Income Tax Return for Estates and Trusts , including recent updates, related forms and instructions on how to file. A trust tax return of a deceased estate is a separate tax return from the date of death return of the deceased person. High call volumes may result in long wait times.

Before calling us, visit COVID-, Tax time essentials , or find to our Top call centre questions. A testamentary trust is a type of trust that is created in a last will and testament. The terms of the trust are specified in the will.

Unlike a living trust , a testamentary trust comes into existence only after the settlor dies. In situations where an Inter Vivos irrevocable trust is the recipient of property contribute a gift tax return would generally be due. Why you should consider creating a testamentary trust? What is an example of a testamentary trust? MeF can accept the current and prior two tax years.

Information for trusts , including testamentary and inter vivos. Includes information on the different types of trusts , filing requirements and information on how to complete the Treturn and certain Tschedules. After the settlement perio the trust is considered a split-interest trust or a charitable trust , whichever applies. Furthermore, separate tax returns can be filed for the spouse on his or her own income and gains and for the spousal testamentary trust , giving the spouse access to two sets of graduated income tax rates. Testamentary trusts also have many non-income tax benefits.

With the current tax free threshold of $120 beneficiaries are potentially able to receive up to $12of tax free income from the testamentary trust each year. If a return is filed on a tax form for other than the appropriate tax year, convert the tax return to the current year format. Think of a Schedule K-as the trust equivalent of a W-2. Here are some examples: Decedent’s Estate. Assets held by a testamentary trust must be sufficient to justify the expense of administering the trust.

For example, accounts will need to be prepared and maintaine and a tax return will need to be lodged each year. But the only options for the beneficiary assessment calculation codes are either for benficiaries of deceased estates or inter-vivos trusts. Smith died and an estate arose, which is a testamentary trust for income tax purposes.

However, creating a testamentary trust allows you to split this income, as the trust is a legal entity with its own tax return. In the en the taxes paid by your spouse would be much lower. In addition, the first $10of a trust ’s revenue is non-taxable.

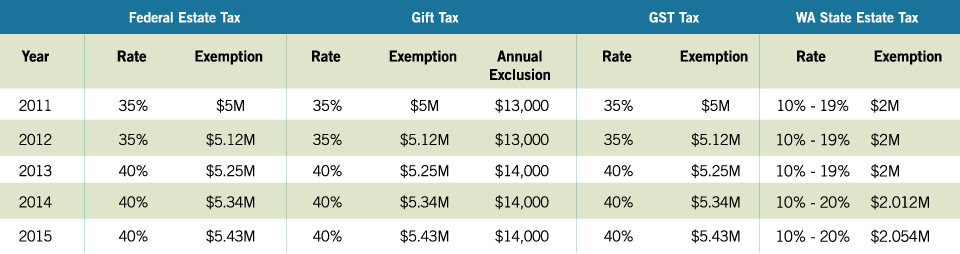

Revocable or Lifetime Irrevocable Trusts : At least two jurisdictions’ appellate courts have upheld the ability to tax the income of a trust established under the Will of a decedent whose estate was probated in the state. The primary reasoning is that the state’s courts were involved. Other states seek to impose.

However, if the trust loses its “ testamentary ” status, these capital losses go wasted leaving the trust ’s income to be taxed at a potentially high rate. One key purpose of a living trust is to allow assets within the trust to avoid the legal proceedings. It is frequently used when the beneficiary or beneficiaries are children or disabled people.

However, the income of inter vivos trusts (which are trusts created during a person’s lifetime) is subject to tax at the top personal marginal tax rate or “flat. Background to taxation of trusts. Under Division 6AA of the ITAA, any minor that receives unearned income is subject to a penalty tax rate. If the beneficiary of a revocable trust dies before the settlor, the settlor can rewrite the trust instrument.

They may be costly to operate. Someone must act as trustee and run the testamentary trust. The Trustee may need legal and accounting assistance. Because the trust won’t owe any tax in its final year, it doesn’t need the estimated tax payments. All income received by the executor, administrator, or trustee in the tax year must be reported on the return.

The tax year cannot be longer than months.