What are the legal obligations of a sole trader? Why to work as a sole trader? What is the difference between self-employed and sole trader? Should you register as a sole trader or a limited company?

Sole Trader vs Partnership. See full list on accountlearning. A sole proprietorship is an unincorporated entity that does not exist apart from its sole owner. A partnership is two or more people agreeing to operate a business for profit.

The benefit of owning a sole trading company is that the sole trader has the right to make all decisions regarding the business. This is the simplest structure. Financial responsibility however is in your hands and you will have yearly tax returns to contend with. You will also have legal responsibility for your business (which can leave you exposed to much greater risk than other structures), so a comprehensive insurance policy is a must.

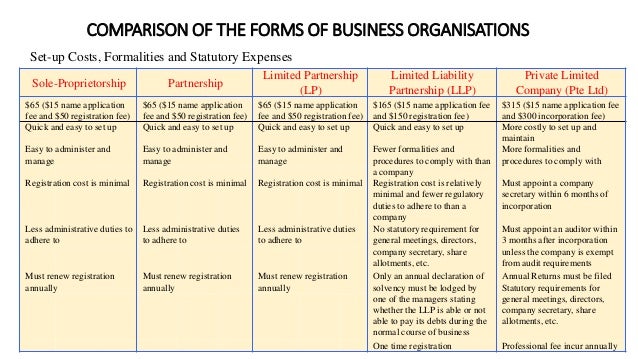

A limited liability partnership (LLP) offers more protection to individual partners as it limits liability to what each partner has invested in the business. You will however have to register with Companies House and put certain information on the public record if taking this option, much like a limited company. For example, providing yourself with a car for business travel is likely to be far more tax efficient this way than through a limited company structure. Limited companies offer a different set-up altogether.

Companies must be registered with Companies House and pay corporation tax on profits. Payroll taxes (under PAYE) will also be relevant, although this is the case where you have employees in any structure. Depending on your profits, corporation tax can offer a much more attractive rate than income tax. You broadly have a choice of whether to pay salary or dividends to yourself with this option, but it is generally advisable to pay a salary of at least a modest amount, even if only to preserve your entitlement to state benefits. Dividends can offer business owners a very tasty tax rate compared with salaries, but on the other han they do not qualify for pension relief, so are not tax-efficient for growing your retirement pot.

When going into business, you will need to choose a structure that reflects your financial, tax and administrative needs. If simply providing consultancy services, for example, then a limited company might be unnecessarily complex. Unfortunately, businesses are so varied that there really is no hard and fast rule for what structure will work and it is likely that as your business grows and your aims change, the most appropriate structure to use will change too. Remember to keep assessing your business as it grows because reviewing your structure could save you money in the long run. To receive more like this you can become a member of the Small Business Network here.

The First one would be the Business Registration, while the second one is the Tax Registration. In this case, a Partnership structure may be right for your business. Get started Start Your Incorporation Answer a few questions. Also if a partnership obtains a certain level of profits, the partners may be faced to pay more than they would in a limited company.

Each partner will have to complete their own self-assessment tax return individually in addition to the partnership return. Partnerships would mostly be registered under a pan-nation Partnership Act, with the exception of few nations like US (State Partnership Acts) Business Decisions. Further, a partnership may find it more difficult to attract investment than a private or public company – it can’t issue debentures, for example. A corporation is a legal entity separate from the owners of the business.

There are a number of factors to consider before deciding which route to take. When you start a business, one of the essential questions you have to consider is what form it should take. On the contrary, Partnership is that form of business organization two or more individuals come together and agree to share profit and losses of the business, which is carried on by them. The individuals who run the business are called partners.

Among the differences between a sole trader and partnership business is a sole trader business has only one owner whereas a partnership has 2-owners. The sole trader is fully responsible for the running of the business from day to day so, the success of the business is limited to the abilities of the owner. The person who owns and runs the business is known as the sole trader or sole proprietor.

The sole proprietor is in full control of all business activities. By definition, a sole proprietorship consists of just one person while a partnership can have anywhere from two to 1owners. In a sole proprietorship, one individual owns and operates the business.

Common examples include a one-person repair shop, a self-employed plumbing contractor or an Internet entrepreneur. We don’t want to scare you, but there’s a lot to plan and consider, especially when you’re starting from scratch. These types are further divided into different forms. In this article, we will discuss the difference between a sole trader and a private limited company.

A sole trader is also called a sole proprietorship. With a sole proprietorship, you can operate your business using your own name or by registering a.