What are surety contracts? A person who binds himself for the payment of a sum of money or for the performance of something else , for another , who is already bound for the same. A surety differs from a guarantor, and the latter cannot be sued until after a suit against the principal. A claim against a performance bond , payment bond or other construction bond sets off a complex series of interrelated events.

It is essential for a surety to quickly evaluate the facts and circumstances behind the claim and understand its rights and obligations. Usually, a surety bond or surety is a promise by a surety or guarantor to pay one party (the obligee) a certain amount if a second party (the principal) fails to meet some obligation , such as fulfilling the terms of a contract. Typically, the Miller Act requires a contractor to obtain a construction performance and payment surety bond. After years with Frost Brown Todd LLC in Cincinnati, Dave has relocated to Jamaica Plain, Massachusetts and formed his own firm.

He will continue to provide services to the surety industry on state and federal projects. Dave has maintained his Ohio license and is admitted to the federal courts in Ohio, the Sixth Circuit, and the US Supreme. A surety bond is a three-party agreement assuring the project owner (obligee) that the contractor (prin- cipal) will perform a contract in accor- dance with the contract documents. Fidelity and Surety Law The purpose of the FSLC is to promote the objectives of the ABA and TIPS, and to further the development, study of, and expertise in practice and improvement of the application of justice concerning matters relating to fidelity and surety.

EXECUTION OF OBLIGATION BY SURETY COMPANY. A surety company authorized to engage in business in this state may execute an obligation. Surety Law and Legal Definition A surety is a person obligated by a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so.

Financial creditors may require the debtor to find a surety , who then signs the loan agreement along with the debtor. Covers the major issues that arise in connection with fidelity and surety bonding through a detailed analysis of representative types of bonds. The surety bond section of the course will focus on public and private construction bonds. The fidelity bond section of the course will focus on employee dishonesty and financial institution bonds.

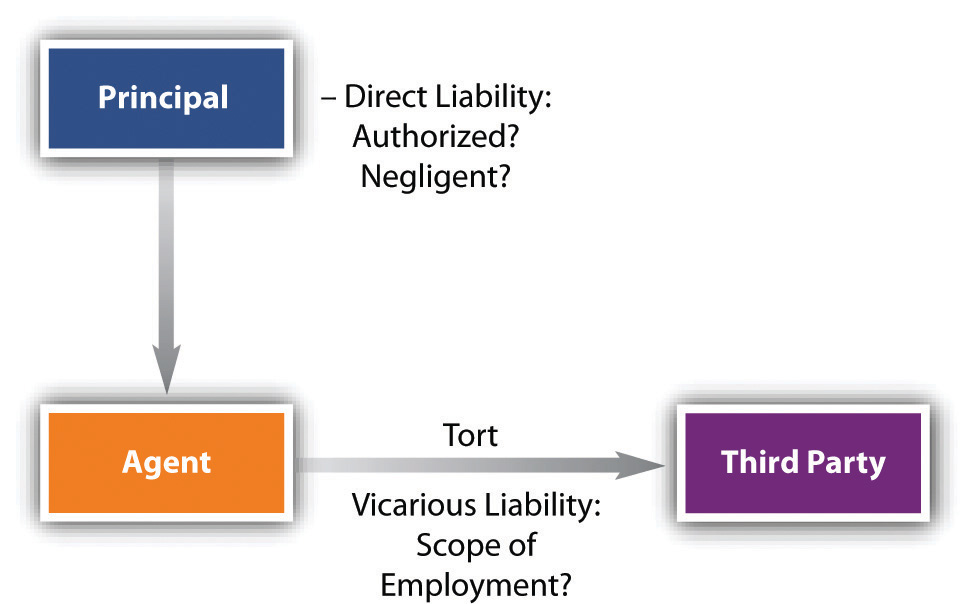

In general, making a claim on a bond happens in two contexts: on private projects or on public projects. The Bonding relationships established by the Contractor, Obligee and Surety are governed by statute contracts law and case law. In both contexts, the process will depend on the type of bond.

The act of limitations or prescription is a perfect bar to a recovery against a surety , after a sufficient lapse of time, when the creditor was sui juris and of a capacity to sue. The discharge of the surety under the bankrupt laws, will put an end to his liability, unless otherwise provided for in the law. You’re a busy professional and we’d like to help you navigate the program with ease. Below are a few things that we hope will help you accomplish your tasks.

Note: At common law a surety is distinguished from a guarantor by being immediately liable as opposed to becoming liable only upon default of the principal. Under the Uniform Commercial Code, however, a surety includes a guarantor, and the two terms are generally interchangeable. Surety Law As a construction project progresses from bidding to completion of construction, unforeseen problems may develop, including failure to perform work and failure to pay for work performed.

An accessory agreement by which a person binds himself for another already boun either in whole or in part, as for his debt, default or miscarriage. Surety bonds are regularly used by the parties on a construction project to guarantee the various obligations for performance or payment. Remember, the surety’s obligation is limited by the “penal sum” or amount of the bon less the value of accepted work to date reducing the contract value.

A surety is entitled to every security which the creditor has against the principal debtor at the time when the surety ship is entered into. Or if the creditor loses or parts with such security the surety is discharged to the extent of the value of the security. This section is applied even when the surety’s consent is not there. In surety bankruptcy practice, the firm members are some of the most experienced lawyers in the country, having assisted in the creation of the fundamentals of this sub-specialty within surety law , and having drafted the forms that many surety practitioners and company representatives in the surety industry use or refer to today in their handling of bankruptcy matters.

Surety agreements – under Dutch law Surety – in the Netherlands The Dutch Civil Code describes suretyship as an agreement in which a third party undertakes towards a contractual creditor to perform the contractual obligations of a debtor. Such a suretyship agreement is entered into between the surety and the creditor. Environmental Surety Law Surety bonds issued for environmentally intensive activities such as mining, oil and gas production, or waste disposal implicate a complex combination of technical issues, regulatory oversight, and surety law. If you are a surety, you have made an express promise to be responsible for a debtor’s debts. Creditors can directly collect from the surety.

For example, a bank might only give you a loan if your father co-signs it. For companies in the fidelity and surety industry, the importance of working with a law firm that combines experience with foresight cannot be overstated. Knowledgeable counsel and effective litigators are the key to avoiding the pitfalls that threaten business models and financial well-being.