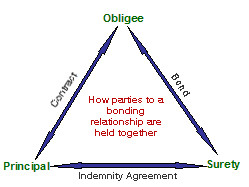

The general agreement of indemnity, or GIA, is a contract between a surety company and a contractor. The GIA is a powerful legal document that obligates the named indemnitors to protect the surety from any loss or expense the surety suffers as a result of having issued bonds on behalf of the bonded principal. The surety company that bonded the contractor will have to investigate the situation and determine if there is a default. Depending on the outcome of the investigation, the surety company may be obligated to pay the owner monetary damages up to the amount of the bond.

Other articles from bizfluent.

INCORPORATED IN: Pennsylvania. What does surety insurance mean? How much does surety bond insurance cost?

They provide a financial guarantee to the obligee that the principal will fulfill their obligations. Their fundamental underwriting and problem solving pervades the company. We experienced this first-hand with a rare claim.

Century Surety Company operates as an insurance company. The Company provides property, casualty, commercial insurance underwriting, and insurance administration services.

European surety bonds can be issued by banks and surety companies. They pay out cash to the limit of guaranty in the. With a highly diverse product line, one of the broadest underwriting capabilities in the industry, and an unparalleled distribution system, the CNA Surety group of companies ranks as one of the largest.

A surety bond from Travelers can be tailored to your needs, from construction material to ERISA fidelity bonds. This arrangement is routinely used when contractors bid and are awarded contracts from governmental agencies at the federal, state and local levels. If you need a surety bond in the US, we can help you.

Click your state to see a full list of all bonds in that state. United States Surety Company provides surety bonds. The Company offers bi performance and payment, court, and energy-related bonds. With more than 250bonds to choose from, our experts provide fast, easy and accurate service.

Next-day shipping on all orders! The Small Business Administration (SBA) guarantees bi performance, and payment surety bonds issued by certain surety companies. All surety claims will be handled in-house.

Hudson Insurance Company is licensed in all U. Best, Financial Size Category XV. Desirable accounts include general contractors, first-tier trades, and specialty contractors with revenues of less than $million.

When necessary, we use funds control, collateral, and the SBA guarantee program. Sun Surety Insurance Company specializes in underwriting bail bonds. Account-Based Commercial Surety. Our $1million bonding capacity gives us the flexibility and scale to support diverse industries of all of your medium to large public and private company customers.

We’re authorized to write bonds in U. Puerto Rico, Canada, Mexico, Guam and the U. Earned time and again through the respect and trust of our bonded principals and selectively appointed agents, IFIC — a member of IAT Insurance Group — is extremely proud of our status as one of America’s leading middle-market surety providers. Insurance contemplates a shift of risk from an insured to an insurance company. The insured pays the insurance company a premium (fee) for accepting his or her risk of loss. Surety is not insurance in the traditional meaning of the word.

American Surety Company ’s experienced staff has more than 1years of experience working in the bail bond insurance industry. Our company handles surety bonds in all states. Take a look at our comprehensive surety bond guides, or get your free quote online.

COVID-Update: We are reducing costs for qualified applicants, and offering same day bonding.