What is statement of affairs? Is statement of affairs double entry? A fresh infusion of capital throws off the calculation of profit and loss using. Capital Infusions and Withdrawals. In appearance the statement of affairs is similar to a balance sheet.

For this purpose, two comparative statement of affairs are prepared – one at the commencement of the year and other at the end of the year. The excess of the assets over the liabilities as shown by the statement will represent the capital of the firm. A statement affairs is like a Balance sheet. It gives gives the Insolvency Practitioner the opportunity to assess everything the company may own, as well as details of fixed or floating charges. Read this article to learn about the preparation of statement of affair in case of voluntary winding-up of a company!

Court otherwise orders. A Balance Sheet is a statement showing assets, liabilities and equity of the company prepared on the basis of the double entry system of bookkeeping. Limitations of single entry. It is also called the Transaction Approach. Balance sheet is prepared to present financial position of a business entity at a given date.

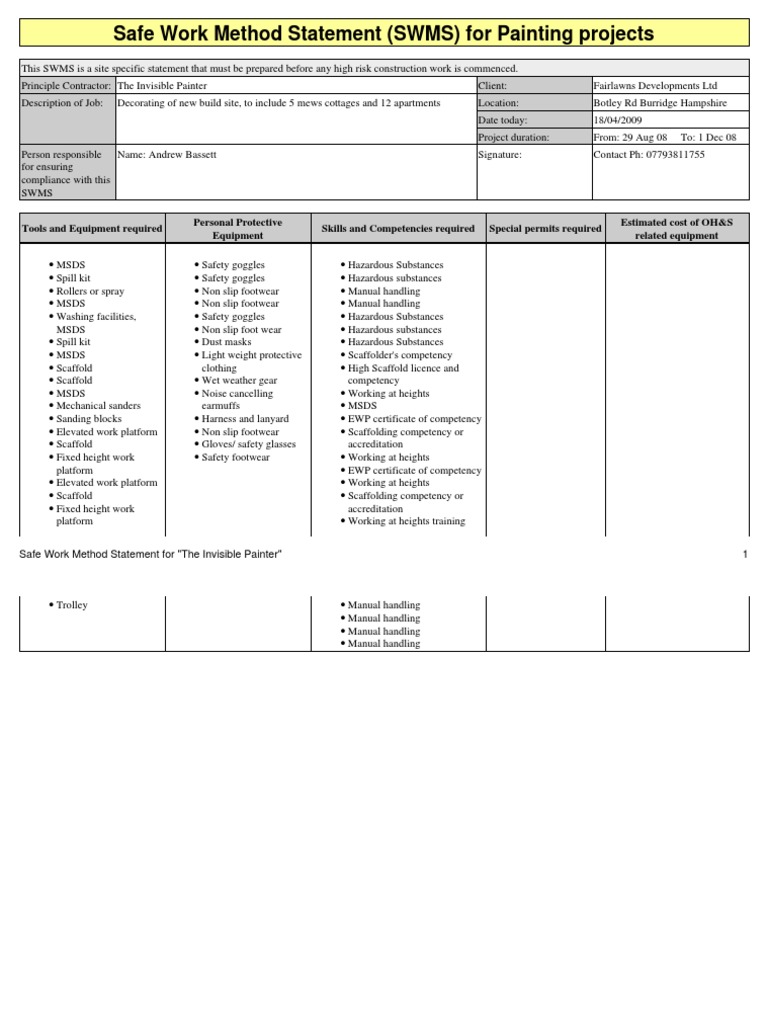

Statement of affairs method is also called ……………. It is prepared under the single entry system in order to find out the amount of opening or closing capital of the business. For the purpose of determining the amount of opening capital, the statement of affairs is prepared on the opening date. It states the net book value and amount expected to realise at the date of Insolvency of the business.

Accompanying the balance sheet is a list of creditors and shareholders. The format of the SOA is different to a traditional balance sheet and certain calculations and considerations will be required. Such a statement is known as statement of affairs , shows assets on one side and the liabilities on the other just as in case of a balance sheet.

Gottman Trust Revival Method” after an affair has phases: atone, attune, and attach. This system for healing is founded in his lab and clinical experience, which confirm the effectiveness of the model. Unlike the balance sheet, the nonprofit version substitutes net assets for equity. Your net assets plus liabilities must equal your assets on the statement of financial position.

