Tired of a Bulky Wallet? Discover the Elegance and Efficiency of a Dedicated Card Holder

In today’s streamlined world, the traditional bulky wallet is becoming increasingly obsolete. Overflowing with faded receipts, outdated membership cards, and a jumble of credit cards, it’s a relic of the past. Enter the sophisticated and practical card holder – a sleek solution designed specifically to organize, protect, and provide quick access to your essential credit cards and identification. This comprehensive guide will delve into the myriad benefits of choosing a dedicated card holder, explore the diverse range of styles and materials available, and ultimately help you select the perfect companion for your valuable credit cards.

Unlocking the Numerous Advantages of Using a Credit Card Holder

Enhanced Organization: Say Goodbye to Clutter

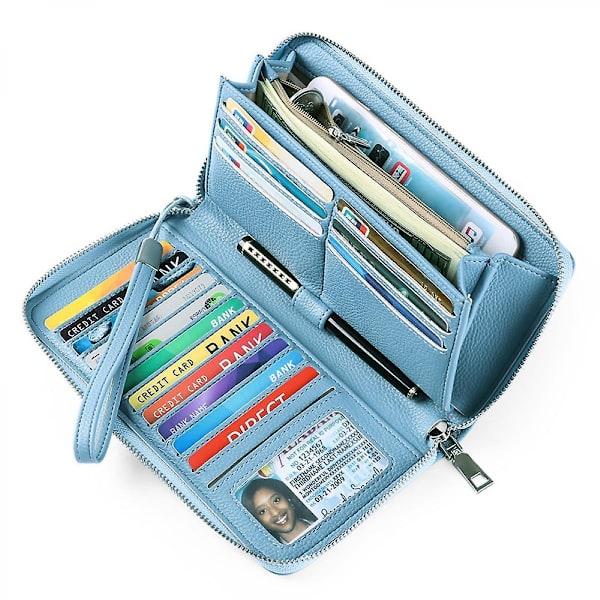

A dedicated card holder provides individual slots or compartments for your credit cards, debit cards, identification, and even a few essential business cards. This systematic organization eliminates the frustrating rummage through a thick wallet, allowing you to quickly and effortlessly locate the exact card you need. Imagine the ease of selecting the right credit card at the checkout without the embarrassment of fumbling through a disorganized mess.

Superior Protection: Safeguarding Your Valuable Assets

Credit cards are not just pieces of plastic; they represent your financial security. A well-constructed card holder offers crucial protection against physical damage such as bending, scratching, and demagnetization. Many modern card holders also incorporate RFID (Radio-Frequency Identification) blocking technology, which acts as a digital shield, preventing unauthorized scanning of your credit card information by potential thieves. This added layer of security provides invaluable peace of mind in an increasingly digital world.

Slim and Minimalist Design: Embracing Effortless Style

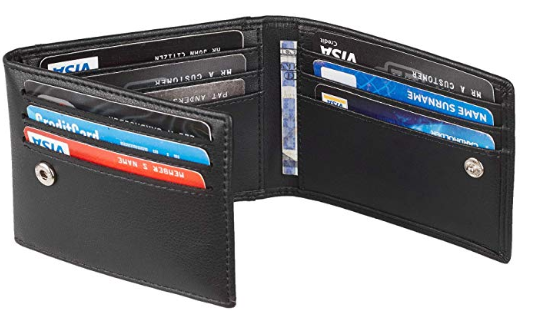

Unlike bulky wallets that can disrupt the lines of your clothing and feel uncomfortable in your pocket, card holders are designed with a slim and minimalist aesthetic. Their compact form factor allows for discreet carrying in front pockets, jacket pockets, or even small purses. This not only enhances your style but also contributes to better posture and reduces the risk of back pain associated with carrying a thick wallet in your back pocket.

Durability and Longevity: An Investment That Lasts

Card holders are often crafted from high-quality materials such as premium leather, durable metals (like aluminum or stainless steel), and robust polymers. These materials are chosen for their ability to withstand daily wear and tear, ensuring that your card holder will remain a reliable companion for years to come. Investing in a quality card holder is a smart choice that can save you money in the long run by eliminating the need for frequent wallet replacements.

Quick and Easy Access: Streamlining Your Transactions

The design of most card holders prioritizes quick and easy access to your credit cards. Whether it’s a fan-out design, individual slots, or a sliding mechanism, retrieving the necessary card is a swift and seamless process. This efficiency can be particularly beneficial in fast-paced environments where every second counts.

