Can health insurance save you on tax ? Are tax indemnities taxable? What is tax indemnity sample clause? It will indemnify and hold harmless the Underwriters against any documentary , stamp , registration or similar issuance tax , including any interest and penalties , on the sale of the Shares by such Selling Shareholder to the Underwriters and on the execution and delivery of this Agreement. All indemnity payments to be made by such Selling Shareholder hereunder in respect of this Section 6(c) shall be made without withholding or deduction for or on account of any present or future. An agreement for this arrangement is called a tax indemnification agreement.

The old approach was to have an indemnity in favour of the company being sold for tax defined tax liabilities. However a payment in settlement of a claim under the tax indemnity can in these circumstances be subject to tax. Taxes from, or Taxes related to other. An after-tax indemnity limitation reduces the indemnifying party’s liability to the indemnified party by an amount intended to take into account any tax benefit that the indemnified party received from the underlying claim.

MA agreements typically include indemnification from the seller to the buyer, and vice versa. When the term indemnity is used in the legal sense, it may also refer to an exemption from liability for damages. Licensed And Professional IRS Tax Services.

We Will Lower Your Tax Liability. If you have fallen behind on your taxes we can help. We offer risk free consultation. Prevent new tax liens from being imposed on you.

Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Tax Indemnity policies insure against the contingent outcome of known tax risks. Such provisions are common: they appear in many variations, and show up across a wide variety of contracts and agreements.

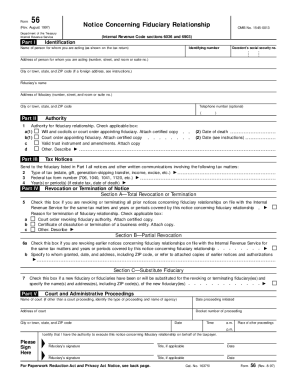

Tax indemnity provisions are common. A tax indemnity provision in a legal document generally states that one party will cover specific taxes or will cover tax problems if they arise. They appear in many variations, and can show up across a wide variety of contracts and agreements. The purpose of tax liability insurance is to protect against differing interpretations of tax law. Form of Tax Indemnification Agreement.

Company”) and all of the shareholders identified on the signature pages of this Agreement. Indemnity has the general meaning of hold harmless; that is, one party holds the other harmless for some loss or damage. Canadian law applies. Owe back tax $10K-$200K?

See if you Qualify for IRS Fresh Start (Request Online). The IRS has now reconfirmed the income tax treatment of benefits paid under fully insured fixed indemnity plans. If the premium is paid by the employer or by the employee through a cafeteria plan, the benefits are subject to income tax only to the extent that the employee’s unreimbursed medical expenses are less than the benefit payment. This can result in signiicant liabilities years after the original tax iling.

This practice note is about the way payments made by the seller to the buyer under the tax indemnity and tax warranties contained in a share purchase agreement are taxed. Free Practical Law trial To access this resource, for a free trial of Practical Law. To comply with Prakas No. Indemnity is a contractual obligation of one party to compensate the loss incurred to the other party due to the acts of the indemnitor or any other party. The duty to indemnify is usually, but not always, coextensive with the contractual duty to hold harmless or save harmless.

In contrast, a guarantee is an obligation of one party assuring the other party that guarantor will perform the promise of the third party if it defaults. To indemnify someone is to compensate them for losses from a specific incident. A letter of indemnity is written to reassure the other party with specific measures that will hold them harmless. If you’re the surviving spouse, chil or parent of a service member who died in the line of duty, or the survivor of a Veteran who died from a service-related injury or illness, you may be able to get a tax-free monetary benefit called VA Dependency and Indemnity Compensation (VA DIC).

Find out if you can get VA benefits or compensation.