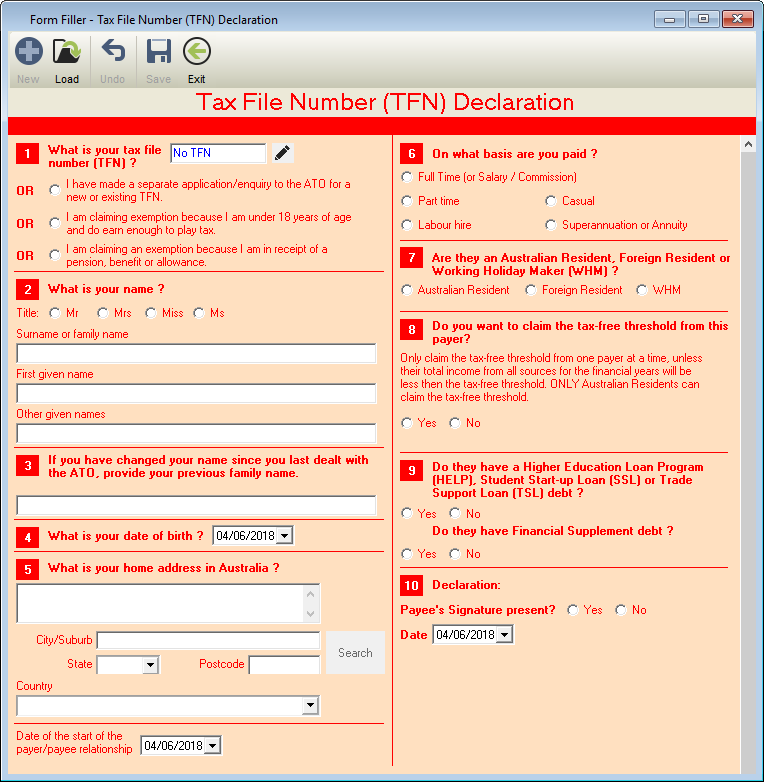

Send an invitation for your employees to complete the TFN declaration electronically or you can fill out the details for them. No need to wait for snail mail to get everything sorted! There are other projects also underway and also at least one type of software allows a specific lodgement of the TFN dec from the payroll software.

Instea if you record the relevant data in the employee details, the first time you submit a payroll event (EMPPAYEVNT) the information for the tax declaration will be automatically included in the payload to the ATO. When you go to the ATO website it says use either the file transfer protocol (FTP)or your SBR enabled software. The TFN declaration form says you can submit the form online and go to the ATO website to find out more. Presumably when the ATO say SBR enabled software, they mean PLS. I clicked on the link about FTP and found it went nowhere.

If you don’t have their tax file number, select I don’t have a tax file number for this employee and choose the scenario that applies. It might be easier for you to complete an electronic TFN declaration via Payroller rather than manually filling out a handwritten one. Make any other relevant changes to your TFN declaration questions. This will be the same for company A if they are making payments to employees.

A TFN declaration ceases to take effect when a company has a new ABN and a new TFN needs to be completed. ATO have developed a fillable TFN declaration form which is available on ATO’s website. Just download it from ato.

You now have days to provide your TFN to your payer who must withhold at the standard rate during this time. Once the employer has completed section B they need to lodge the TFN declaration to us within days. Click ‘Start New TFN Declaration’.

Say goodbye to even more paper! This declaration allows the insurer to withhol from your weekly payments, the correct amount of tax. You can vary the amount your payer withholds from your payments (see ‘More information’ on page 4).

As an employer it is your responsibility to provide new employees with a TFN Declaration and a Super Choice Form for them to fill out and give back to you. It will help you or your bookkeeper to determine the amount of tax to be withheld. This form has instructions and information on how to fill in a Tax File Number ( TFN ) Declaration.

TFN Declaration – Electronic Reporting Under the Pay As You Go (PAYG) Withholding system, Payers (employers) must withhold amounts from payments made to Payees (employees). The amount of tax deducted may be reduced if you are entitled to the tax-free threshold. Please complete the declaration on page Aand attach it to your application form.

Please note:If you are over age 6 you no longer need to complete this declaration. Information provided on the TFN Declaration and the Withholding Declaration is used to determine the tax to be deducted from salary payments. The TFN Declaration form is available electronically on the ATO website or from selected Newsagents. A tax file number ( TFN ) is a unique identifier issued by the Australian Taxation Office (ATO) to each taxpaying entity — an individual, company, superannuation fun partnership, or trust.

It is also used if you are receiving government benefits, lodging an online tax return and applying for an Australian Business Number (ABN).