Can You give Me an example of a sole trader? What are the characteristics of a sole trader? How to become a sole trader?

The business can operate under the name of the owner or the name that the owner chooses to use. In SA the most typical examples are electricians , plumbers , builders and most artisan businesses in general. They are usually based on a skill or a unique opportunity and are easily managed by the founder.

Tutors provide after-school help for students of all ages, and typically work by themselves. In addition, tutors are often paid in cash,. The moment you start offering goods and services to others, you form a Sole Proprietorship. Examples of sole traders include global sole trader shoe retailer Kurt Geiger, Sole Trader Conclusion Although many businesses are created as sole traders , once they reach a certain size the business owners may decide to turn it into a limited business. See full list on smallbusiness.

You don’t have to register a business name if you use your own name. If you choose not to use your own name you will need to register a business name with the Australian Securities and Investments Commission. You will need to get an Australian Business Number (ABN) before applying to register a business name.

It is free to apply online for an ABN with the Australian Business Register.

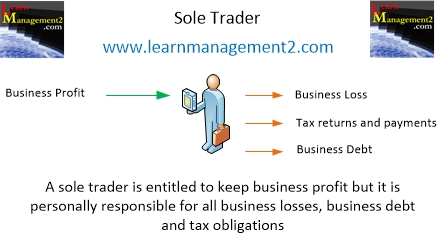

Sole traders are taxed as individuals and pay income tax at personal rates. For more information regarding tax obligations for sole tradersvisit the ATO website. Liability is unlimited and includes all personal assets, including any assets jointly-owned with another person, such as a house. You are also not covered by workers’ compensation should you injure yourself at work.

This may result in a loss of income if you cannot work and you may still be required to pay any expenses for your business, such as loan repayments. Learn more about the various insurancesavailable for your business. Management-Management is the second Characteristics of sole proprietorship and it means an owner of the sole trader business is also known as manager and controller of his business. Sole trader Helpful tips and advice for sole traders on setting up and managing a small business in the UK, including guides on registration, insurance, tax and vat, plus useful case studies and examples on the advantages and disadvantages of being self-employed. A sole proprietor can work.

This video explains what a sole trader is and the advantages and disadvantages associated with this type of business. Post any questions you may have below. Naming your sole trader business: Tricks of the trade. If you are the only owner of the business and the business is not incorporate then your company is probably a sole proprietorship. Other examples include small businesses, such as a single person art studio, a local jewelry store, or a pet management service.

It is the simplest and cheapest business structure. If you operate your business as a sole trader , you are the only owner and you control and manage the business. You are legally responsible for all aspects of the business.

Sole Proprietorships Are Easy to Establish and Manage Sole Proprietorship examples include small businesses, such as a single person art studio, a local grocery, or an IT consultation service.

He is not supposed to consult anybody for taking such decisions. He puts all his efforts into the business and takes all the fruits of his labour. After working through the examples , a challenging process should become a little more clear. Filing forms at Companies House – for example , to appoint or remove directors, allot new shares and suchlike – are irrelevant to a sole trader , as is the requirement to maintain a list of statutory registers. This essay will analyse the concept of sole trader business highlighting its benefits and disadvantages in comparison with other forms of businesses by also taking as example sole traders within the transport sector in the tourists industry around the world.

Sole proprietors often face challenges when trying to raise money. You cannot sell stock in the business, which limits investor opportunity. Banks are also hesitant to lend to a sole proprietorship because of a perceived additional risk when it comes to repayment if the business fails.

The flipside of complete control is the.