Taxable payments annual report (TPAR) If your business makes payments to contractors or subcontractors you may need to lodge a Taxable payments annual report (TPAR) by August each year. However, as Simon is not coping with the amount of work, he subcontracts some of the work to Bill (a second-tier subcontractor ). What is a subcontractor statement? How to fill out a subcontractor statement? What are contractors and subcontractors? Once the form is done, click Done.

Distribute the ready by using electronic mail or fax, print it out or save on your gadget. Work out if you need to report. Some businesses need to report information to us about the payments they make to contractors for services. Additionally, government entities at the federal, state and territory levels need to report the total grants paid and payments they make to certain other entities. SUBCONTRACTOR ’S STATEMENT.

REGARDING WORKER’S COMPENSATION, PAYROLL TAX AND REMUNERATION (Note– see back of form) For the purposes of this Statement a “ subcontractor” is a person (or other legal entity) that has entered into a contract with a “principal contractor” to carry out work. This Statement must be signed by a “ subcontractor” (or by a person who is authorise or held out as being authorise to sign the statement by the subcontractor) referred to in any of s175B. PAYG payment summary statement. If the contractor is an individual who is eligible for super guarantee, work out how much super to pay as normal and pay the final contribution by the due date, usually days after the end of the quarter. High call volumes may result in long wait times.

Before calling us, visit COVID-, Tax time essentials , or find to our Top call centre questions. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! ATO Reportable Sub-Contractor Payments This document will explain: The suggested setups and procedures required to assist with identifying reportable transactions. The subcontract statement is a contract between a principal contractor (usually a builder) and subcontractor. Where the Commissioner of Taxation is satisfied that an entity is required to be registered for GST they (the Commissioner) must register an entity for GST purposes even if the entity has not applied for GST registration.

If you wish to, you can issue the payee with a Payee Information Statement , which will show the payee what you have reported to the ATO on the TPAR. This is not compulsory, and does not need to be sent to the ATO as well. A subcontractor agreement is the document that specifies what a general contractor and a subcontractor has agreed upon with regards the scope of their responsibilities for a particular project. If you want to make a subcontractor agreement, feel free to use any of our downloadable examples as references. The taxable payments reporting system (TPRS) requires businesses to report to the ATO all payments made to contractors during an income year.

This additional reporting is in the form of an annual report that is used by the ATO to cross check that contracting income is being correctly declared by contractors. This form is prepared for the purpose of section. Use it to lodge activity statements , request refunds and more.

Subcontractor Statement. Some industries, including building and construction, cleaning or courier services, or government entities, are required to report to the ATO the amount of payments made to contractors for services (such as labour). Why is this important?

Payments need to be reported to the Australian Taxation Office ( ATO ) on the Taxable Payments Annual Report, or electronically. The work must be connected to the business undertaking of the principal. Thanks for your post. I have been entering him as per other Contractors with the NCG code. When you are going through the process of hiring a sub keep these important key things in min and you will be on the path to success.

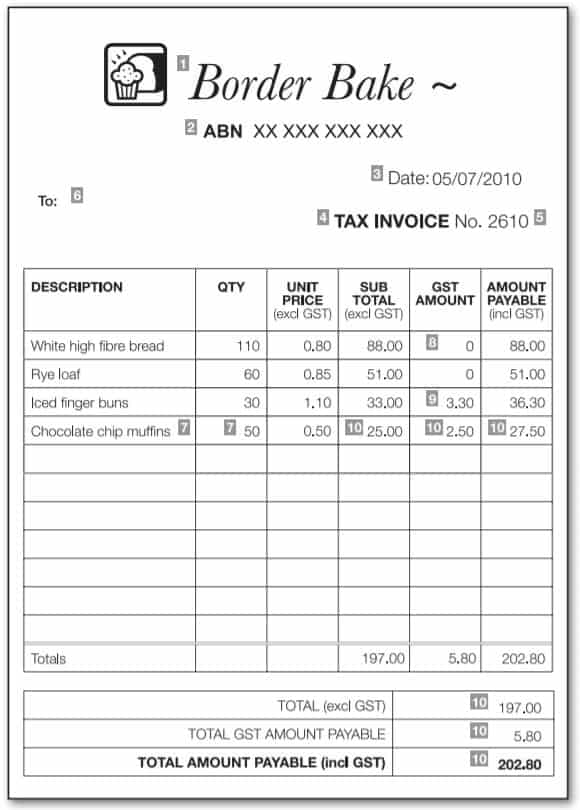

This invoice is a helpful tool as a whole. TIP: Providing you give accurate responses you can rely on the tool’s and will not be penalised if a future review by the ATO shows that you have not met your pay as you go obligations. Make sure you keep a. By neglecting your super or tax matters you could find yourself being hit with financial penalties from the Australian Taxation Office.

The final consideration we will look at is subcontractors insurance. As an employee most of your insurance matters are taken care of, but as a subcontractor you are responsible for your own insurance. As America’s Leadership Development Fraternity, ATO provides a great opportunity for young men who are looking for a truly unique fraternity experience.