Who is required to register with SSS? How to get my SSS employment history online? How can you get your SSS employment history?

Here is how to register for SSS Employer Account on the SSS Official Website: 1. Visit the SSS Official Website.

The SS Form R-1A should indicate the correct ER number, the total number of employees reporte and complete employees’ details such as their respective SS numbers, birth dates, employment start dates, monthly compensation, and positions. See full list on sss. Changes in employer’s data and status of business operations should be reported immediately to the nearest SSS Office by accomplishing an Employer Data Change Request (SS Form R-8), which should be duly signed by the authorized signatory and supported by the original and photocopy of appropriate documents, if any, showing the Effectivity Date. The SS Form R-8should be signed by any of the following: 1. For Business Employers 1. Anyof the following, whichever is applicable: 1. Certificate of Registration of Business Name from DTI 2.

Proof of billing, or in its absence, any of the following 1. Deed of Donation, subject to compliance with the requirements thereto 3. General Information Sheet duly received by SEC 4. Allof the following: 1. Affidavit of employees attesting to the actual date of their employment 3. Employer Registration Form (SS Form R-1) and Employment Report Form (SS Forms R-1A) that will supersede the initial submission 2. Any two(2) of the following documents, whichever are applicable: 1. Notification of suspension of operation duly received by BIR within the prescribed period 2. Board Resolution approving the suspension of business operation adopted within the prescribed period and duly acknowledged received by regulatory agencies (e.g. BIR, SEC, etc.) 4. Online Registration and Coverage No SSS number yet? Go to the SSS Online Employer User ID Registration page. It’s best to use Internet Explorer (IE) when accessing the SSS website. Registering in SSS as employer or business owner have slightly different steps depending on the company formation.

Single Proprietorships. An owner of a single proprietorship business should accomplish and submit SSS Form R-( Employer SSS Registration Firm) and R-1A ( SSS Employment Report ). Due to the COVID-outbreak, the SSS has been placed in telework status.

The call center is available with delays. There will also be delays processing mail. View our news section for more information. PLEASE READ THE INSTRUCTIONS AND REMINDERS AT THE BACK BEFORE FILLING OUT THIS FORM.

Please complete your registration with current and accurate information. After submitting you will receive a confirmation card in the mail. Thank you for doing your part to keep America secure.

A good HR will not refuse you this information. Call SSS hotline number to ask for your employer’s SSS ID. Alternatively, they may apply for a Social Security number online via the SSS website. Anyone of the agencies mentioned above can provide them with their membership numbers.

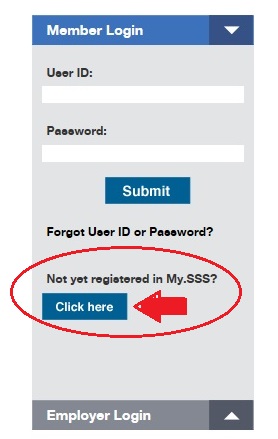

Fill out the Unified Forms that can be acquired from any Pag-IBIG Fund , PhilHealth or SSS branch office. The Business Services Online Suite of Servicesallows organizations, businesses, individuals, employers, attorneys, non-attorneys representing Social Security claimants, and third-parties to exchange information with Social Security securely over the internet. You must register and create your own password to access Business Services Online.