You keep the same TFN even if you change your name, change jobs, move interstate or go overseas. Tax file number – application or enquiry for individuals living outside Australia. Only one TFN is issued to you for your lifetime. Your tax file number ( TFN ) is your personal reference number in the tax and super systems. It is a unique digit number issued to individuals and organisations to administer tax and other Australian government systems.

How to apply for a TFN? What is individual tax identification number? To apply online you must have a valid passport or relevant travel documents. Once you have completed your application online, we will post your TFN to the Australian postal address on your. Companies, trusts, partnerships, deceased estates and many other organisations can apply for a tax file number ( TFN ) online.

Most businesses or organisations can apply for a TFN while completing their ABN application. Complete the online application form by visiting the ATO website Print the application summary and gather your required identity documents to present at an interview Find a participating Post Office near you. If you already have a TFN , complete this application if: you want to know what your TFN is and your details have changed since you last applied you would like a copy of your TFN advice you need to confirm your identity details with the ATO. You do not need to register them for a TFN in a separate process.

Your TFN will then be sent to you. When you apply for a TFN at the same time you apply for an ABN, your client will be automatically registered with a business TFN when their ABN application is processed. As a temporary visa holder, permanent migrant or temporary visitor, you can apply for your Australian Tax File Number ( TFN ) after arriving in Australia. You now have days to provide your TFN to your payer, who must withhold at the standard rate during this time. TFN application form or made an enquiry to obtain your TFN.

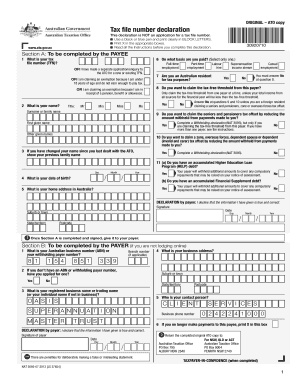

Apply for a Tax File Number. Modify form from the left hand menu. The Tax Office has developed a fillable TFN ( Tax File Number ) declaration form which is available on their website. To complete your application , you may need to: provide Proof of Identity documents, and attend an interview.

Tax File Number Australia – The trusted Tax File Number ( TFN ) service for travellers who plan to work in Australia. Tab to the form inputs, and if they are present, through tabbed or wizard menus, tips information, or additional menu items. Sole traders cannot apply for a TFN for business as part of the ABN application. However they can separately apply for an individual TFN with the ATO. Visit the Australian Tax Office website to learn more about applying for an TFN as an Australian resident, person living outside Australia, foreign passport holder, permanent migrant, or temporary visa holder.

Parents and guardians can also apply for a TFN on behalf of their children. You will need to provide proof of identity documents as outlined on the application form. Post the application form and identity documents. To find out more check out the ATO’s website.

You may also choose to submit certified copies of documents from the issuing agency instead of original documents. Original documents you submit will be returned to you at the mailing address shown on your Form W-7. As a reminder, ITINs with middle digits 7 7 72. The Australian Taxation Office (ATO) will automatically issue your partnership, company or trust with a business TFN when you apply for an Australian Business Number (ABN). Please read this page and the back page carefully before completing this application.

This will ensure that unnecessary processing delays are avoided. Application Form Perennial Trusts Please use this form if you are a new investor and wish to invest in this Trust by making an initial application. I am not sure if I have a TFN. What if I don’t provide a Tax File Number when I start working? Firstly, you are not required to provide your employer with a tax file number declaration form.

But if you don’t provide your TFN within days of starting work, then your employer is obliged to tax you at the TOP marginal rate. You can apply online or complete a paper application. If you have a resident visa or a student or work visa.