Suppose a local USA Authority. These bonds are required before a court proceeding. It provides protection. Let’s say that you’re an entrepreneurwho hires a contractor to build you a brand new space for your employees because you’ve outgrown your old facility.

In this example, the entrepreneur plays the role of the obligee , or the person or group who wants a service or project done. A surety bond is basically an insurance policy on a contract. For example, if Party A agrees to perform a contract for Party B, Party B could require a surety bond.

If Party A does not perform on the contract, Party B will collect the. Large corporations, government agencies, and municipalities almost always require a surety bond before agreeing to do business with a company. Some state laws and regulations require certain business types to carry bonds as well.

For example, in many states you must have commercial and fidelity surety bonds to run an auto dealership. A popular example from the license bonds category is that of auto dealer bonds. For instance, health insurance protects your health by paying for a portion of your health care if you need it. Surety bond examples Auto Dealer Bonds.

In the same way, surety bonds protect the public by paying for damages if needed. Customs bonds, including importer entry bonds, which assure compliance with all relevant laws, as well as payment of. Tax bonds , which assure that a. Commercial surety helps obtain capacity at the lowest cost for all corporate surety needs. International surety examines the unique surety requirements internationally.

For this type of bond , the obligee is the government agency requiring the bond , the principal is the business that must be bonde and the surety company is the party that insures the bond. Almost every state requires their own form of an auto dealer bond. Examples of License and Permit Bonds Auto Dealer Bond. A key term in nearly every surety bond is the penal sum.

They usually require surety bonds from local businesses or contractors. This protects them and their citizens from “bad behavior” of whoever has the bond. To the obligee, the surety bond is like insurance. Licensed in all states and with access to over T-liste A-Rated bonding companies, we have the contacts, expertise, and top service to provide you with a hassle-free experience, all while offering competitive rates for your surety bond. When a trade contractor first gets license they are required to obtain a contractor bond that helps protect customers from unfinished work.

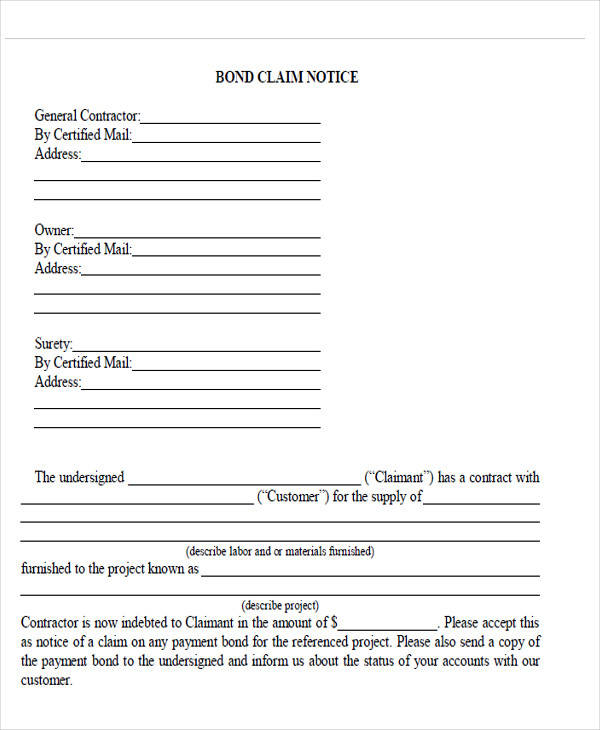

A surety permits the principal to make changes to the surety bond. Anyone can make a claim against your bond , and in most cases, the claim cannot be for more than the total amount of the bond. A sample surety agreement is one that shows the basic terms of the performance or payment bond. This bond can be referred to as an.

Another term for this bond is a BMC bond or an ICC broker bond. Freight broker and freight. A Performance Bond is a surety bond issued by an insurance company to guarantee satisfactory completion of a project by a Contractor. For example , a Contractor may be required to post a Performance Bond in favor of a client for whom the Contractor is constructing a building. If the Contractor fails to construct the building according to the specifications provided in the contract, the client is guaranteed compensation for monetary losses up to the amount of the Bond.

Suppliers of construction materials, for example, are often required supply bonds. In the construction industry, the payment bond is usually issued along with the performance bond. The obligee, usually a.