Wherever You Are In The World. Your Taxes Done With Ease. Prevent new tax liens from being imposed on you.

Generally, aliens who enter the United States in an immigration status which allows them to be employed in the United States under specific circumstances under U. The only thing that comes close are the following ones: Payee type Tax File Number to use. Can I use a temporary tax number? What is a tax ID number? In your home country, you normally need to have some form of a tax identification number so that you can start to earn your income.

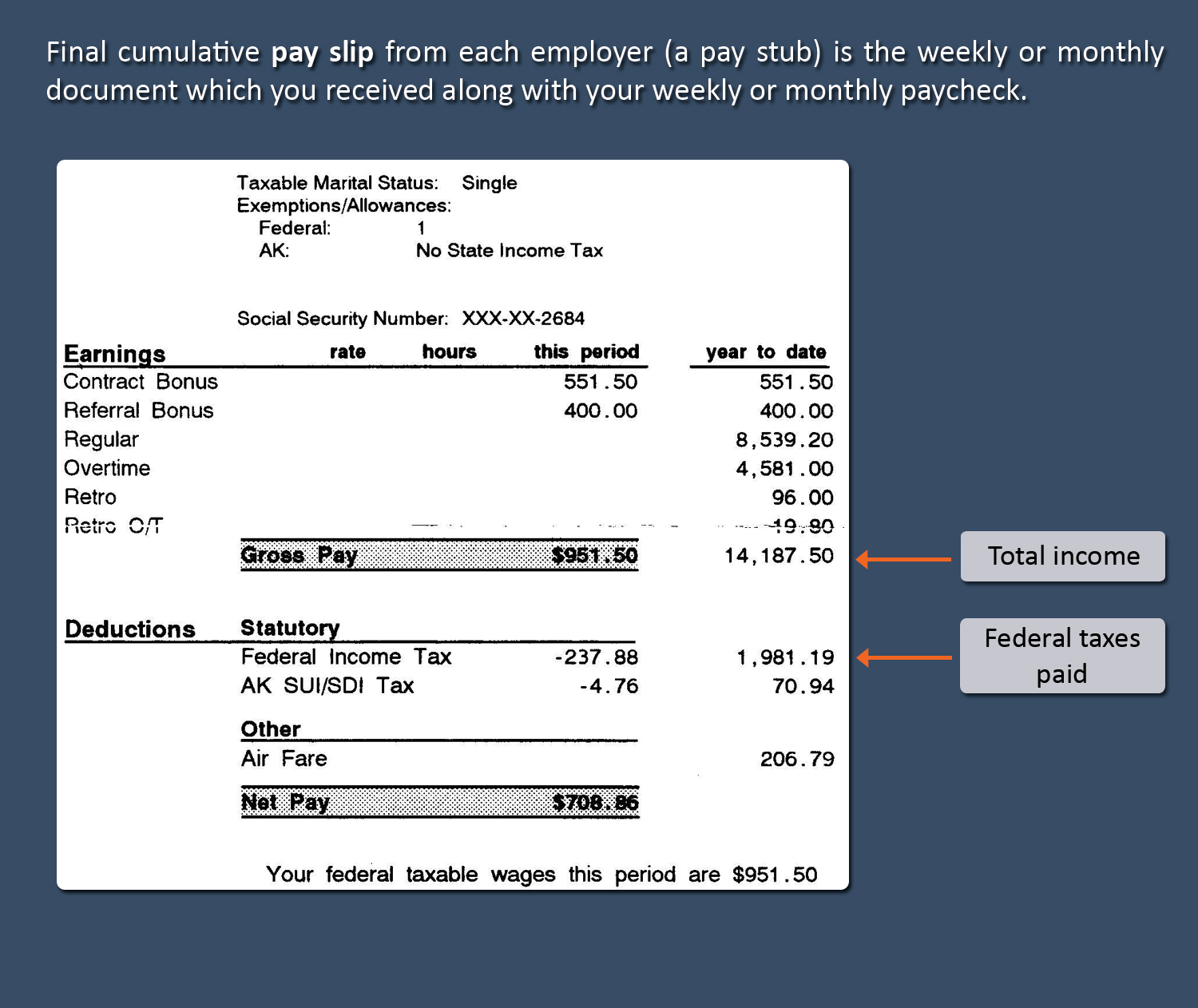

In Australia, you need to get a Tax File Number (TFN) before you can start to earn an income in the Land Down Under. This applies to Australian citizens, migrants and temporary residents. A tax file number (TFN) is free and identifies you for tax and superannuation purposes. You keep the same TFN even if you change your name, change jobs, move interstate or go overseas. People who are issued temporary seller’s permits are required to file a return due on or before the last day following the month after the temporary sales location closes.

Temporary Tax Number. We need to file our taxes by April 30th. All you need for US easily. We help you avoid any problems while traveling. Tax identification number help.

As a reminder, ITINs with middle digits 7 7 72. Hope this helps, JodieH. Income here would cover salary from a job, wages, payments received from the government, as well as money that you reap from your investments including.

Employee without a TFN ( Tax File Number ) This thread is now closed to new comments. Some of the links and information provided in this thread may no longer be available or relevant. If you had employment income from Canada and you want to declare it, you must apply for a SIN. You need this number whether you work for someone else or run your own business. An ABN is an Australian Business Number and in a similar way that your TFN registers you into the tax.

This number allows you to file a tax return at the end of the financial year. My Employer sai i cant start work until i have a tax file number , so do i have. Do not submit this form if you have previously obtained a SIN, an ITN, or a temporary taxation number.

Continue to use the tax number you have already been issued. Indicate the reason you are applying for an ITN: Filing a Canadian income tax return. It is a separate number that was assigned by the California Secretary of State when you registered with that office. Tax File Number (TFN) If you want to get a job as soon as you land in Australia, one of the first things you need to do when arriving in Australia is apply for your Tax File Number (TFN). Hi there, I believe that it’s still the “Sales tax permit.

Sometimes if you are out of state you would file for a “use tax permit” instea but in this case the option is for “consumer use tax ,” and that’s for people who live in WI but who didn’t pay sales tax on a purchase. Even in cases where it is not obligatory for Spanish citizens to have ID (e.g., children aged under 14), a tax number will be needed if financial transactions are carried out. The latter is the only distinction provided for in the Mexican tax provisions. An Individual Taxpayer Identification Number (ITIN) is a United States tax processing number issued by the Internal Revenue Service (IRS).

It is a nine-digit number beginning with the number “9”, has a range of numbers from to 6 to 8 “90” to “92” and “94” to “99” for the fourth and fifth digits and is formatted like a SSN (i.e. 9XX-7X-XXXX). The Confirmation Number will serve as an official acknowledgement that your application has been received by DRS and act as your temporary tax identification number.

You will receive your registration package with your permanent Connecticut tax registration number in approximately business days. Access the online registration. You cannot apply before arriving in the country. Three Conditions You Must Meet to Apply for a Tax File Number Online.

You are a foreign passport holder, permanent migrant or temporary. Forms are available from the special event promotor or by contacting the Special Events Unit. Who can apply for a tax file number online? You can apply for a tax file number (TFN) online only if you are currently in Australia and you have: a valid permanent migrant visa a valid visa with work rights a valid overseas student visa a valid visa allowing you to stay in Australia indefinitely. You will find your Tax File Number on your Taxation Notice of Assessment, which is issued to you by the ATO after your tax return has been lodged and assessed.

Us Deal with the IRS. Get Peace of Mind Support Guarantee! See How Easy It Really Is!