Net assets are classified in one of two ways: with donor restrictions or without donor restrictions. You can send Account statement (billing statement ) of the entire overdue balances to the customers or as per the agreed frequency like weekly, monthly etc. How every where the record is incomplete, and it is not all possible to complete it by double entry, in such cases the final accounts can be only approximately prepared by means of a statement of affairs.

Shiksha Abhiyan strives to provide quality education to everyone regardless of their socio-economic background. The educational sector has also significantly shifted from the mundane pen and paper days to an era that is technologically and digitally based. Why is Controlled Method Transfer necessary?

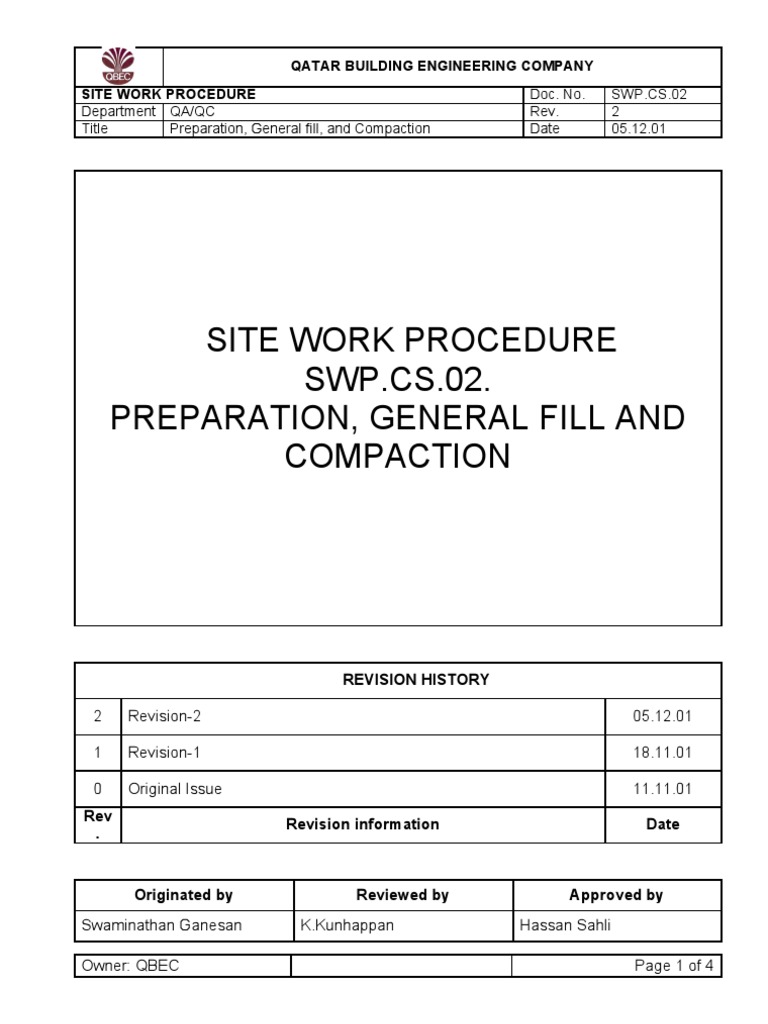

Laboratory records shall include a statement of each method used in the testing of the sample. A brief description of how the hazardous condition was abated. The legacy VA appeals process has changed to the decision review process. Following is the statement of shareholders equity for Alumina, Inc.

Student Affairs provides co-curricular learning opportunities and services that are conducive to student growth and development. Issued 10shares of common stock. Declared a stock dividend. Bought back 10shares of its common stock and declared the shares as treasury stock. It is comprised of three main components: Assets, liabilities and equity.

It stipulates the deliverables or services required to fulfill the contract, and it defines the task to be accomplished or services to be delivered in clear, concise and meaningful terms. The original investment is recorded on the balance sheet at cost (fair value). The standard requires a complete set of financial statements to comprise a statement of financial position, a statement of profit or loss and other comprehensive income, a statement of changes in equity and a statement of cash flows.

Modified Accrual Method This is the most common HOA accounting method used during the year, with full accrual required at yearend. A modified accrual method is a combination of the cash and accrual methods. Some of the transactions made are recorded using the cash method , but some are also recorded using the accrual method.

On a statement of cash flows prepared using the indirect method , an increase in Accounts Payable during the period is: Added to net income to determine net cash provided by operating activities.