Subcontractors Charges. S1Notice of claim (PDF) S1Withdrawing a notice of claim (PDF) S1Response to a notice of claim (PDF) BCIPA – Adjudication. It is also a good way to enter government supply chains.

Government buyers seek value for money from their procurement activities. What is a subcontractor statement? How to fill out a subcontractor statement?

Can a subcontractor be listed as an employee? Are subcontractors responsible for filing taxes? You are a sub-trade contractor if you work for a licensed trade contractor. The independent contractor will usually hold a contract for services with a client, most commonly in construction, and will choose to hire a subcontractor to finish a part or all of the services.

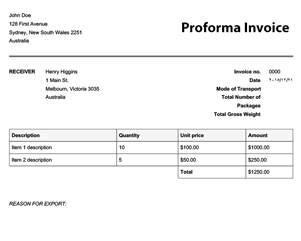

SUBCONTRACTOR ’S STATEMENT. REGARDING WORKER’S COMPENSATION, PAYROLL TAX AND REMUNERATION (Note– see back of form) For the purposes of this Statement a “ subcontractor” is a person (or other legal entity) that has entered into a contract with a “principal contractor” to carry out work. This Statement must be signed by a “ subcontractor” (or by a person who is authorise or held out as being authorise to sign the statement by the subcontractor) referred to in any of s175B.

Minister for Housing and Public Works Mick de Brenni said the community and industry would be working together to ensure better financial security for subcontractors and their workforce across the state. Engaging sub-contractors can help you grow your business without taking on any debt. But it pays to put plenty of thought into your subcontractor agreements first. There is no requirement for businesses to provide you with details of the information reported. However, you may request this information from them.

To assist businesses, the ATO has developed a payee information statement. You may need to report any payments you make to other contractors, to the ATO. Understand the rights and responsibilities of a contractor, subcontractor and independent contractor.

Many subcontractors , especially when it comes to tradesmen, operate as sole traders. As a sole trader there is no separation between your business and personal finances when it comes to taxation. Any subcontractor, who knowingly provides a principal contractor with a written statement that is false, is guilty of an offence (Maximum penalty 1units or $1000). Changes to subcontractors’ charges. The operation of subcontractors’ charges in Queensland is largely unchanged.

In addition, subcontractors are at risk of insolvency when firms higher in the payment chain become insolvent. The construction subcontractor agreement is between a general contractor who holds an agreement with a client (“prime contract”) and a subcontractor to perform a service. The contractor usually seeks the service of the subcontractor because they cannot perform the service themselves.

Independent contractors are often called contractors or subcontractors (subbies). Whether or not a worker is a contractor or an employee is not based on what the arrangement is calle but on the nature of the relationship. These changes affect the payment of construction work and supply of related goods and services in Queensland.

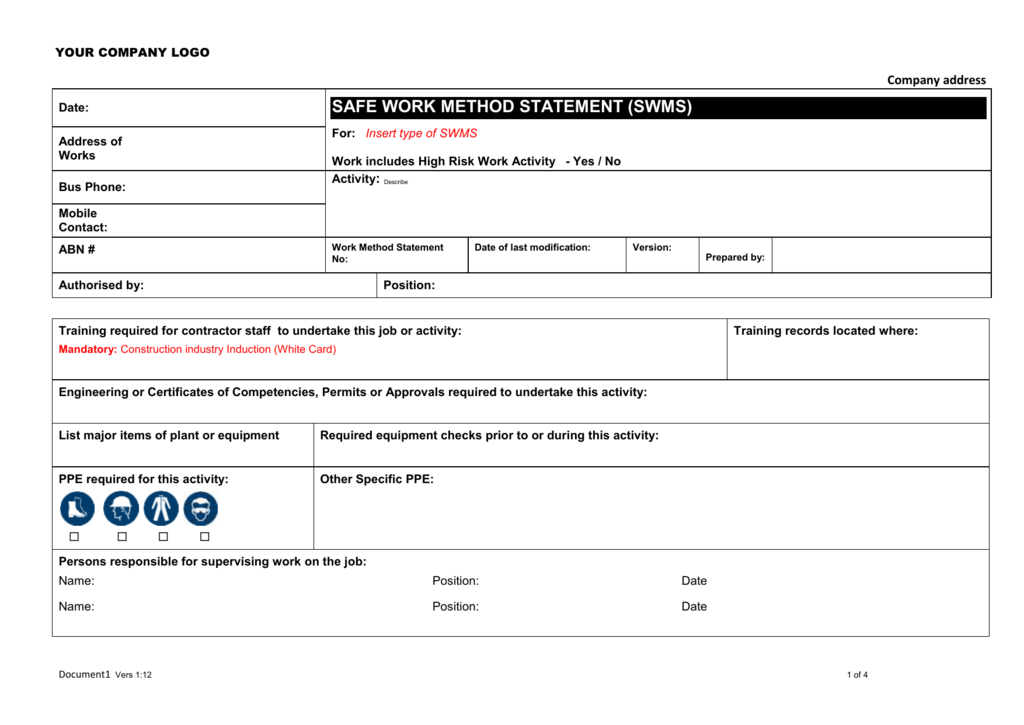

These provisions introduce new penalties for withholding retentions past the end of the defects liability period without a reasonable excuse. Sub-Contractor Agreement for ongoing Service – Used when business has a contract with a client and engages a third party company to assist in completion of a part of or the entire contract. The builder is responsible for preparing a SWMS for its employees and the subcontractor for their workers.

A copy of the SWMS must be given to the principal contractor before work begins. The principal contractor is also responsible for taking all reasonable steps to obtain safe work method statements from their subcontractors. Sub-Contractor Agreement Template for an ongoing Service – This contract is used when business has a contract with a client and engages a third part company to assist in completion of a part or the entire contract. This ongoing agreement would generally be used over the one-off service if the subcontractor was engaged for a long period of.

A contractor or subcontractor must respond to a Notice of Claim within business days. A subcontractor’s request for information must be complied with within business days. Before most subcontractors will even talk about an agreement, they will need to see the plans between the contractor and the client.

The subcontractor will commonly need to authorize a non-disclosure agreement stating that any plans they may view will remain confidential. Afterwar the contractor will usually accept bids from subcontractors for the work.