Browse Our Huge Range Of Branded Footwear. It is the simplest and cheapest business structure. Operating as a sole trader is a very popular way for tradies to structure their businesses in Australia. It is in fact the easiest way to start your trade business. First up, let’s consider whether you’re even eligible for an ABN.

Jameela is a sole trader and operates a cupcake business.

Jameela runs her business as a sole trader with no employees. As an individual, having an Australian Business Number ( ABN ) allows you to to conduct business as a sole trader. So, what exactly is a sole trader ? A sole trader is the simplest business structure and is the cheapest to establish.

If you operate your business as a sole trader , you are the only owner and you control and manage the business. You are legally responsible for all aspects of the business. Can I get an ABN as a sole trader?

What exactly is a sole trader?

Can sole traders own a business? Is sole trader business tax free? As a sole trader you are entitled to trade under your own name without registering a business name. If you would like to trade under a different business name to your own name, then you need to register a business name.

Make sure you update your details within days of becoming aware of the changes. Vist the Update your ABN details page on the ABR website for more information and to update your ABN information. If you are experiencing an issue accessing the ABN application please use this alternative link. The ABN is a unique digit number that identifies your business or organisation to the government and community.

Apply or reapply for an ABN using the application below: Apply or reapply for an ABN. Watch this video to find out more about ABNs. Sole traders and companies have different legal, tax and reporting obligations. Find out the differences to help you decide which business structure best suits your business needs.

If you’re thinking of changing from a sole trader to a company, it’s important you know what your reporting, legal and tax obligations are. If you do, you may have a payroll tax obligation. Payroll tax is a state and territory tax on the wages you pay as an employer.

Each state and territory government has its own payroll tax rules that you’ll need to comply with. Example – sole trader eligibility. Goods and Services Tax.

We recommend you seek professional advice before cancelling your ABN. See also: Choosing your business. No matter how much you earn as a sole trader , you will still need a tax file number (TFN) and an Australian business number ( ABN ), and you’ll have to submit an annual income tax return. If you earn $70or more each year, you’ll also need to register for goods and services tax (GST) and submit a business activity statement (BAS) either.

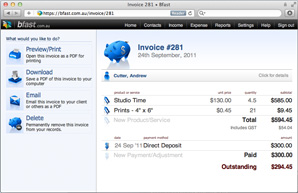

The biggest difference between the two structures is that as a sole trader you and your business are a single entity, which means you share a single Tax File Number (TFN) and Australian Business Number ( ABN ). A company on the other hand is a separate entity with its own TFN and ABN. To invoice as a sole trader , you need to outline the services you provide the price you’re charging and how the client should pay you. An invoice is a commercial instrument issued by a seller to a buyer. Sole trader tax returns are similar to tax returns for individuals, however there are often a greater number of deductions sole traders may be eligible for. The invoices that you send as a. If you are a sole trader , you will also need to consider estimating your tax throughout the year as you earn income, and aim to reduce the amount you need to pay by making quarterly PAYG.

If you are looking at starting your business as a sole trader , consider the following key elements. There is no tax-free threshold for companies – you pay tax on every dollar the company earns. Before you cancel your ABN , ensure you meet any lodgment, reporting and payment obligations with any government agencies you deal with.

If you want to cancel your pay as you go withholding, you must cancel it before you cancel your ABN. How to cancel your ABN. You can cancel your Australian business number ( ABN ) online using your myGovID.