Information you provide in this declaration will allow your payer to. Instructions and form for. This is not a TFN application form. All Australian residents can apply for a TFN online. Please note: This application applies to Australian residents only.

If you live outside Australia, or are a permanent migrant or temporary visitor, visit the Australian Taxation Office (ATO) website for more information. You do not need a TFN for interest, dividends or royalty payments as these are subject to non-resident withholding tax. BEFORE COMPLETING THIS APPLICATION Make sure that you have the necessary proof of identity documents.

A tax file number (TFN) is free and identifies you for tax and superannuation purposes. You keep the same TFN even if you change your name, change jobs, move interstate or go overseas. How to find your tax file number? What is a tax filing number?

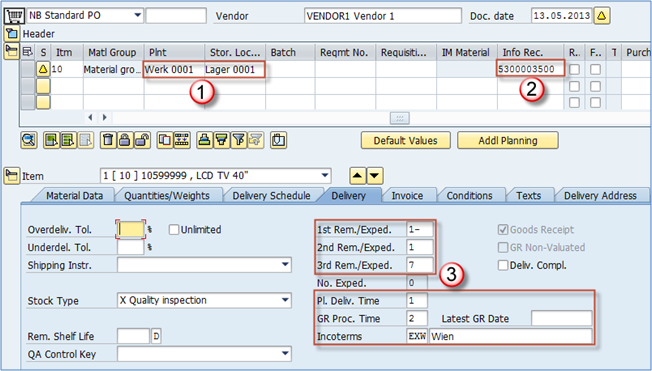

GENERAL: Items on the form are self-explanatory or are discussed below. The numbers match the numbered items on the form. Helping you to move to United States. Everything online, and simplified. Avoid any mistakes and arrive to USA smoothly!

Convert PDF to Editable Online. The registration process is similar for both, Australia citizens and non-Australians. In both cases you only need to complete a form through an agency or the official Australia taxation office website.

As a reminder, ITINs with middle digits 7 7 72. You will need to provide proof of identity documents as outlined on the. Do not use this application. Please read this page and the back page carefully before completing this application.

This will ensure that unnecessary processing delays are avoided. Please tick the appropriate box: I am applying for a tax file number (TFN). The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. An IRS individual taxpayer identification number (ITIN) is for U. Application type (check one box): Apply for a new ITIN. Renew an existing ITIN.

Reason you’re submitting Form W-7. Click here for specific instructions regarding opening and using any of our pdf fill-in forms , if you are a Windows user. Tax declaration form. All you need for US easily.

Your guide to moving to United States. We help you avoid any problems while traveling. Fax Number If your representative has a Facsimile Machine, write the number here. Continue to use the tax number you have already been issued.

Indicate the reason you are applying for an ITN: Filing a Canadian income tax return. You may, but are not required to,provide a TFN or an exemption. If you choose not to provide a TFN or claim exemption, we are required to deduct tax from any income at the highest marginal rate (plus the Medicare Levy).

Your tax file number (TFN) is your personal reference number in the tax and super systems. It is a unique digit number issued to individuals and organisations to administer tax and other Australian government systems. Your TFN is an important part of your tax and super records as well as your identity, so keep it secure.