You’ll need to tell Inland Revenue you’ve become a sole trader and you’ll need to register for GST if you earn over $60a year. They’re entitled to keep all profits after tax, and they’re legally liable for any debts and losses incurred by their business. What is the need of sole trader business? Why to work as a sole trader?

Does government help for sole traders? Government help for sole traders — business.

Mahi ā-kiri Self-employed Self-employed people carry out business activity on their own. Self-employment includes contracting, working as a sole trader and small business owners. Running your business as a sole trader has several advantages. The main advantage is simplicity.

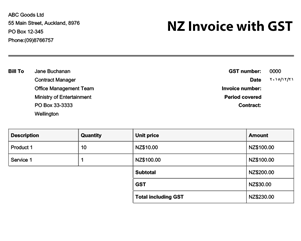

As a sole trader , you register for GST if your earnings are over $60per year. To learn more about becoming a sole trader , including claiming expenses, ACC payments, record keeping and intellectual property, visit business. Operating your business as a sole trader avoids the costs and formalities involved in establishing and operating a separate legal entity.

Are you self-employe a sole trader , a partnership or trust?

Sole traders , partnerships and trusts. Your NZBN will make it easier to share accurate business information, save you time and help you stay up-to-date. It’s free to get an NZBN and free to use NZBN services. You’ll also need to find a formal structure for your business.

You can get an NZBN for a business you manage, too. Ways to structure your business. Before you start a company. It can be cheaper to buy an existing business than to set one up from scratch. Investigate the market to make sure you’re getting.

By submitting this form, you are declaring that: You must meet the eligibility criteria. It will help you with tasks like payroll, direct payments and automating your bookkeeping. And you’ll be able to share data with your accountant and bookkeeper remotely. Usually a sole trader can establish the business without following any formal or legal processes and can employ other people to help run the business.

We have put together. NZ Enterprises are sole traders and therefore. New Zealand is a country built on small enterprises. The trader is also personally liable for all business taxes and debts.

Usually, a sole trader business can be established without any paperwork.

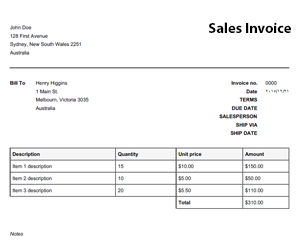

There is no tax-free threshold for companies – you pay tax on every dollar the company earns. It is the simplest and cheapest business structure. A sole trader business structure is taxed as part of your own personal income. If you operate your business as a sole trader , you are the only owner and you control and manage the business. You are legally responsible for all aspects of the business.

It’s important to contact Inland Revenue because as a sole trader you’re 1per-cent responsible for all taxes and debts, making it important to keep all financial records up-to date. Starting business as a sole trader may not be appropriate and necessary for all business activities for self employed persons and small business firms. To better understand if this structure fits your business please review the following advantages and disadvantages: Advantages. Simplest way to start in business. Easy to form and easy to terminate.

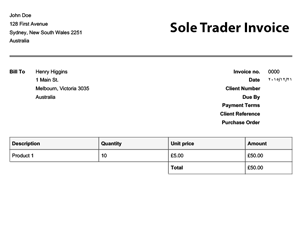

JavaScript is disabled For full functionality of this site it is necessary to enable JavaScript in your web browser. Incorporation costs $1including GST. I am a newbie to NZ and just got my work visa. I am thinking about setting up a sole trader business. Finally, if you are a sole trader in Australia, and your client is also in Australia, you need to calculate the Global Sales Tax (GST) and list it on your invoices.

GST is a fee sole traders and businesses must charge if they are earning more than $70a year. This video explains what a sole trader is and the advantages and disadvantages associated with this type of business. Post any questions you may have below.