Exploring the Diverse World of Card Holders: Finding Your Perfect Match

The market offers a wide array of card holders, each with its unique features and benefits. Understanding the different types available will help you narrow down your choices and select the one that best suits your individual needs and preferences.

Leather Card Holders: Timeless Elegance and Durability

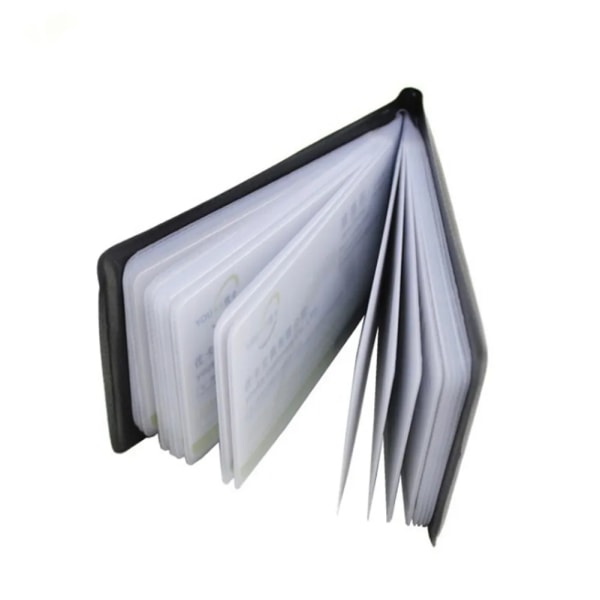

Leather card holders exude a classic and sophisticated charm. Crafted from various types of leather, such as full-grain, top-grain, and genuine leather, they offer a luxurious feel and exceptional durability. Leather develops a unique patina over time, adding to its character and appeal. They often feature multiple slots for credit cards and may include additional compartments for cash or identification.

Metal Card Holders: Sleek Security and Modern Style

Metal card holders, typically made from aluminum or stainless steel, offer a robust and secure way to carry your credit cards. Their rigid structure provides excellent protection against bending and crushing. Many metal card holders incorporate RFID blocking technology as a standard feature. Their sleek and minimalist design appeals to those with a modern aesthetic.

RFID Blocking Card Holders: Enhanced Digital Security

As contactless payment technology becomes increasingly prevalent, the risk of RFID skimming has also risen. RFID blocking card holders are specifically designed to prevent unauthorized scanning of your credit card information. They achieve this by incorporating a metallic layer or specialized material that blocks radio waves, ensuring your financial data remains secure.

Minimalist Card Holders: Streamlined Simplicity

For those who prefer to carry only the absolute essentials, minimalist card holders offer the ultimate in streamlined simplicity. These ultra-slim designs typically hold a few essential credit cards and perhaps a driver’s license. They are incredibly lightweight and discreet, perfect for individuals who prioritize a clutter-free lifestyle.

Pop-Up or Sliding Card Holders: Effortless Access

Pop-up or sliding card holders feature a mechanism that allows you to easily access your credit cards with a simple flick of a lever or push of a button. This design provides quick and convenient access to your cards while keeping them securely stored when not in use. They often have an integrated RFID blocking feature as well.

Hybrid Card Holders: Combining Features and Functionality

Some card holders combine features from different styles to offer enhanced functionality. For example, a leather card holder might include RFID blocking technology, or a metal card holder might have additional slots for cash or business cards. These hybrid designs cater to individuals who need a balance of style, security, and practicality.

Key Considerations When Choosing the Perfect Credit Card Holder

Selecting the ideal credit card holder depends on your individual needs and preferences. Consider the following factors to make an informed decision:

Elevate Your Everyday Carry with the Perfect Card Holder

A dedicated card holder is more than just an accessory; it’s a practical and stylish solution for organizing and protecting your essential credit cards. By offering enhanced organization, superior protection, a slim design, and quick access, a quality card holder can significantly streamline your everyday carry. Whether you prefer the timeless elegance of leather, the modern security of metal, or the minimalist simplicity of a slim design, there’s a card holder out there to perfectly complement your needs and lifestyle. Invest in a card holder today and experience the difference it makes in simplifying your life and safeguarding your valuable financial assets.